We Think BioNeutra Global (CVE:BGA) In Taking Some Risk With Its Debt

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that BioNeutra Global Corporation (CVE:BGA) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for BioNeutra Global

How Much Debt Does BioNeutra Global Carry?

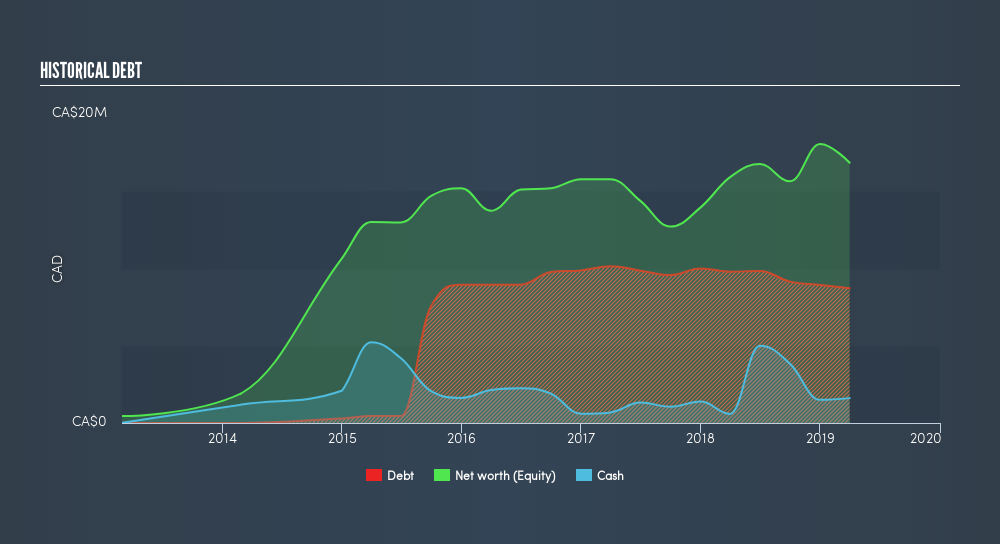

The image below, which you can click on for greater detail, shows that BioNeutra Global had debt of CA$8.72m at the end of March 2019, a reduction from CA$9.81m over a year. On the flip side, it has CA$1.61m in cash leading to net debt of about CA$7.11m.

A Look At BioNeutra Global's Liabilities

Zooming in on the latest balance sheet data, we can see that BioNeutra Global had liabilities of CA$13.6m due within 12 months and liabilities of CA$7.77m due beyond that. Offsetting these obligations, it had cash of CA$1.61m as well as receivables valued at CA$4.34m due within 12 months. So its liabilities total CA$15.5m more than the combination of its cash and short-term receivables.

This deficit is considerable relative to its market capitalization of CA$22.8m, so it does suggest shareholders should keep an eye on BioNeutra Global's use of debt. This suggests shareholders would heavily diluted if the company needed to shore up its balance sheet in a hurry. Because it carries more debt than cash, we think it's worth watching BioNeutra Global's balance sheet over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While BioNeutra Global's debt to EBITDA ratio (3.39) suggests that it uses debt fairly modestly, its interest cover is very weak, at 2.03. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. Looking on the bright side, BioNeutra Global boosted its EBIT by a silky 69% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since BioNeutra Global will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, BioNeutra Global created free cash flow amounting to 15% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Neither BioNeutra Global's ability to cover its interest expense with its EBIT nor its conversion of EBIT to free cash flow gave us confidence in its ability to take on more debt. But its EBIT growth rate tells a very different story, and suggests some resilience. When we consider all the factors discussed, it seems to us that BioNeutra Global is taking some risks with its use of debt. So while that leverage does boost returns on equity, we wouldn't really want to see it increase from here. Over time, share prices tend to follow earnings per share, so if you're interested in BioNeutra Global, you may well want to click here to check an interactive graph of its earnings per share history.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSXV:BGA

BioNeutra Global

Engages in the research and development, production, and commercialization of food for nutraceutical, functional, and mainstream food and beverage products, with a focus on oligosaccharides.

Slight and slightly overvalued.

Market Insights

Community Narratives