- Canada

- /

- Personal Products

- /

- TSX:JWEL

Should Jamieson Wellness' (TSX:JWEL) Upbeat 2025 Guidance and Dividend Announcement Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Jamieson Wellness recently reported third quarter 2025 results, highlighting sales of C$199.33 million and a net income of C$14.98 million, alongside declaring a C$0.23 per share cash dividend payable December 15, 2025.

- The company also updated its fiscal 2025 earnings guidance, projecting revenue growth and confirming strong year-to-date performance.

- We'll take a closer look at how Jamieson’s updated growth outlook shapes its investment narrative amid continued earnings improvement.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Jamieson Wellness' Investment Narrative?

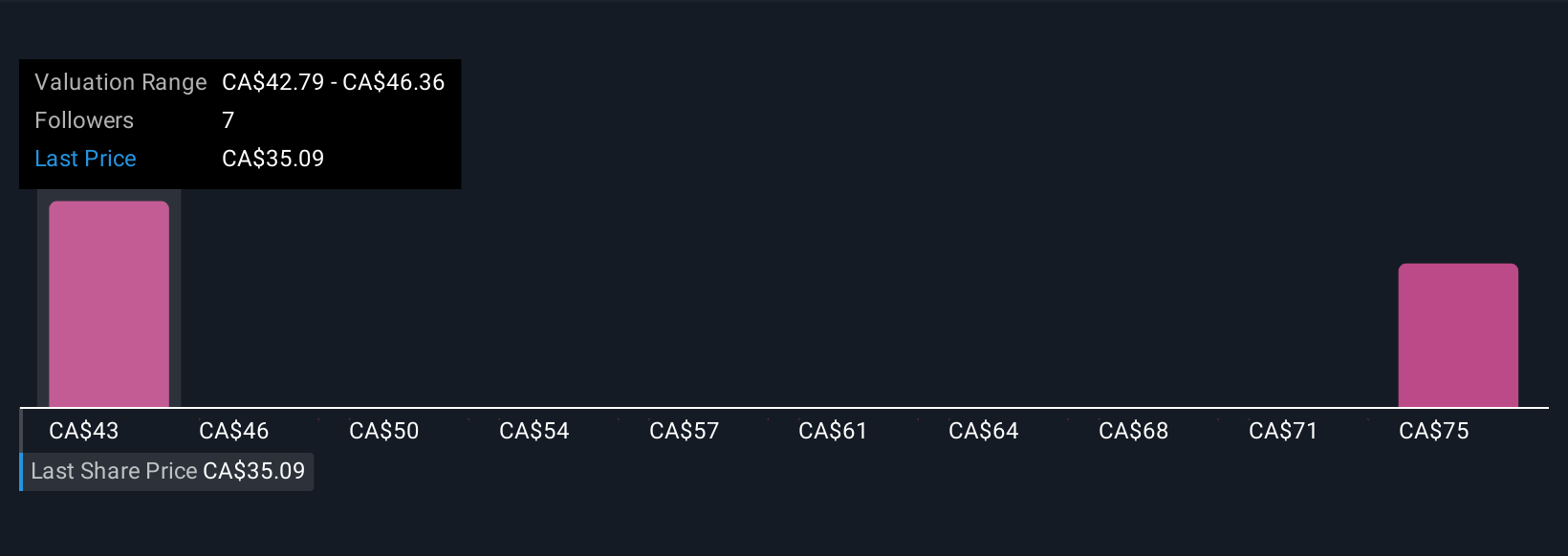

For investors considering Jamieson Wellness, the big picture centers on belief in the company’s ability to drive reliable revenue growth and maintain resilient profitability, even in a competitive market. The latest earnings and guidance update, with solid third-quarter results and an upwardly revised revenue outlook for 2025, may reinforce confidence in Jamieson’s growth story and support near-term optimism around continued earnings improvement. The declared dividend and the confirmation of robust year-to-date performance echo management’s ongoing commitment to shareholder returns, which could act as supportive short-term catalysts. However, the news does not appear to significantly shift the key risk profile: Jamieson’s heavy debt load, underperformance against both the broader market and industry benchmarks, and a valuation above peer averages remain important issues to watch. These remain front and center, even as profit margins and earnings growth show encouraging trends. Contrasting this, Jamieson’s higher-than-peer valuation still poses downside risks that investors should watch closely.

Jamieson Wellness' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Jamieson Wellness - why the stock might be worth just CA$42.93!

Build Your Own Jamieson Wellness Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jamieson Wellness research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Jamieson Wellness research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jamieson Wellness' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:JWEL

Jamieson Wellness

Develops, manufactures, distributes, markets, and sells the natural health products for human in Canada, the United States, China, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives