If you want to know who really controls Biosenta Inc. (CSE:ZRO), then you'll have to look at the makeup of its share registry. Large companies usually have institutions as shareholders, and we usually see insiders owning shares in smaller companies. I quite like to see at least a little bit of insider ownership. As Charlie Munger said 'Show me the incentive and I will show you the outcome.

Biosenta is not a large company by global standards. It has a market capitalization of CA$869k, which means it wouldn't have the attention of many institutional investors. Our analysis of the ownership of the company, below, shows that institutions don't own shares in the company. Let's delve deeper into each type of owner, to discover more about Biosenta.

See our latest analysis for Biosenta

What Does The Lack Of Institutional Ownership Tell Us About Biosenta?

Small companies that are not very actively traded often lack institutional investors, but it's less common to see large companies without them.

There are multiple explanations for why institutions don't own a stock. The most common is that the company is too small relative to funds under management, so the institution does not bother to look closely at the company. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Institutional investors may not find the historic growth of the business impressive, or there might be other factors at play. You can see the past revenue performance of Biosenta, for yourself, below.

Hedge funds don't have many shares in Biosenta. Looking at our data, we can see that the largest shareholder is William Connor with 19% of shares outstanding. With 7.8% and 4.5% of the shares outstanding respectively, Amarvir Gill and Dene Rogers are the second and third largest shareholders. They also happen to be Chief Executive Officer and Member of the Board of Directors, respectively. That is, insiders feature higher up in the heirarchy of the company's top shareholders.

On studying our ownership data, we found that 5 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Biosenta

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

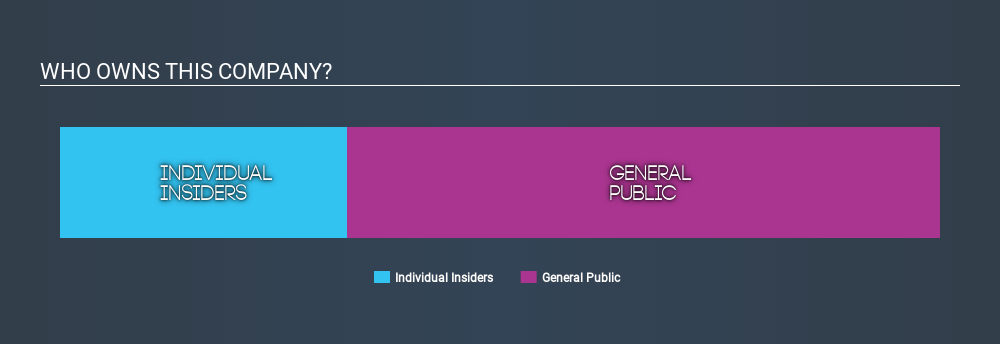

Our most recent data indicates that insiders own a reasonable proportion of Biosenta Inc.. Insiders have a CA$284k stake in this CA$869k business. I would say this shows alignment with shareholders, but it is worth noting that the company is still quite small; some insiders may have founded the business. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public, who are mostly retail investors, collectively hold 67% of Biosenta shares. With this size of ownership, retail investors can collectively play a role in decisions that affect shareholder returns, such as dividend policies and the appointment of directors. They can also exercise the power to decline an acquisition or merger that may not improve profitability.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Biosenta better, we need to consider many other factors. For example, we've discovered 5 warning signs for Biosenta (4 are a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About CNSX:ZRO

Biosenta

Develops, manufactures, and sells chemical compounds for household and industrial applications in Canada.

Medium-low risk with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success