- Canada

- /

- Personal Products

- /

- CNSX:AAWH.U

Slammed 27% Ascend Wellness Holdings, Inc. (CSE:AAWH.U) Screens Well Here But There Might Be A Catch

Ascend Wellness Holdings, Inc. (CSE:AAWH.U) shareholders won't be pleased to see that the share price has had a very rough month, dropping 27% and undoing the prior period's positive performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 39%, which is great even in a bull market.

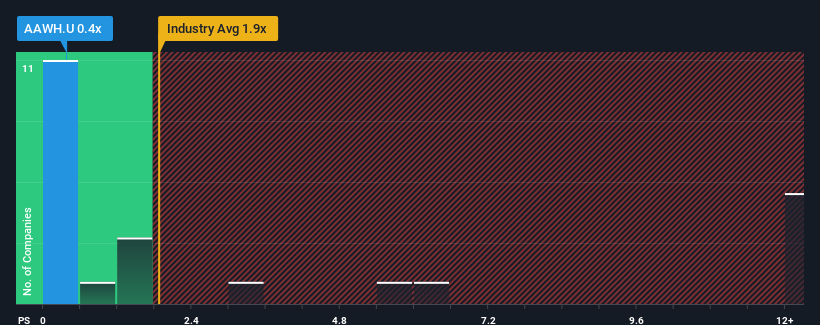

After such a large drop in price, Ascend Wellness Holdings' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Personal Products industry in Canada, where around half of the companies have P/S ratios above 1.7x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Ascend Wellness Holdings

How Has Ascend Wellness Holdings Performed Recently?

Recent times have been advantageous for Ascend Wellness Holdings as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Ascend Wellness Holdings will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

Ascend Wellness Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. The strong recent performance means it was also able to grow revenue by 192% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 7.6% per annum as estimated by the eight analysts watching the company. With the industry predicted to deliver 7.0% growth each year, the company is positioned for a comparable revenue result.

With this information, we find it odd that Ascend Wellness Holdings is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

The southerly movements of Ascend Wellness Holdings' shares means its P/S is now sitting at a pretty low level. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Ascend Wellness Holdings currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It is also worth noting that we have found 2 warning signs for Ascend Wellness Holdings that you need to take into consideration.

If these risks are making you reconsider your opinion on Ascend Wellness Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AAWH.U

Ascend Wellness Holdings

Engages in the cultivation, manufacture, and distribution of cannabis consumer packaged goods in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives