- Canada

- /

- Personal Products

- /

- CNSX:AAWH.U

Ascend Wellness Holdings, Inc. (CSE:AAWH.U) Stock's 30% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, Ascend Wellness Holdings, Inc. (CSE:AAWH.U) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

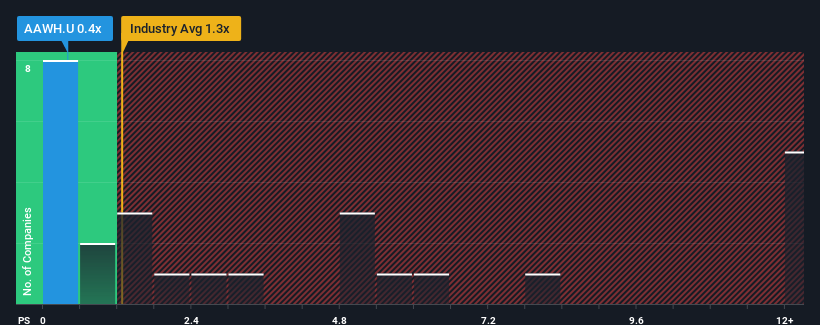

After such a large drop in price, Ascend Wellness Holdings' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Personal Products industry in Canada, where around half of the companies have P/S ratios above 1.4x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ascend Wellness Holdings

How Has Ascend Wellness Holdings Performed Recently?

Ascend Wellness Holdings could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ascend Wellness Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Ascend Wellness Holdings' Revenue Growth Trending?

Ascend Wellness Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% per year during the coming three years according to the nine analysts following the company. That's shaping up to be materially higher than the 9.6% per annum growth forecast for the broader industry.

In light of this, it's peculiar that Ascend Wellness Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Ascend Wellness Holdings' P/S Mean For Investors?

Ascend Wellness Holdings' recently weak share price has pulled its P/S back below other Personal Products companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look at Ascend Wellness Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Ascend Wellness Holdings you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AAWH.U

Ascend Wellness Holdings

Engages in the cultivation, manufacture, and distribution of cannabis consumer packaged goods in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives