The Canadian market has shown resilience, closing October near record highs despite potential disruptions from geopolitical tensions and central bank policies. In such a climate, investors often look for opportunities in less conventional areas like penny stocks—an outdated term that still signifies smaller or newer companies with potential growth. By focusing on those with strong financials, investors may find promising opportunities among these under-the-radar stocks.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.33 | CA$63.96M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.35 | CA$226.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.425 | CA$3.38M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.01 | CA$671.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.04 | CA$21.21M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.19 | CA$919.77M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.92 | CA$149.73M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.07 | CA$196.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 416 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

EcoSynthetix (TSX:ECO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: EcoSynthetix Inc. is a renewable chemicals company that develops and commercializes bio-based technologies to replace synthetic, petrochemical-based chemicals across various regions, with a market cap of CA$251.69 million.

Operations: The company's revenue is primarily derived from its Biopolymer Nanosphere Technology Platform, which generated $19.71 million.

Market Cap: CA$251.69M

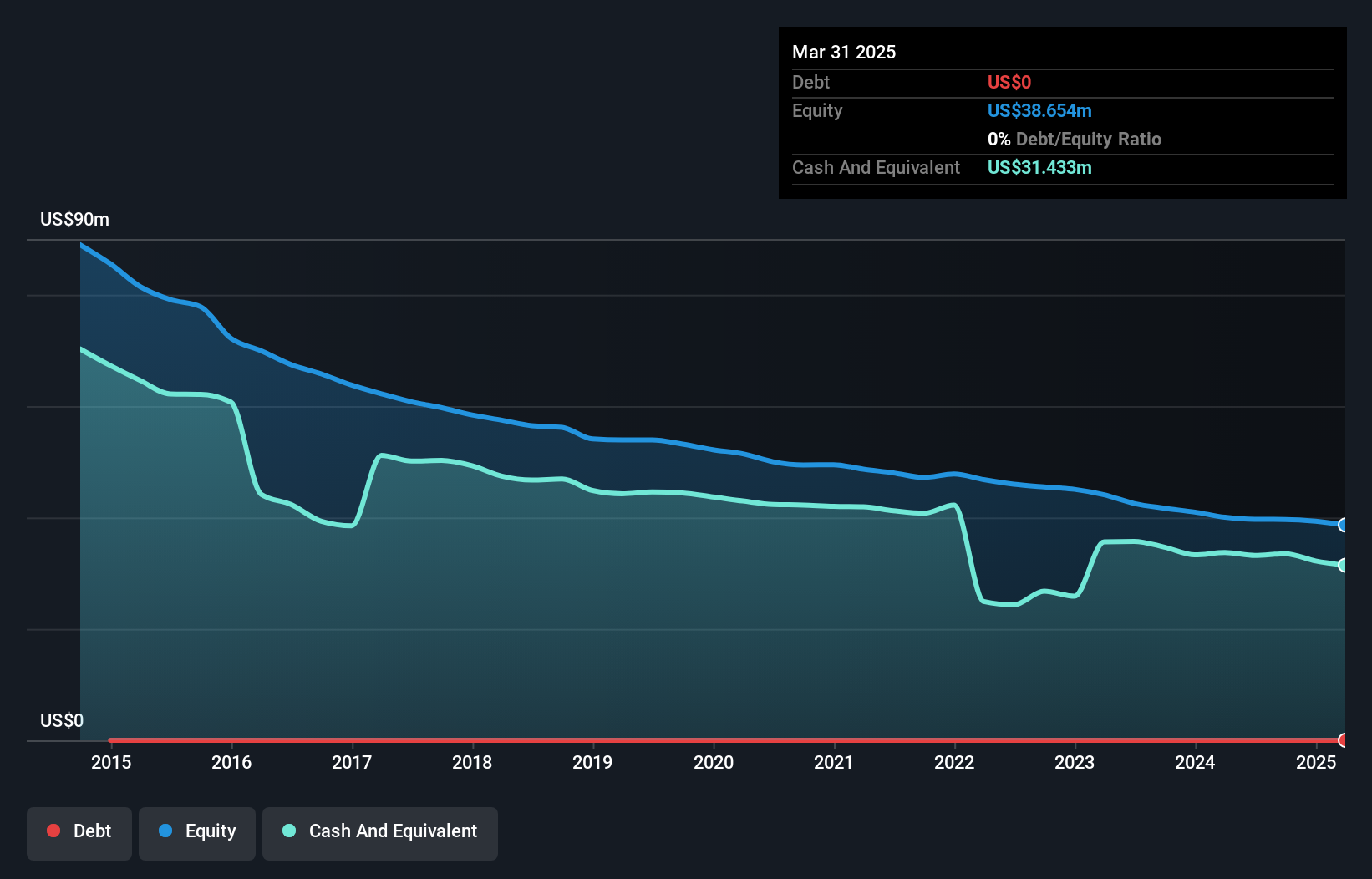

EcoSynthetix Inc., with a market cap of CA$251.69 million, has shown resilience despite being unprofitable, reducing its losses by 9.9% annually over five years. The company is debt-free and boasts a seasoned management team with an average tenure of 17.6 years, supported by an experienced board. Its short-term assets of $36.8M comfortably cover liabilities, and it maintains a cash runway exceeding three years even if free cash flow declines at historical rates. Recent client wins in Europe for its SurfLock product signal potential growth avenues as EcoSynthetix continues to commercialize its bio-based technologies effectively.

- Click to explore a detailed breakdown of our findings in EcoSynthetix's financial health report.

- Assess EcoSynthetix's previous results with our detailed historical performance reports.

Medicenna Therapeutics (TSX:MDNA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Medicenna Therapeutics Corp. is a clinical-stage immunotherapy company focused on developing and commercializing Superkines and empowered Superkines for treating cancer, inflammation, and immune-mediated diseases, with a market cap of CA$124.28 million.

Operations: Medicenna Therapeutics currently does not report any revenue segments.

Market Cap: CA$124.28M

Medicenna Therapeutics, with a market cap of CA$124.28 million, is pre-revenue and focused on advancing its clinical-stage immunotherapy pipeline. The company is debt-free and has short-term assets of CA$22.6M that cover both short- and long-term liabilities. Despite its unprofitability, Medicenna's management team is seasoned with an average tenure of 11.2 years, suggesting stability in leadership. Recent events include the announcement of updated MDNA11 clinical data to be presented at the ESMO Immuno-Oncology Congress 2025, highlighting ongoing developments in its IL-2 therapy for cancer treatment amidst high share price volatility over recent months.

- Get an in-depth perspective on Medicenna Therapeutics' performance by reading our balance sheet health report here.

- Examine Medicenna Therapeutics' earnings growth report to understand how analysts expect it to perform.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zentek Ltd. is a Canadian company focused on the research and development of graphene and related nanomaterials, with a market cap of CA$129.53 million.

Operations: The company's revenue comes from Intellectual Property Development, amounting to CA$0.13 million.

Market Cap: CA$129.53M

Zentek Ltd., with a market cap of CA$129.53 million, is pre-revenue, focusing on graphene and related nanomaterials. The company recently raised CA$2.48 million through private placements to bolster its cash runway, which was initially forecasted for 4-6 months based on free cash flow estimates. Despite being unprofitable, Zentek's short-term assets exceed both its short- and long-term liabilities, providing some financial stability. Recent executive changes include the resignation of CEO Greg Fenton and interim appointment of CFO Wendy Ford as CEO. Zentek's board remains relatively inexperienced with an average tenure of 1.8 years amidst high share price volatility.

- Jump into the full analysis health report here for a deeper understanding of Zentek.

- Examine Zentek's past performance report to understand how it has performed in prior years.

Where To Now?

- Embark on your investment journey to our 416 TSX Penny Stocks selection here.

- Seeking Other Investments? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EcoSynthetix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ECO

EcoSynthetix

A renewable chemicals company, develops and commercializes bio-based technologies that are used as replacement solutions for synthetic, petrochemical-based chemicals, and other related products in the Americas, Europe, the Middle East, Africa, and Asia Pacific.

Flawless balance sheet with weak fundamentals.

Similar Companies

Market Insights

Community Narratives