- Canada

- /

- Metals and Mining

- /

- TSXV:OCO

TSX Penny Stocks: 3 Picks With Market Caps Under CA$300M

Reviewed by Simply Wall St

As the U.S. government shutdown brings a temporary pause to key economic data releases, the Canadian market remains resilient, buoyed by strong consumer spending and significant investments in artificial intelligence. In this context, penny stocks—though often seen as relics from earlier market days—continue to offer intriguing opportunities for investors willing to explore smaller or newer companies. By focusing on those with robust financial health and potential for growth, investors can find compelling options among Canada's penny stocks that may offer both stability and upside potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.77 | CA$70.78M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.55M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.57M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.37 | CA$951.38M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.13 | CA$22.59M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.81 | CA$439.26M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.36 | CA$174.09M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.17 | CA$210.75M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.79 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 416 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company dedicated to acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$212.68 million.

Operations: Chesapeake Gold Corp. does not report any revenue segments as it focuses on the exploration and evaluation of precious metal deposits in North and Central America.

Market Cap: CA$212.68M

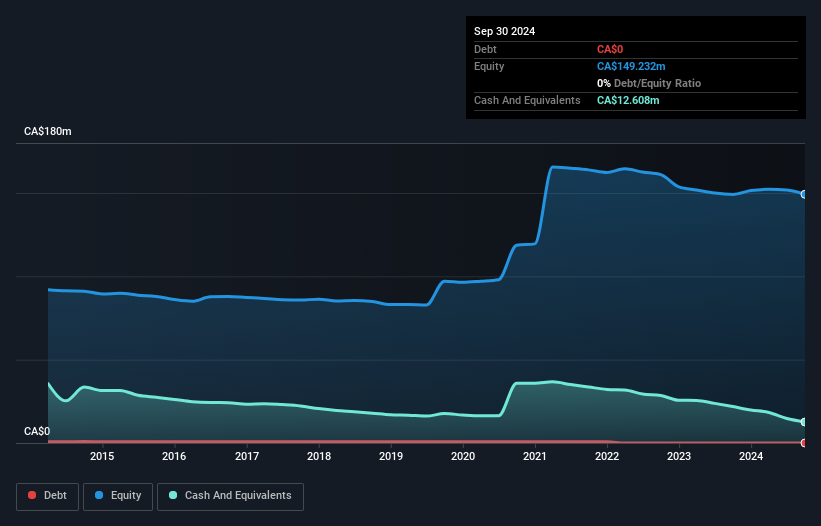

Chesapeake Gold Corp., a pre-revenue mineral exploration company with a market cap of CA$212.68 million, is advancing its proprietary sulphide leach technology, aiming to commercialize it for significant value generation. Recent metallurgical tests on the Metates project and exploration at Lucy have shown promising results, including the identification of new mineralized corridors. Despite being unprofitable with earnings declining over 5 years, Chesapeake remains debt-free and has sufficient cash runway for over a year. The company's short-term assets exceed liabilities, supporting ongoing exploration and development efforts without recent shareholder dilution.

- Click here to discover the nuances of Chesapeake Gold with our detailed analytical financial health report.

- Examine Chesapeake Gold's past performance report to understand how it has performed in prior years.

Oroco Resource (TSXV:OCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oroco Resource Corp. is an exploration stage company focused on acquiring and exploring mineral properties in Mexico, with a market cap of CA$101.62 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company focused on mineral properties in Mexico.

Market Cap: CA$101.62M

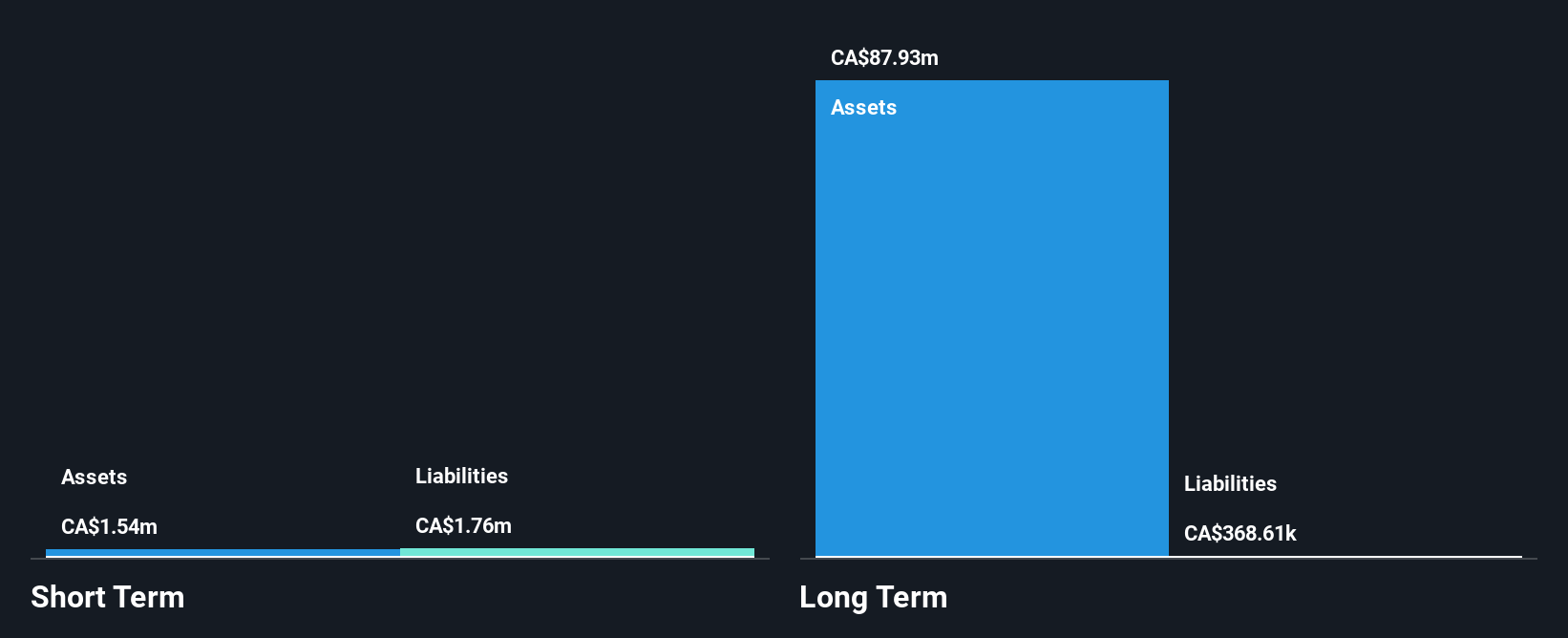

Oroco Resource Corp., with a market cap of CA$101.62 million, is a pre-revenue exploration company focused on mineral properties in Mexico. Despite being debt-free and having an experienced management team, the company faces financial challenges, including a recent net loss of CA$3.64 million and auditor concerns about its ability to continue as a going concern. However, Oroco has raised additional capital through private placements and strengthened its board with the appointment of seasoned mining executive Faysal Rodriguez. Regulatory approval for exploration activities at Santo Tomás provides strategic momentum for future development efforts.

- Get an in-depth perspective on Oroco Resource's performance by reading our balance sheet health report here.

- Gain insights into Oroco Resource's past trends and performance with our report on the company's historical track record.

Zentek (TSXV:ZEN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zentek Ltd. is a Canadian company focused on the research and development of graphene and related nanomaterials, with a market cap of CA$122.51 million.

Operations: The company's revenue is primarily derived from Intellectual Property Development, amounting to CA$0.13 million.

Market Cap: CA$122.51M

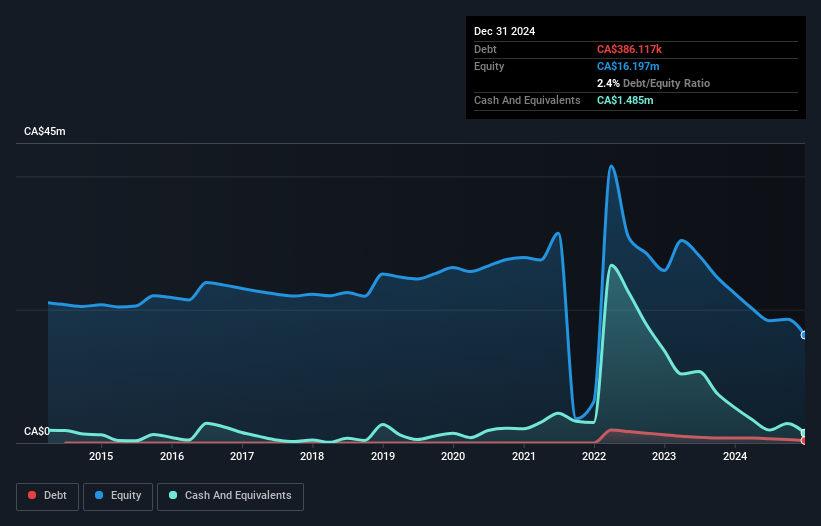

Zentek Ltd., with a market cap of CA$122.51 million, operates as a pre-revenue company focused on graphene and nanomaterials development. Recent strategic moves include a non-brokered private placement to raise up to CA$2 million, potentially extending its cash runway beyond the current 6 months. Despite having more cash than debt and short-term assets exceeding liabilities, Zentek faces challenges such as high share price volatility and an inexperienced board with an average tenure of 1.7 years. The company is advancing its influenza countermeasure project with promising preliminary results from in vivo testing supported by government contracts.

- Jump into the full analysis health report here for a deeper understanding of Zentek.

- Understand Zentek's track record by examining our performance history report.

Next Steps

- Reveal the 416 hidden gems among our TSX Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OCO

Oroco Resource

An exploration stage company, engages in the acquisition and exploration of mineral properties in Mexico.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026