- Canada

- /

- Healthtech

- /

- TSXV:RHT

We Take A Look At Why Reliq Health Technologies Inc.'s (CVE:RHT) CEO Has Earned Their Pay Packet

The performance at Reliq Health Technologies Inc. (CVE:RHT) has been quite strong recently and CEO Lisa Crossley has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 21 December 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

See our latest analysis for Reliq Health Technologies

How Does Total Compensation For Lisa Crossley Compare With Other Companies In The Industry?

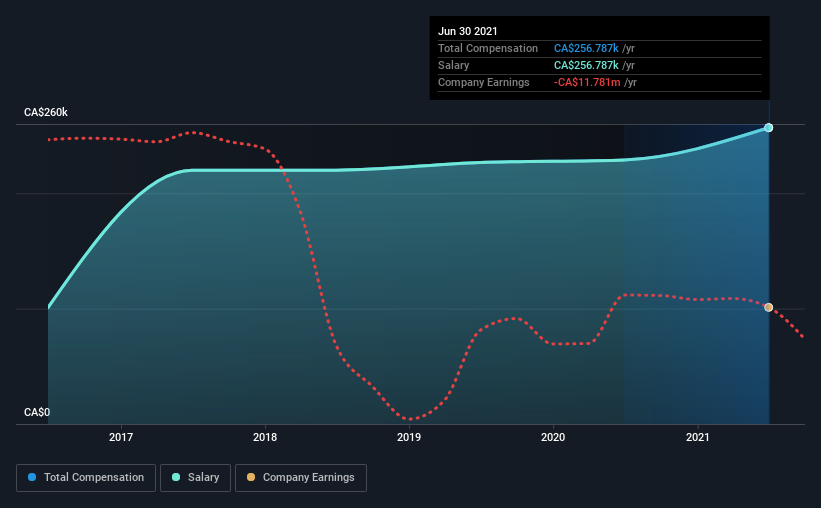

At the time of writing, our data shows that Reliq Health Technologies Inc. has a market capitalization of CA$192m, and reported total annual CEO compensation of CA$257k for the year to June 2021. Notably, that's an increase of 12% over the year before. It is worth noting that the CEO compensation consists entirely of the salary, worth CA$257k.

In comparison with other companies in the industry with market capitalizations under CA$257m, the reported median total CEO compensation was CA$211k. This suggests that Reliq Health Technologies remunerates its CEO largely in line with the industry average. Moreover, Lisa Crossley also holds CA$2.7m worth of Reliq Health Technologies stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | CA$257k | CA$229k | 100% |

| Other | - | - | - |

| Total Compensation | CA$257k | CA$229k | 100% |

Speaking on an industry level, nearly 88% of total compensation represents salary, while the remainder of 12% is other remuneration. Speaking on a company level, Reliq Health Technologies prefers to tread along a traditional path, disbursing all compensation through a salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Reliq Health Technologies Inc.'s Growth Numbers

Reliq Health Technologies Inc. has seen its earnings per share (EPS) increase by 27% a year over the past three years. It achieved revenue growth of 168% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Reliq Health Technologies Inc. Been A Good Investment?

Boasting a total shareholder return of 329% over three years, Reliq Health Technologies Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Reliq Health Technologies rewards its CEO solely through a salary, ignoring non-salary benefits completely. Some shareholders will probably be more lenient on CEO compensation in the upcoming AGM given the pleasing performance of the company recently. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 5 warning signs for Reliq Health Technologies (of which 2 can't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:RHT

Reliq Health Technologies

A healthcare technology company, develops secure telemedicine and virtual care solutions for the healthcare market.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives