- Canada

- /

- Medical Equipment

- /

- TSXV:NSCI

TSX Penny Stocks To Watch In May 2025

Reviewed by Simply Wall St

As Canadian large-cap stocks recently reached new all-time highs, the market continues to navigate a landscape marked by persistent inflation and softer economic growth. For those investors looking beyond the traditional giants, penny stocks—often representing smaller or newer companies—offer intriguing opportunities. While the term "penny stock" may seem outdated, these investments remain relevant today as they can present hidden value and potential for significant returns when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.80 | CA$79.91M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.44 | CA$91.82M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.38 | CA$136.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.07 | CA$537.5M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.78 | CA$447.75M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.65 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$539.88M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.61 | CA$132.47M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.39 | CA$52.9M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 902 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Metalla Royalty & Streaming (TSXV:MTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metalla Royalty & Streaming Ltd. is a precious metals royalty and streaming company focused on acquiring and managing gold, silver, and copper royalties and streams in Canada, with a market cap of CA$363.50 million.

Operations: Metalla Royalty & Streaming Ltd. has not reported any specific revenue segments.

Market Cap: CA$363.5M

Metalla Royalty & Streaming Ltd., with a market cap of CA$363.50 million, is pre-revenue and currently unprofitable, although it has reduced its net losses over recent years. The company's net debt to equity ratio is satisfactory at 1.6%, and it maintains a sufficient cash runway for over three years based on current free cash flow. Despite short-term liabilities exceeding short-term assets, long-term obligations are covered by existing assets. Recent earnings reports show narrowing losses, suggesting potential operational improvements. Analysts anticipate significant stock price appreciation, though the company remains volatile with stable weekly fluctuations at 7%.

- Get an in-depth perspective on Metalla Royalty & Streaming's performance by reading our balance sheet health report here.

- Gain insights into Metalla Royalty & Streaming's outlook and expected performance with our report on the company's earnings estimates.

New Age Metals (TSXV:NAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Age Metals Inc. is a mineral exploration company focused on acquiring, exploring, and developing platinum group metals, precious, and base metals properties in Canada and the United States with a market cap of CA$5.83 million.

Operations: New Age Metals Inc. does not currently report any revenue segments.

Market Cap: CA$5.83M

New Age Metals Inc., with a market cap of CA$5.83 million, is pre-revenue and currently unprofitable, experiencing increasing losses over the past five years. The company recently received a Letter of Acceptance for grassroots exploration on its Newfoundland gold-antimony properties, expanding its land holdings to 19,300 hectares. Despite high share price volatility and negative return on equity, NAM remains debt-free with sufficient cash runway for over three years under current free cash flow conditions. Its seasoned management team plans to commence Phase 1 exploration mid-May 2025, aiming to uncover promising mineralized targets in strategic locations.

- Take a closer look at New Age Metals' potential here in our financial health report.

- Evaluate New Age Metals' historical performance by accessing our past performance report.

Nanalysis Scientific (TSXV:NSCI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanalysis Scientific Corp. develops, manufactures, and sells magnetic resonance technology products globally, with a market cap of CA$31.14 million.

Operations: The company generates revenue from two main segments: CA$26.10 million from Security Services and CA$19.40 million from Scientific Equipment.

Market Cap: CA$31.14M

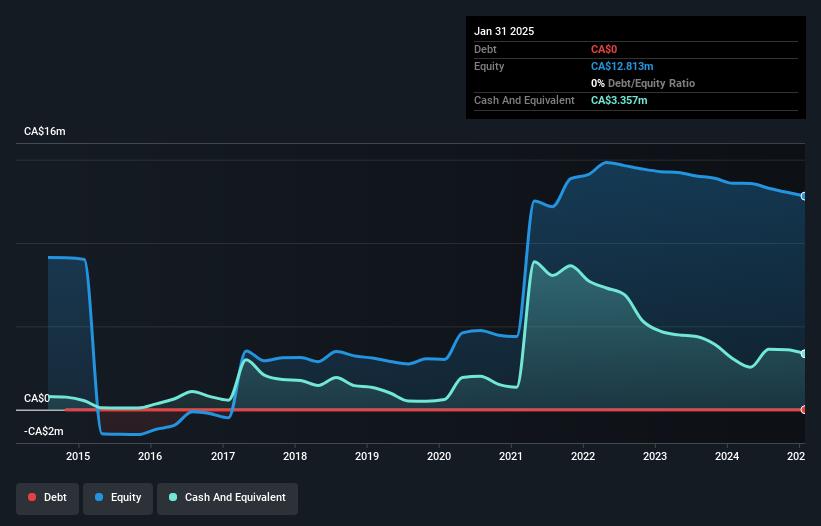

Nanalysis Scientific Corp., with a market cap of CA$31.14 million, reported revenues of CA$45.5 million for 2024, reflecting growth from the previous year. Despite this revenue increase, the company remains unprofitable with a net loss of CA$13.61 million and faces auditor concerns regarding its ability to continue as a going concern. The launch of its advanced 60 MHz Benchtop NMR spectrometer aims to capture demand across various industries by offering enhanced capabilities at competitive pricing. While short-term assets cover both short and long-term liabilities, the high net debt to equity ratio indicates financial leverage challenges amidst ongoing operational losses.

- Jump into the full analysis health report here for a deeper understanding of Nanalysis Scientific.

- Understand Nanalysis Scientific's earnings outlook by examining our growth report.

Key Takeaways

- Jump into our full catalog of 902 TSX Penny Stocks here.

- Looking For Alternative Opportunities? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanalysis Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NSCI

Nanalysis Scientific

Develops, manufactures, and sells magnetic resonance technology products in Canada, the United States, Europe, Asia, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives