- Canada

- /

- Healthcare Services

- /

- TSXV:NLH

TSX Penny Stocks With Market Caps Under CA$70M To Consider

Reviewed by Simply Wall St

With Canada's election now concluded, the political landscape has shifted, allowing policymakers to focus on pressing economic issues such as trade and fiscal policy. As investors navigate this evolving environment, penny stocks remain an intriguing option for those seeking growth opportunities outside mainstream investments. Although the term "penny stock" may seem outdated, these smaller or newer companies can still offer potential rewards when backed by strong financials and strategic positioning.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.80 | CA$74.85M | ✅ 4 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.99 | CA$73.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.97 | CA$1.05B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.13 | CA$576.02M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.73 | CA$280.6M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$503.49M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.50 | CA$128.51M | ✅ 1 ⚠️ 2 View Analysis > |

| McCoy Global (TSX:MCB) | CA$3.12 | CA$84.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.465 | CA$14.04M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.61 | CA$116.3M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alta Copper (TSX:ATCU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alta Copper Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada and Peru with a market cap of CA$37.24 million.

Operations: Alta Copper Corp. currently does not report any revenue segments.

Market Cap: CA$37.24M

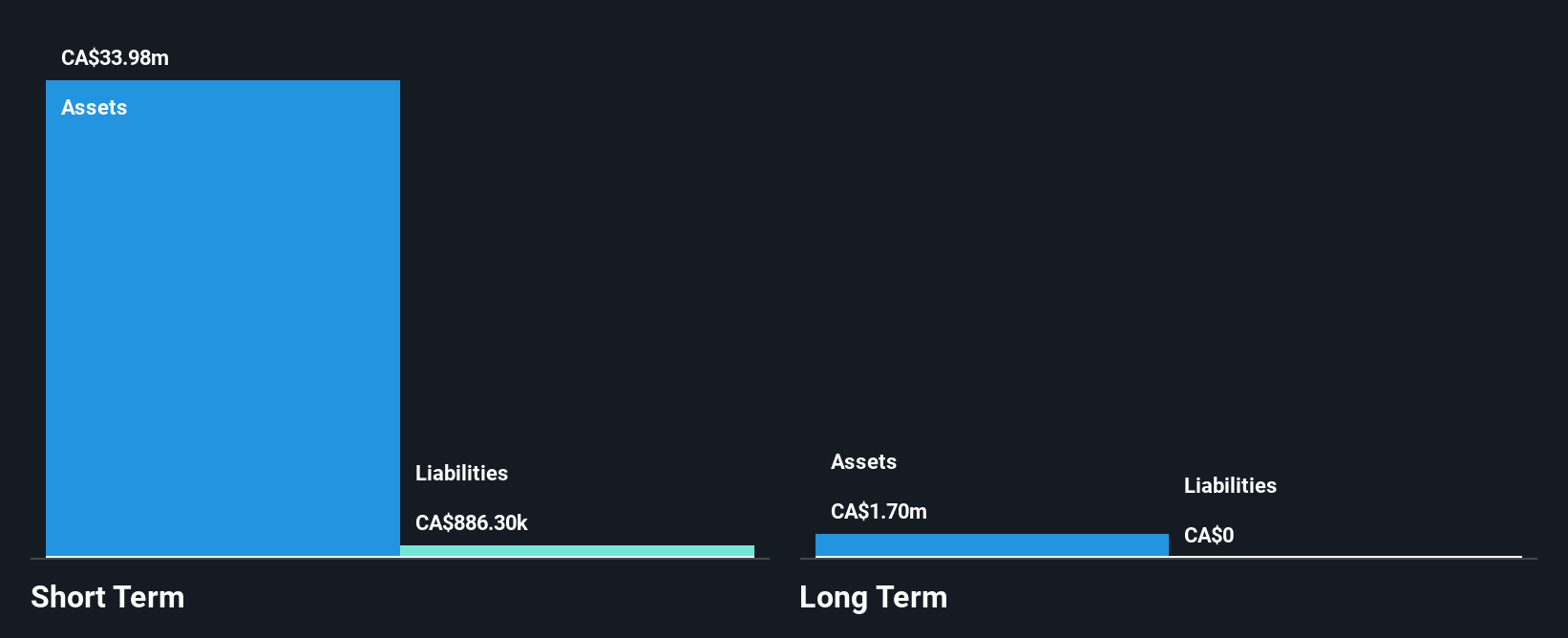

Alta Copper Corp., with a market cap of CA$37.24 million, is pre-revenue and currently unprofitable, having reported a net loss of US$1.83 million for 2024. The company has less than a year of cash runway and no debt or long-term liabilities, but its short-term assets exceed its short-term liabilities. Despite stable weekly volatility and an experienced management team, the board's inexperience and auditor's going concern doubts highlight financial challenges. Shareholders have not been meaningfully diluted recently, yet the company's negative return on equity remains a concern for potential investors in this speculative sector.

- Jump into the full analysis health report here for a deeper understanding of Alta Copper.

- Explore historical data to track Alta Copper's performance over time in our past results report.

Globex Mining Enterprises (TSX:GMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Globex Mining Enterprises Inc. focuses on the acquisition, exploration, and development of mineral properties in North America with a market cap of CA$69.56 million.

Operations: The company's revenue is primarily generated from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to CA$1.48 million.

Market Cap: CA$69.56M

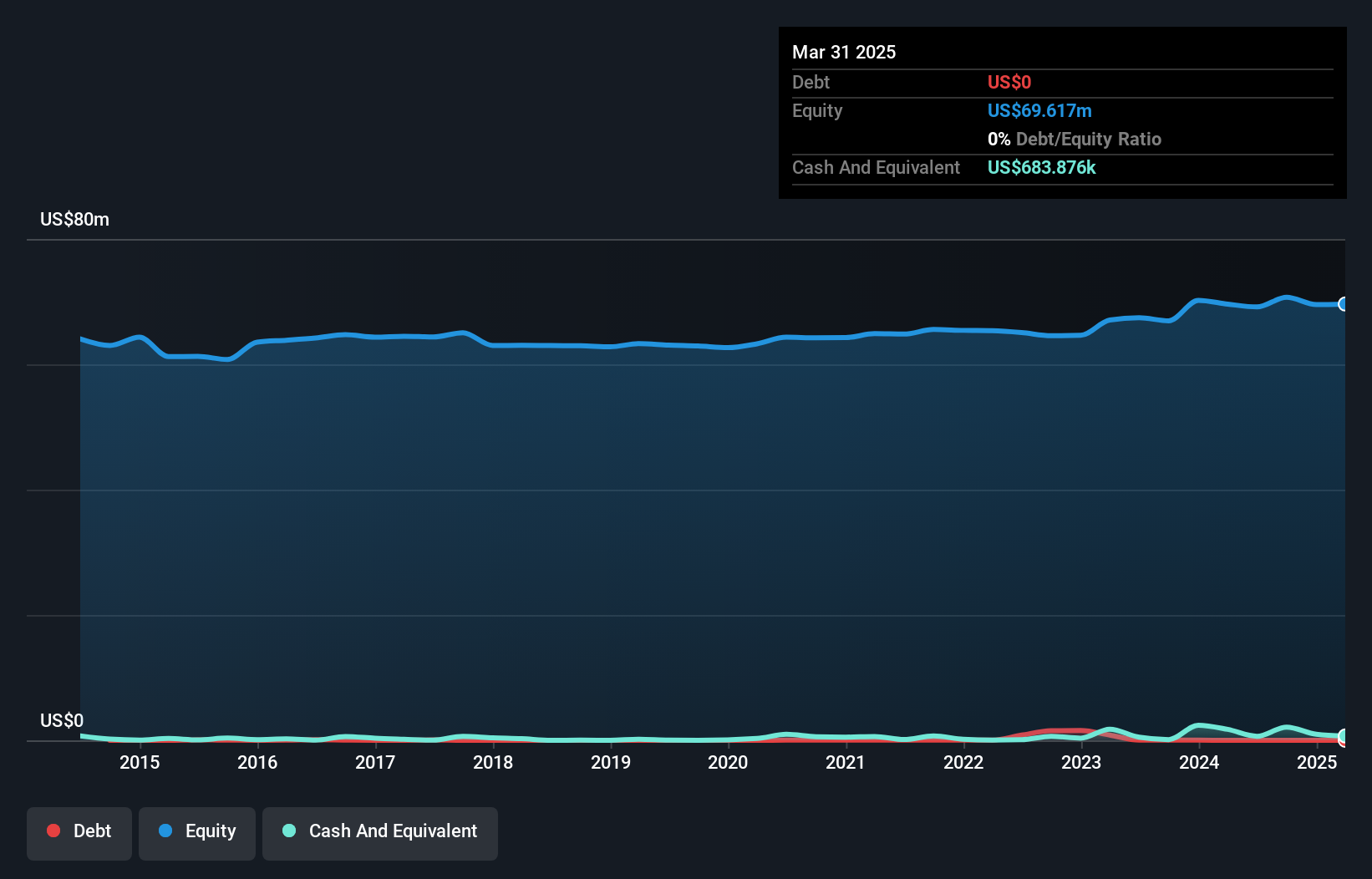

Globex Mining Enterprises, with a market cap of CA$69.56 million, is pre-revenue and focuses on mineral property exploration in North America. The company has no debt or long-term liabilities, which mitigates financial risk. Recent developments include acquiring gold royalties from IAMGOLD Corporation and positive lithium drill results on its Lac Escale claims. Despite negative earnings growth over the past year, Globex's board is seasoned with an average tenure of 40.3 years, providing experienced oversight. The company's strategy involves enhancing asset value through exploration to attract potential partnerships or pursue independent development opportunities.

- Take a closer look at Globex Mining Enterprises' potential here in our financial health report.

- Evaluate Globex Mining Enterprises' historical performance by accessing our past performance report.

Nova Leap Health (TSXV:NLH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nova Leap Health Corp. operates through its subsidiaries to offer home and home health care services in the United States and Canada, with a market cap of CA$21.83 million.

Operations: The company's revenue is primarily derived from its operations in the United States, generating $21.87 million, and Canada, contributing $3.88 million.

Market Cap: CA$21.83M

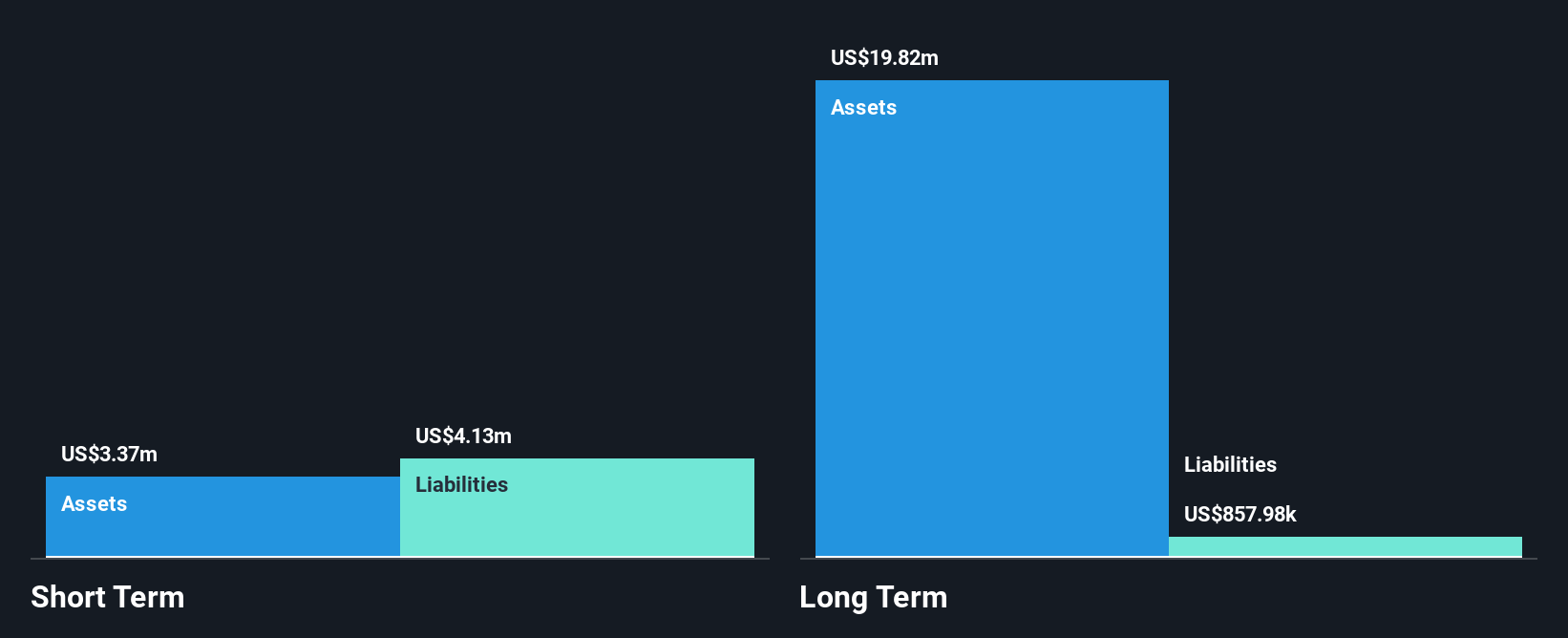

Nova Leap Health Corp., with a market cap of CA$21.83 million, has transitioned to profitability, reporting a net income of US$1.38 million for 2024, compared to a loss the previous year. The company’s financial health is supported by its satisfactory net debt to equity ratio (0.8%) and strong interest coverage (8.1x). Its operating cash flow covers 90% of its debt, indicating robust financial management despite high share price volatility and low return on equity (7.6%). Nova Leap's board is experienced with an average tenure of 8.6 years, contributing to strategic stability as it continues operations in North America.

- Navigate through the intricacies of Nova Leap Health with our comprehensive balance sheet health report here.

- Learn about Nova Leap Health's historical performance here.

Make It Happen

- Investigate our full lineup of 930 TSX Penny Stocks right here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nova Leap Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NLH

Nova Leap Health

Provides home and home health care services in the United States and Canada.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives