- Canada

- /

- Healthcare Services

- /

- TSX:WELL

WELL Health Technologies (TSX:WELL) Reports Impressive Revenue Growth

Reviewed by Simply Wall St

WELL Health Technologies (TSX:WELL) reported a significant increase in Q1 2025 sales, though they also transitioned from a profit to a notable net loss. Over the past week, the company's stock rose 8.55%, a movement worth noting amidst a broader market rally of 5.3%. While WELL Health's substantial sales growth might have contributed positively, the net loss may have tempered excitement. Despite this, broader market trends led by tech sector gains, such as those in Nvidia and AMD, might have further buoyed investor sentiment towards WELL Health, aligning its performance with the general uptrend in the market.

Outshine the giants: these 30 early-stage AI stocks could fund your retirement.

The recent news surrounding WELL Health Technologies' transition from profit to a net loss, despite a reported increase in sales, shouldn't be worrying, as the loss was attributable to the accounting treatment on an equity investment. Although the stock rose 8.55% over the past week, aligning with a broader market rally, the company's five-year total shareholder return was 37.38%. This long-term performance offers a more tempered view compared to the single-year performance, where WELL Health underperformed the Canadian Healthcare industry, which returned 33%.

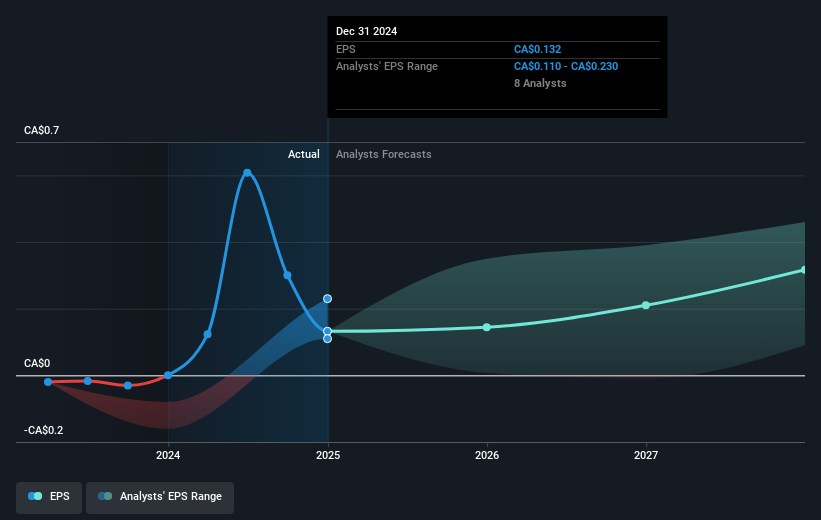

In light of the recent developments, analysts' revenue growth projections for WELL Health could be influenced by the integration challenges of acquisitions and the impact of deferred revenues. With anticipated earnings of CA$47.4 million by 2028, there is pressure to enhance operational efficiencies to meet these expectations. Furthermore, the price movement towards the analyst consensus price target of CA$7.86, which stands at a notable premium over the current share price of CA$3.98, reflects investor optimism. Yet, this also highlights the need for the company to achieve substantial growth in both revenue and earnings to justify such a valuation. The announced initiatives, including strategic divestments and an anticipated IPO, could play a crucial role in altering WELL Health’s financial landscape in the coming years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives