- Canada

- /

- Healthcare Services

- /

- TSX:WELL

Is WELL Health Stock a Hidden Opportunity After Recent 20% Surge in 2025?

Reviewed by Simply Wall St

Approach 1: WELL Health Technologies Cash Flows

A Discounted Cash Flow (DCF) model estimates how much a company is really worth by projecting its future cash flows and then discounting them back to their value today. This approach gives investors a way to gauge intrinsic value based on the money the business is expected to actually generate over time.

For WELL Health Technologies, the most recent annual Free Cash Flow stands at approximately CA$51.9 million. Analysts are forecasting that by 2035, this number could rise to more than CA$104 million. This is a strong trajectory and reflects confidence in WELL’s ability to grow its business and generate larger cash returns each year.

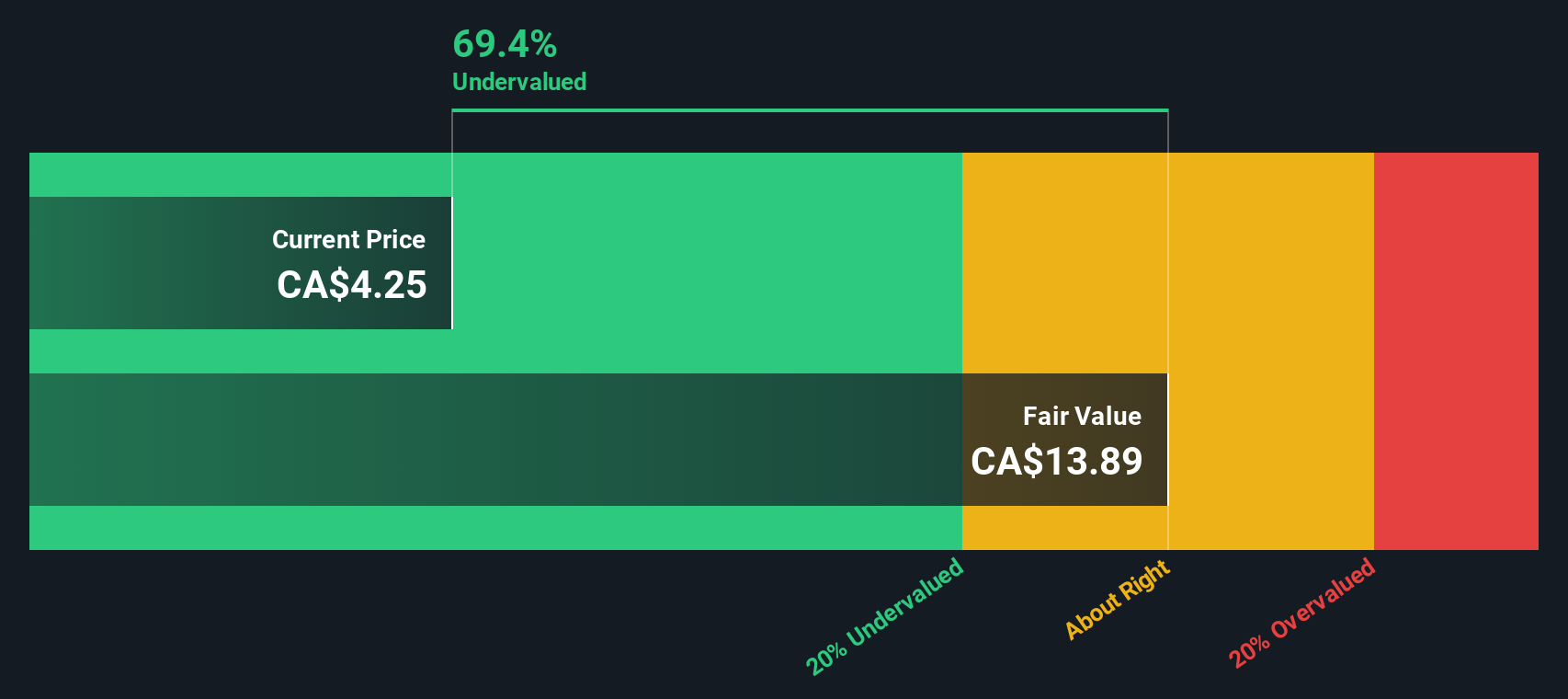

Using a two-stage Free Cash Flow to Equity model, the DCF calculation estimates WELL’s intrinsic value per share at CA$9.81. At current prices, this puts WELL Health at around 50.6% undervalued based on this DCF approach. This means its shares are trading at a significant discount to what analysts believe the company is fundamentally worth.

Result: UNDERVALUED

Approach 2: WELL Health Technologies Price vs Sales

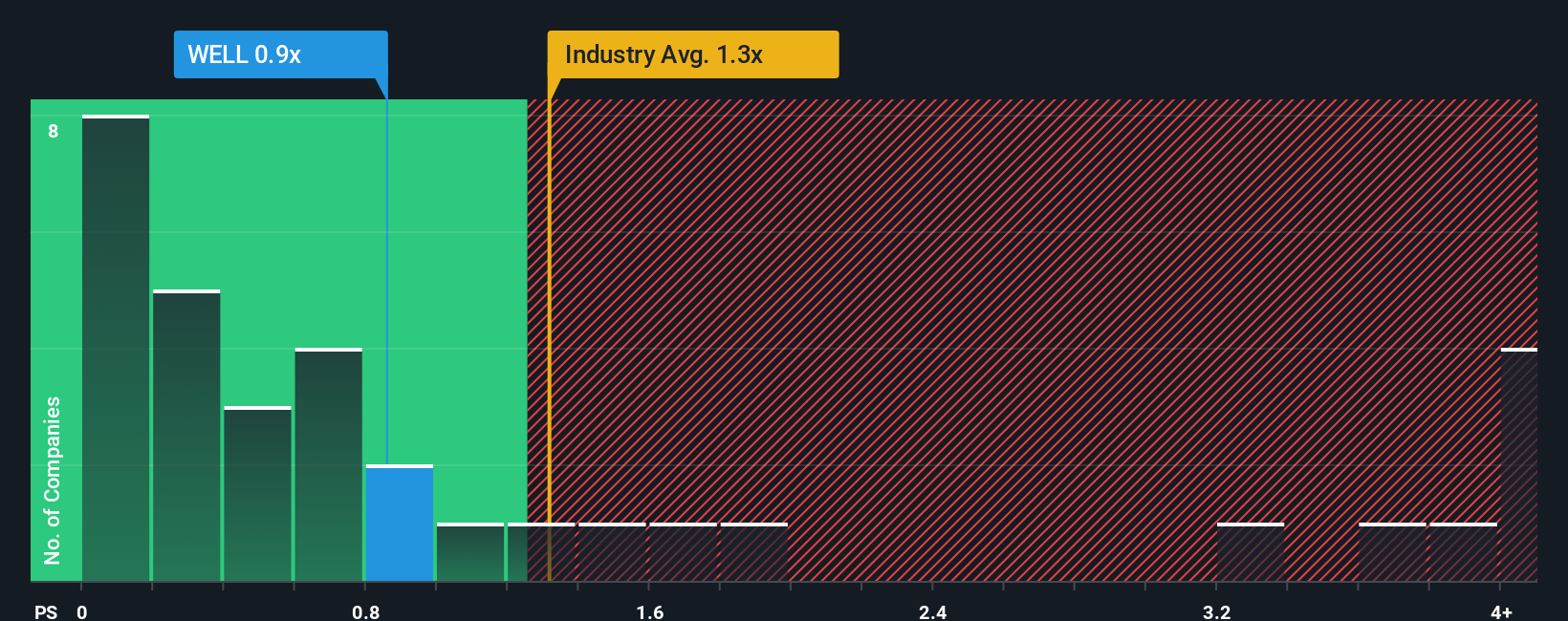

For companies like WELL Health Technologies that are focused on growth but may not always deliver steady profits, the Price-to-Sales (P/S) ratio is particularly useful. This metric evaluates how much investors are paying for each dollar of revenue, making it a useful way to gauge value, especially for digital healthcare businesses aiming to expand rapidly.

A "normal" or "fair" P/S ratio depends on a company’s future growth expectations and its perceived risks. Higher growth prospects and lower risks can justify higher P/S multiples, while lower growth rates or added uncertainties usually limit that potential.

WELL Health currently trades at a P/S ratio of 1.10x. This is notably lower than both the healthcare industry average of 1.37x and the average among direct peers at 2.26x. To provide even more context, Simply Wall St’s proprietary Fair Ratio for WELL Health is 1.95x, which accounts for its earnings growth, margins, market standing, and risk profile.

Compared to this fair value benchmark, WELL Health’s current multiple appears quite attractive. Since the actual P/S of 1.10x is well below the Fair Ratio of 1.95x, this suggests the stock may be undervalued by this measure.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your WELL Health Technologies Narrative

Beyond crunching numbers, making smart investment decisions often comes down to having a clear story, what we call a "Narrative." A Narrative is simply your view of the company’s future, combining its business story with your expectations for its financials such as revenue, earnings, and margins, and tying that perspective to a fair value estimate.

Unlike static metrics or one-size-fits-all models, Narratives let you connect the dots: from WELL Health Technologies’ latest growth moves or new digital health initiatives, to specific forecast numbers, all the way through to what you believe its shares are actually worth today. By linking a company’s real-world journey to its latest estimates, Narratives empower you to see where the price stands compared to your own fair value calculation. This approach can make it easier to decide whether to buy, hold, or sell.

Narratives are built to adapt, too. Whenever there is a fresh earnings report or breaking news, your Narrative and fair value update automatically, keeping your outlook current. With the Simply Wall St platform and its global community, you can browse, tweak, or even build your own Narrative in just a few clicks. You can also see how others interpret the same data from different angles. For example, one investor’s Narrative for WELL might highlight transformational AI and SaaS adoption (with a fair value of CA$9.00 per share), while another might focus on integration risks (targeting CA$5.25 instead).

Do you think there's more to the story for WELL Health Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WELL Health Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WELL

WELL Health Technologies

Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives