- Canada

- /

- Healthtech

- /

- TSX:VHI

TSX Growth Leaders With High Insider Ownership

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by potential interest rate cuts and robust corporate earnings growth, investors are encouraged to view any market volatility as an opportunity for strategic portfolio adjustments. In this context, stocks with high insider ownership can be particularly appealing, as they often indicate strong confidence from those closest to the company's operations and may offer resilience amid broader market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 23.1% | 93.4% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.8% |

| Orla Mining (TSX:OLA) | 10.7% | 67.9% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| Heliostar Metals (TSXV:HSTR) | 16.4% | 41% |

| Enterprise Group (TSX:E) | 32.1% | 30.4% |

| CEMATRIX (TSX:CEMX) | 10.5% | 77.8% |

| Almonty Industries (TSX:AII) | 12.5% | 65% |

| Allied Gold (TSX:AAUC) | 15.2% | 74.4% |

Let's explore several standout options from the results in the screener.

Electrovaya (TSX:ELVA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electrovaya Inc. designs, develops, manufactures, and sells lithium-ion batteries and related products for energy storage and clean electric transportation in North America, with a market cap of CA$364.97 million.

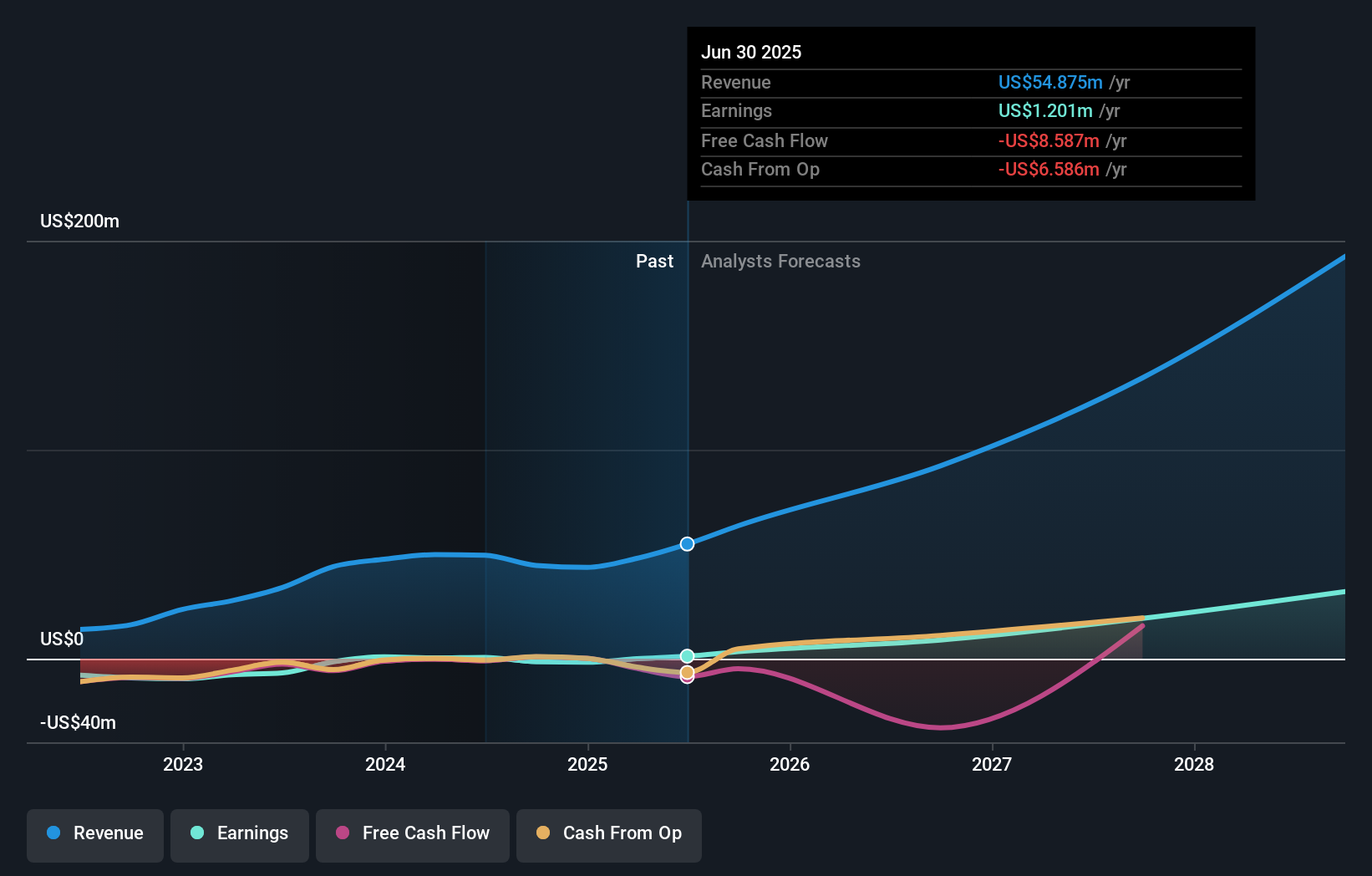

Operations: The company generates revenue of $54.88 million from the development, manufacturing, and marketing of power technology products, including lithium-ion batteries and battery management systems for energy storage and electric transportation applications in North America.

Insider Ownership: 33.9%

Electrovaya is experiencing significant growth, with forecasted revenue and earnings expected to outpace the Canadian market. Recent guidance indicates record quarterly and annual revenues, driven by strong demand for its advanced energy storage systems. Despite past shareholder dilution, Electrovaya's strategic expansions in production capabilities and new product launches position it well in the energy storage sector. However, financial constraints are evident as interest payments are not fully covered by earnings, highlighting potential risks amidst its rapid expansion.

- Dive into the specifics of Electrovaya here with our thorough growth forecast report.

- Our valuation report unveils the possibility Electrovaya's shares may be trading at a discount.

Kits Eyecare (TSX:KITS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$480.44 million.

Operations: The company's revenue primarily comes from the sale of eyewear products, totaling CA$182.88 million.

Insider Ownership: 22.4%

Kits Eyecare is poised for significant growth, with earnings forecasted to increase substantially faster than the Canadian market. Despite a recent executive change, the company continues to innovate with its OpticianAI platform, enhancing customer experience and potentially boosting revenue. While trading below estimated fair value and analysts expecting a price rise, the recent net loss in Q2 raises concerns. However, robust revenue growth projections suggest potential upside amidst these challenges.

- Delve into the full analysis future growth report here for a deeper understanding of Kits Eyecare.

- The valuation report we've compiled suggests that Kits Eyecare's current price could be quite moderate.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp., along with its subsidiaries, offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and other international markets with a market cap of CA$654.73 million.

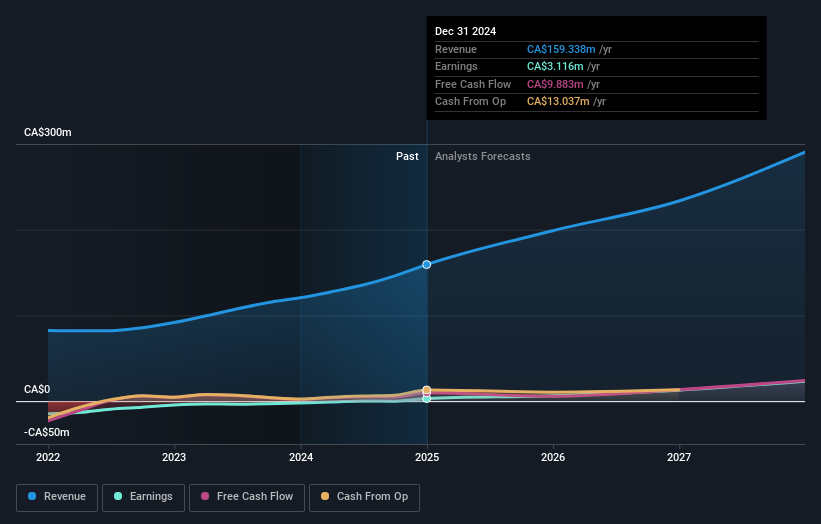

Operations: The company's revenue is primarily derived from its Healthcare Software segment, which generated CA$82.63 million.

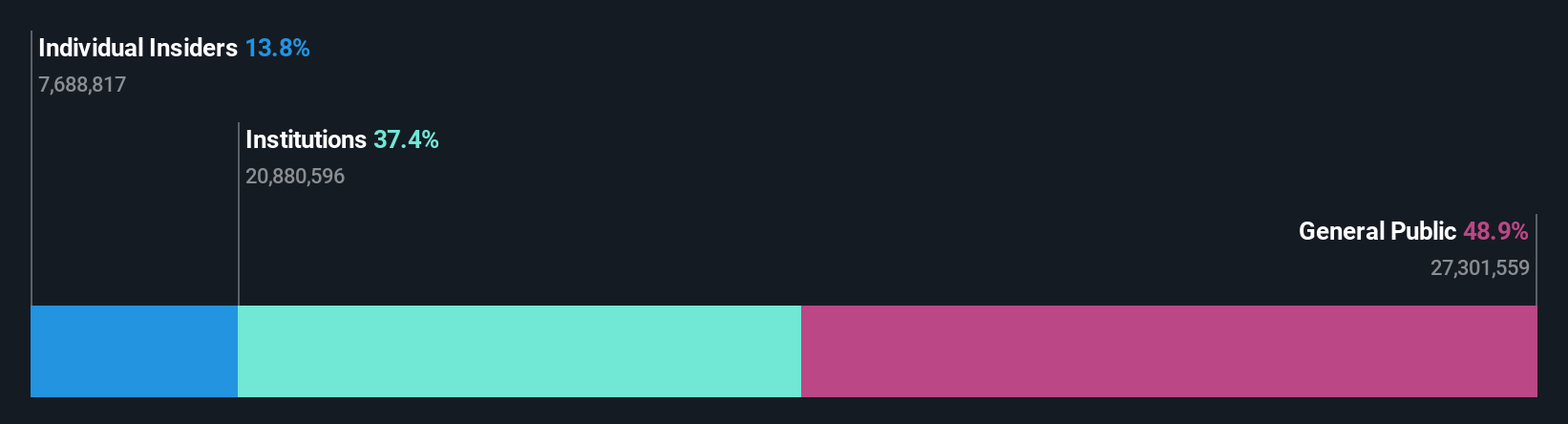

Insider Ownership: 10.7%

Vitalhub demonstrates potential for growth, with earnings expected to rise significantly faster than the Canadian market. Despite recent shareholder dilution and a follow-on equity offering of C$65 million, insider activity shows more buying than selling in the past three months. The company reported improved financial results for Q2 2025, with revenue increasing to C$23.86 million and net income turning positive. Trading below fair value, analysts anticipate a notable price increase amidst these developments.

- Click here to discover the nuances of Vitalhub with our detailed analytical future growth report.

- The analysis detailed in our Vitalhub valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 41 Fast Growing TSX Companies With High Insider Ownership selection here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives