- Canada

- /

- Healthtech

- /

- TSX:VHI

A Look at Vitalhub (TSX:VHI) Valuation Following Strong Q3 Revenue Growth and Profit Decline

Reviewed by Simply Wall St

Vitalhub (TSX:VHI) just shared its third quarter results, catching attention with a near doubling of revenue over last year. Although profitability declined, the sales surge stands out for investors tracking growth stories.

See our latest analysis for Vitalhub.

Vitalhub’s latest quarterly update, paired with management’s ongoing focus on acquisitions, arrives after a tough stretch for investors. The company’s share price closed at $9.80, but has faced a 9.8% drop over the past month and is down 10.4% year-to-date. Momentum has cooled this year despite management’s active growth strategy. Still, Vitalhub’s long-term performance has been a standout, with a three-year total shareholder return of 334% and 258% over five years. This reminds long-term holders that this has been an impressive growth story even amid current challenges.

If you’re curious about what else is possible in healthcare tech, it’s worth taking the next step and exploring See the full list for free.

With revenue nearly doubling but profit margins declining, is Vitalhub’s recent weakness a value opportunity for investors, or is the current stock price already reflecting all of its future growth potential?

Most Popular Narrative: 36.9% Undervalued

Vitalhub’s most widely followed narrative pegs its fair value at CA$15.53, a substantial premium to the recent close of CA$9.80. That gap is driven by the market’s recognition of the company’s recurring revenue engine, robust sector trends, and continued expansion into new healthcare platforms.

The healthcare sector's accelerated move toward interoperable, cloud-based systems and digital patient management, alongside regulatory pushes for data sharing, aligns with Vitalhub's high-margin SaaS offerings and integrated platform strategy. This makes increased net margins and ARR from SaaS subscriptions likely.

Find out the bold revenue and profit targets that power this eye-catching valuation. Curious which industry shifts and financial leaps could surprise the market? The playbook behind this price target goes beyond typical growth stories. See what the consensus is really betting on.

Result: Fair Value of $15.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing integration challenges from large acquisitions and unpredictable recurring revenues could quickly shift sentiment on Vitalhub’s growth story.

Find out about the key risks to this Vitalhub narrative.

Another View: What Do Valuation Ratios Signal?

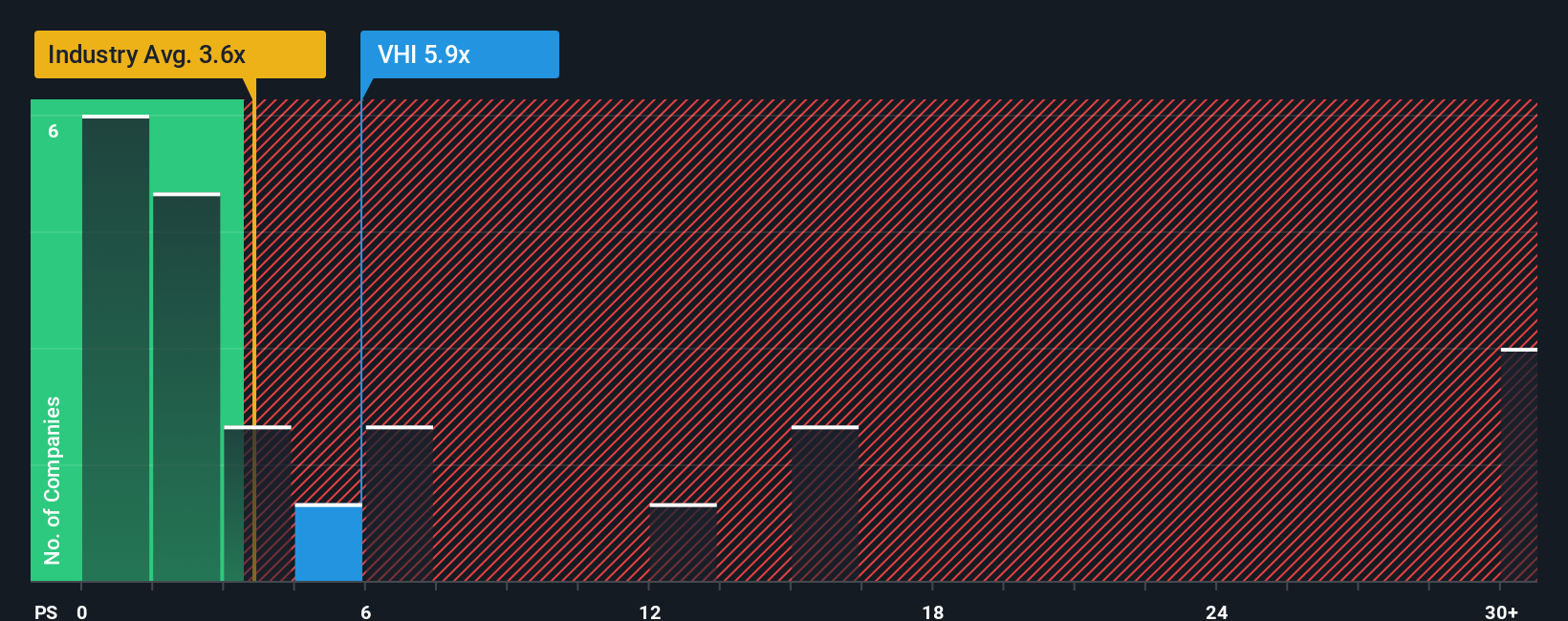

Looking at Vitalhub’s price-to-sales ratio, the stock trades at 6.3x, which is higher than the North American industry average of 3.2x but below the peer average of 10.3x. This gap means Vitalhub looks expensive compared to the broader market, but more attractive relative to its closest competitors. Notably, its ratio sits slightly above the fair ratio of 5.9x, hinting at limited upside unless growth accelerates. Could this signal risk if growth stalls, or is it actually a springboard if sector trends remain strong?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vitalhub Narrative

If you’re not convinced by the current narratives or want to dig deeper using your own perspective, you can craft your own story in just a few minutes, your way. Do it your way

A great starting point for your Vitalhub research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stick to just one opportunity when the market is brimming with unique ways to grow your wealth. Take action now before these smart investment ideas get away.

- Capitalize on the AI boom with these 27 AI penny stocks companies that are setting new standards in machine learning and automation.

- Put your cash to work in these 14 dividend stocks with yields > 3% and take advantage of attractive yields from stable businesses that prioritize steady income.

- Ride the momentum of digital finance by backing these 82 cryptocurrency and blockchain stocks at the forefront of blockchain, payments, and the adoption of next-generation technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives