- Canada

- /

- Healthcare Services

- /

- TSX:SIA

Sienna Senior Living (TSX:SIA) Valuation in Focus After Opening Two Major Ontario Facilities

Reviewed by Simply Wall St

If you have been watching Sienna Senior Living (TSX:SIA), the company just announced the official opening of two new long-term care communities in Ontario: Northern Heights in North Bay and a campus-of-care project in Brantford. These projects mark Sienna’s first major redevelopments in recent years, completed on time and within budget. Beyond the headlines, asset sales and strong resident demand are fueling the sense that this move could meaningfully boost the company’s bottom line and potentially shape its future growth story.

Investors have certainly taken notice. Even with a slight dip over the past month, Sienna’s stock has climbed nearly 18% in the past year and over 67% in the past three years, signaling that momentum is still present. News of the completed developments and property sales seems to be giving the market a fresh perspective on the company, with optimism around occupancy rates and operating efficiencies coming into focus as the new facilities come online.

After this year’s performance and these latest milestones, the big question is whether Sienna Senior Living is now a compelling consideration or if the market has already reflected all the good news in the stock price.

Price-to-Earnings of 50.1x: Is it justified?

Based on the latest analysis, Sienna Senior Living trades at a price-to-earnings (P/E) ratio of 50.1x. This is significantly higher than both the peer average of 38.1x and the North American Healthcare industry average of 21.7x. The stock is positioned as notably expensive by traditional valuation measures.

The price-to-earnings ratio is an important metric for investors because it shows how much the market is willing to pay today for a company’s earnings. In the healthcare sector, steady cash flows and predictable earnings are valued, and a very high P/E can indicate market expectations for accelerated future growth, above-average profitability, or strong competitive advantages.

Sienna’s elevated valuation suggests that investors are factoring in strong future performance or potential catalysts, but the premium is pronounced compared to sector peers. Whether this multiple is justified by future growth remains a key question as the company’s new developments begin to impact results.

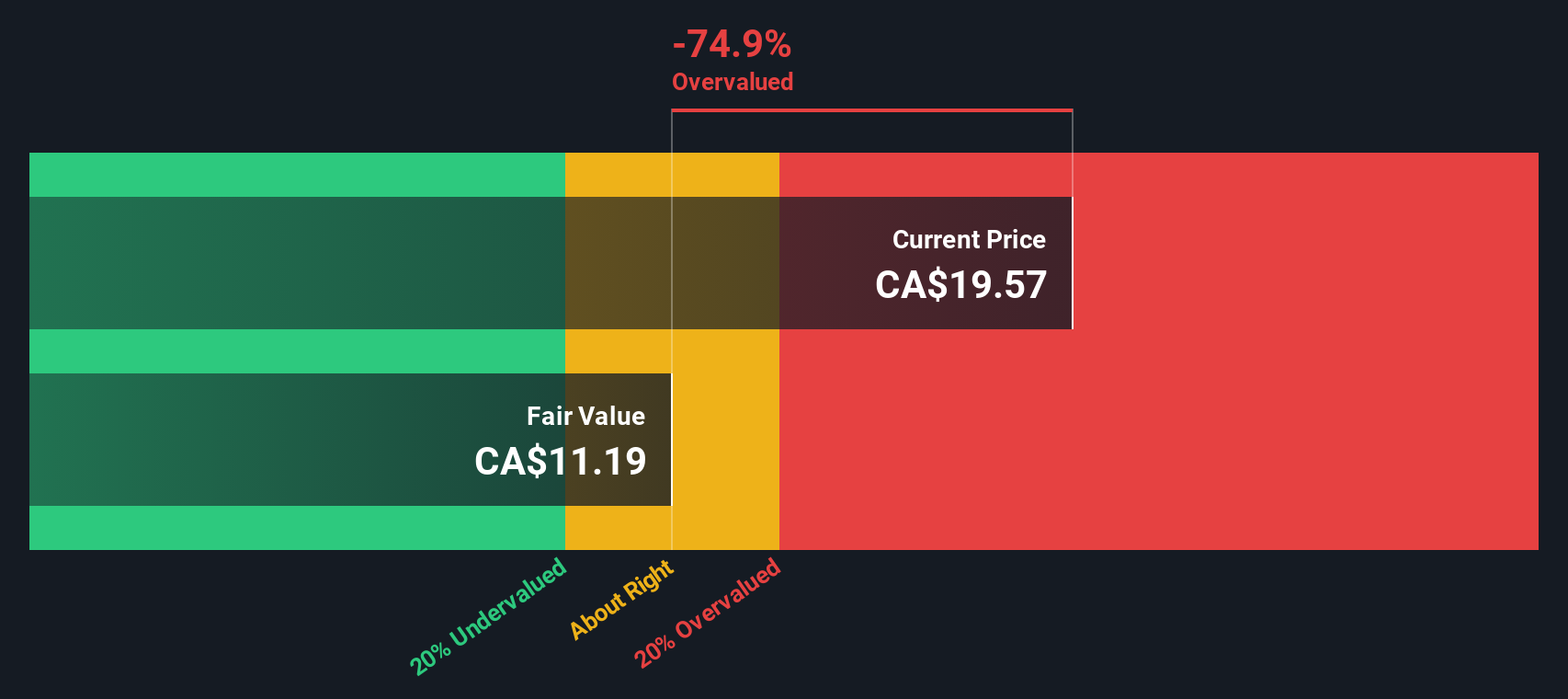

Result: Fair Value of $2.31 (OVERVALUED)

See our latest analysis for Sienna Senior Living.However, slower-than-expected occupancy growth or declines in operational efficiency could challenge the optimism around Sienna's valuation and impact future investor sentiment.

Find out about the key risks to this Sienna Senior Living narrative.Another View: The DCF Model Perspective

Looking through our DCF model, Sienna Senior Living appears significantly overvalued based on its future cash flow estimates. This method offers a more detailed analysis than typical market multiples. Could this mean the current optimism is misplaced?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Sienna Senior Living Narrative

If you have a different perspective or want to draw your own conclusions from the numbers, you can build your own story in just a few minutes with our tools. Do it your way

A great starting point for your Sienna Senior Living research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at just one opportunity. Don’t limit your potential—there could be unique stocks out there that align perfectly with your goals. Use the Simply Wall Street Screener to unlock possibilities you might have overlooked.

- Spot companies on the verge of rapid innovation, including those shaping the AI revolution, in our AI penny stocks selection.

- Boost your passive income with rock-solid, high-yield shares by checking out dividend stocks with yields > 3% for compelling dividend opportunities above 3%.

- Seize overlooked bargains with strong fundamentals using our tool to sift through undervalued stocks based on cash flows that the market may have mispriced.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:SIA

Proven track record second-rate dividend payer.

Market Insights

Community Narratives