- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

Revenues Working Against Quipt Home Medical Corp.'s (TSE:QIPT) Share Price Following 25% Dive

To the annoyance of some shareholders, Quipt Home Medical Corp. (TSE:QIPT) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

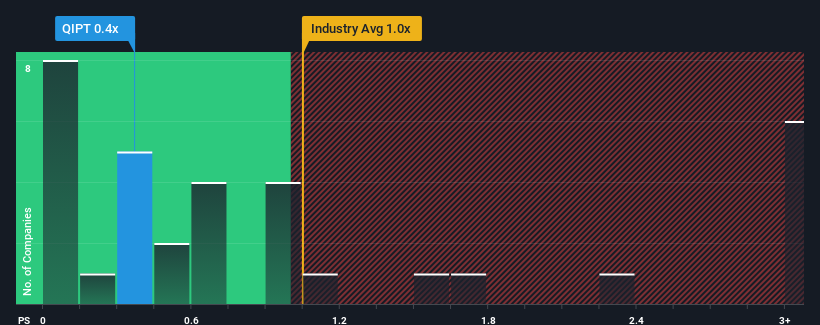

Following the heavy fall in price, when close to half the companies operating in Canada's Healthcare industry have price-to-sales ratios (or "P/S") above 1x, you may consider Quipt Home Medical as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Quipt Home Medical

What Does Quipt Home Medical's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Quipt Home Medical has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Quipt Home Medical .Is There Any Revenue Growth Forecasted For Quipt Home Medical?

Quipt Home Medical's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.8% last year. This was backed up an excellent period prior to see revenue up by 148% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 3.7% during the coming year according to the five analysts following the company. With the industry predicted to deliver 21% growth, the company is positioned for a weaker revenue result.

In light of this, it's understandable that Quipt Home Medical's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Quipt Home Medical's P/S

Quipt Home Medical's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Quipt Home Medical's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 2 warning signs we've spotted with Quipt Home Medical .

If these risks are making you reconsider your opinion on Quipt Home Medical, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026