- Canada

- /

- Healthtech

- /

- TSX:KSI

kneat.com And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As 2025 draws to a close, the Canadian market is navigating through a period of noisy yet encouraging data, with signs pointing toward easing inflation and stabilizing labor markets. In this context, the concept of penny stocks—traditionally seen as smaller or newer companies—remains relevant for investors seeking growth potential at lower price points. When these stocks are grounded in strong financials, they can offer an attractive opportunity for discovering hidden value within the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.08 | CA$53.09M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.31 | CA$246.67M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.16 | CA$116.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.45 | CA$3.88M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.335 | CA$51.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.34 | CA$864.89M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.18 | CA$23.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.14 | CA$153.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$185.47M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 394 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

kneat.com (TSX:KSI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Kneat.com, Inc., along with its subsidiaries, specializes in designing, developing, and supplying software for data and document management in regulated environments across North America, Europe, and the Asia Pacific; it has a market cap of CA$465.19 million.

Operations: The company generates revenue of CA$60.00 million from its Software & Programming segment.

Market Cap: CA$465.19M

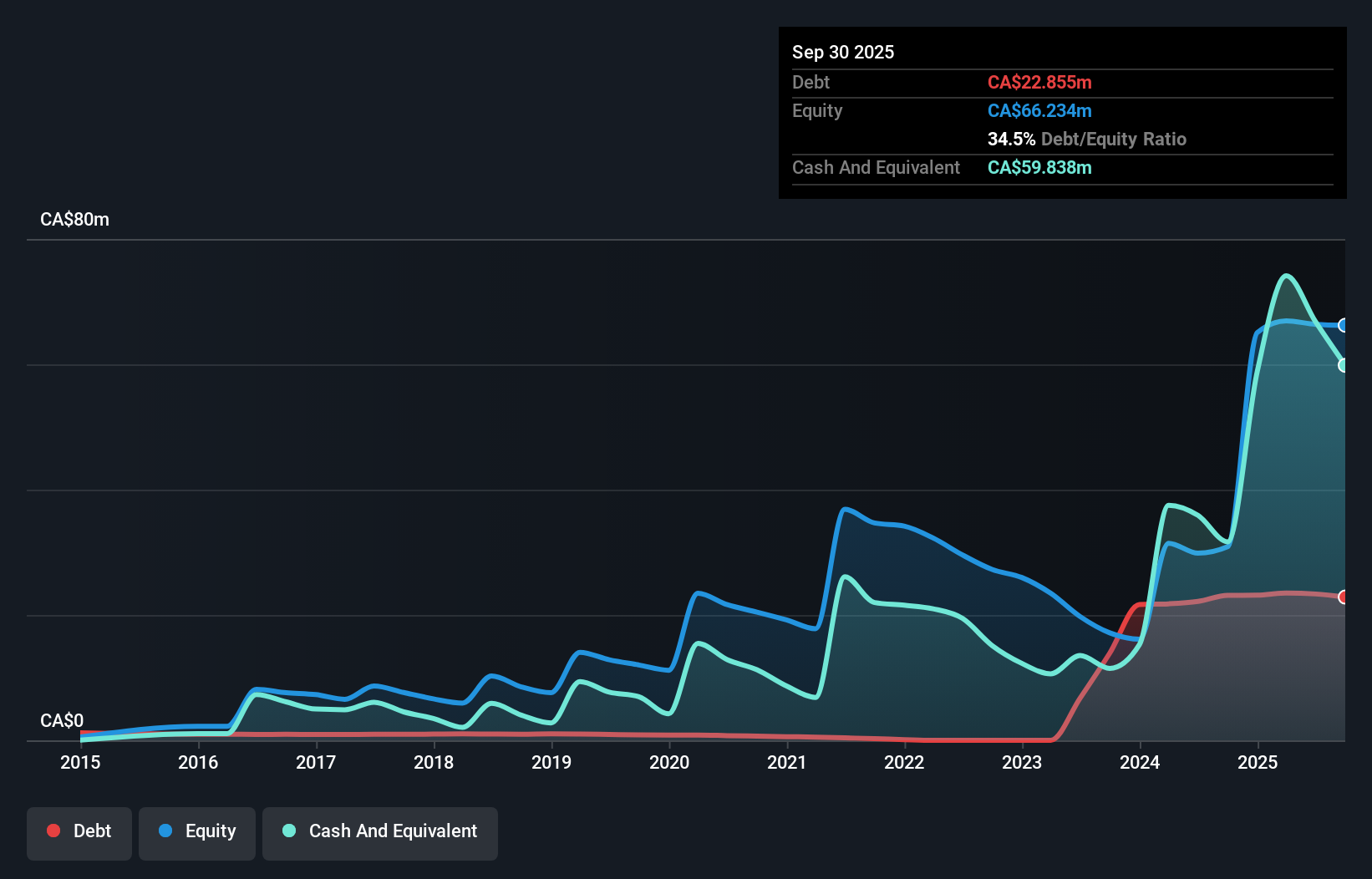

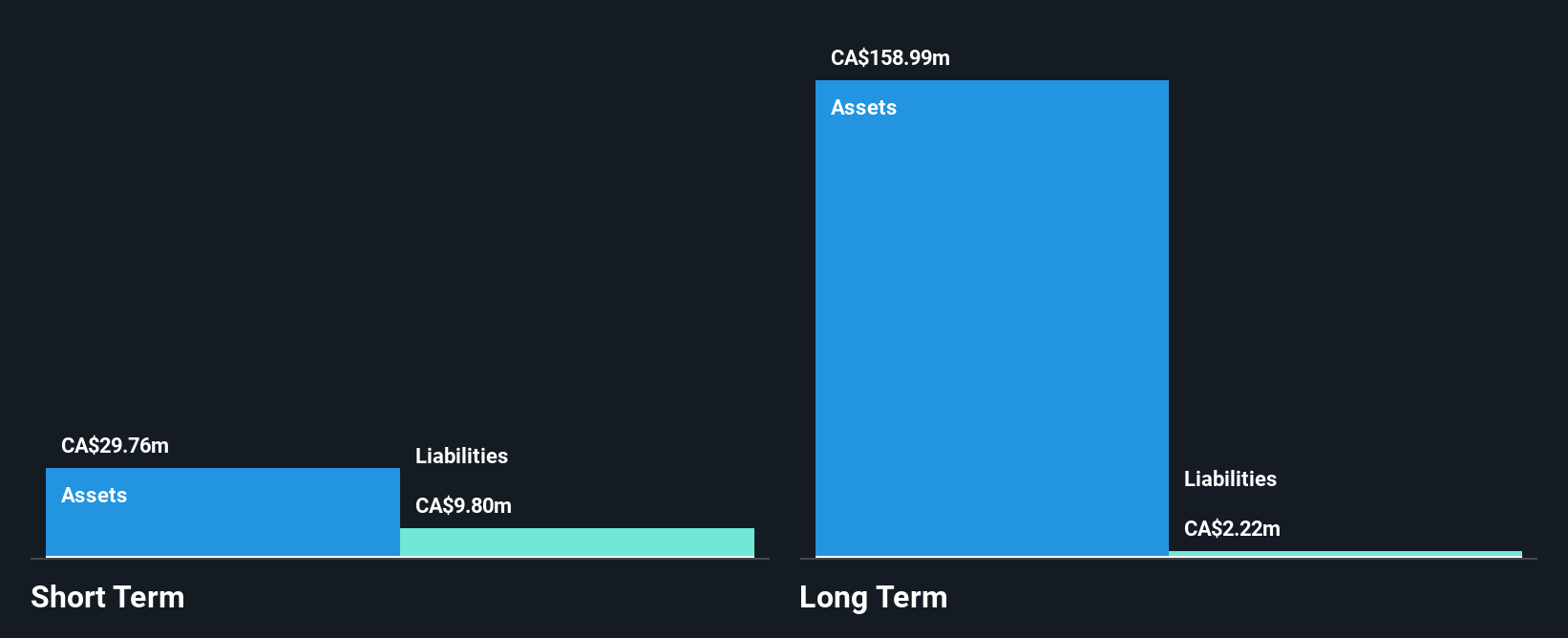

Kneat.com, Inc. has demonstrated significant growth potential despite being currently unprofitable, as evidenced by its recent three-year Master Services Agreement with a major specialty chemicals company. This deal highlights Kneat's strong customer acquisition momentum and its platform's adaptability across various industries, including pharma and healthcare. The company's short-term assets exceed both its long-term and short-term liabilities, providing financial stability. While Kneat has more cash than debt and an experienced management team, it faces challenges with a negative return on equity and increased debt-to-equity ratio over the past five years.

- Unlock comprehensive insights into our analysis of kneat.com stock in this financial health report.

- Review our growth performance report to gain insights into kneat.com's future.

Aldebaran Resources (TSXV:ALDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aldebaran Resources Inc. focuses on the acquisition, exploration, and evaluation of mineral properties in Canada and Argentina with a market cap of CA$543.73 million.

Operations: Aldebaran Resources Inc. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and evaluation of mineral properties.

Market Cap: CA$543.73M

Aldebaran Resources Inc. is pre-revenue, focusing on mineral exploration with a market cap of CA$543.73 million. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges, evidenced by a net loss of CA$7.78 million for the year ending June 2025, and auditor concerns about its viability as a going concern. The management team is seasoned with an average tenure of 7.5 years; however, Aldebaran has less than one year of cash runway at current free cash flow levels and relies heavily on external funding to sustain operations in the near term.

- Take a closer look at Aldebaran Resources' potential here in our financial health report.

- Assess Aldebaran Resources' previous results with our detailed historical performance reports.

Sintana Energy (TSXV:SEI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sintana Energy Inc. is involved in the exploration and development of crude oil and natural gas, with a market cap of CA$156.26 million.

Operations: Sintana Energy Inc. does not currently report any revenue segments.

Market Cap: CA$156.26M

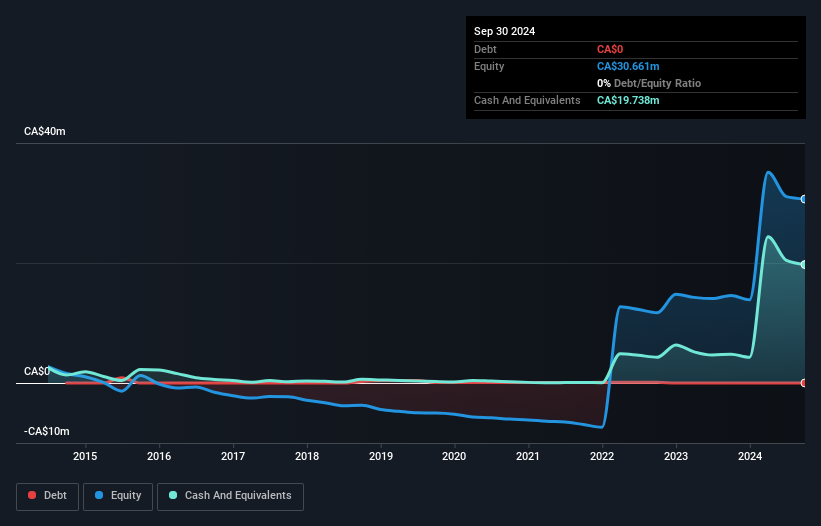

Sintana Energy Inc., with a market cap of CA$156.26 million, is pre-revenue and currently unprofitable, reporting a net loss of CA$3.55 million for Q3 2025. Despite its financial challenges, the company benefits from being debt-free and having short-term assets (CA$15.4M) that exceed both short-term (CA$2M) and long-term liabilities (CA$507.7K). Sintana's experienced management team averages 8.3 years in tenure, and it has over a year of cash runway at current free cash flow levels, although profitability isn't expected in the next three years according to forecasts.

- Jump into the full analysis health report here for a deeper understanding of Sintana Energy.

- Explore Sintana Energy's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Discover the full array of 394 TSX Penny Stocks right here.

- Contemplating Other Strategies? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KSI

kneat.com

Designs, develops, and supplies software for data and document management within regulated environments in North America, Europe, and the Asia Pacific.

High growth potential and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion