HLS Therapeutics Inc. (TSE:HLS) will pay a dividend of CA$0.05 on the 15th of September. The dividend yield is 1.4% based on this payment, which is a little bit low compared to the other companies in the industry.

See our latest analysis for HLS Therapeutics

HLS Therapeutics' Distributions May Be Difficult To Sustain

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. HLS Therapeutics is not generating a profit, but its free cash flows easily cover the dividend, leaving plenty for reinvestment in the business. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Over the next year, EPS could expand by 1.1% if recent trends continue. While it is good to see income moving in the right direction, it still looks like the company won't achieve profitability. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

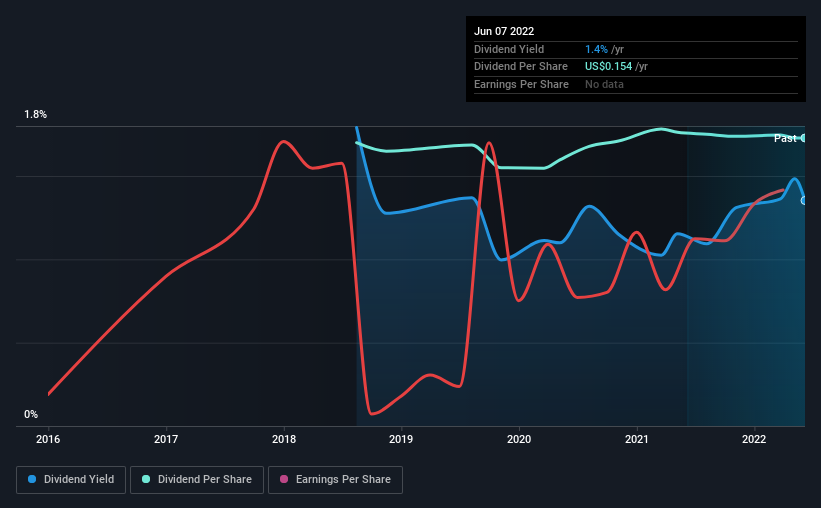

HLS Therapeutics Doesn't Have A Long Payment History

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 4 years, which isn't that long in the grand scheme of things. The first annual payment during the last 4 years was US$0.15 in 2018, and the most recent fiscal year payment was US$0.15. Its dividends have grown at less than 1% per annum over this time frame. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

HLS Therapeutics May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Although it's important to note that HLS Therapeutics' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time. With no profits, we don't think HLS Therapeutics has much potential to grow the dividend in the future.

Our Thoughts On HLS Therapeutics' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for HLS Therapeutics that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if HLS Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HLS

HLS Therapeutics

A specialty pharmaceutical company, acquires and commercializes pharmaceutical products for the treatment of psychiatric disorders, central nervous system, and cardiovascular disease in Canada, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success