- Canada

- /

- Healthcare Services

- /

- TSX:AND

Assessing Andlauer Healthcare Group (TSX:AND) Valuation After Steady Share Price Gains in 2024

Reviewed by Kshitija Bhandaru

See our latest analysis for Andlauer Healthcare Group.

Andlauer Healthcare Group’s recent upward move caps off a robust stretch, with a 21.5% year-to-date share price return and a healthy 1-year total shareholder return of nearly 33%. This steady climb suggests momentum is building as investors recognize the company’s resilience and long-term growth potential.

If Andlauer’s progress has you thinking about what else might be on the rise in the sector, explore more names on our See the full list for free.

But with Andlauer Healthcare shares trading close to analyst price targets and recent gains already strong, should investors see value at current levels? Or has the market already priced in all the company’s future growth?

Price-to-Earnings of 30.8x: Is it justified?

Andlauer Healthcare Group trades at a price-to-earnings (P/E) ratio of 30.8x, which is a key starting point to assess how the market values its shares relative to profits. At the last close of CA$53.18, this multiple suggests investors are paying a premium to own the company’s earnings. How does this compare to peers?

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company’s earnings. A higher multiple can signal strong confidence in future growth or a business with a resilient model. A lower number might reflect concerns around sustainability of those profits or lower growth expectations. For Andlauer, a 30.8x ratio positions it as a premium play within the sector.

Compared to the peer group, Andlauer’s price-to-earnings ratio is attractive. It trades well below the peer average of 81.3x, suggesting shares may be relatively undervalued compared to direct competitors. However, looking across the North American Healthcare industry more broadly, its P/E is somewhat expensive, as the sector average stands at 21.3x. This creates a split narrative: the company is inexpensive against local rivals, but looks expensive versus the wider industry norm. There is no available fair ratio estimate at this time to provide further context on how far the current multiple could move toward a fair value level.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 30.8x (ABOUT RIGHT)

However, slower revenue growth and shares trading near price targets could pose risks. This may potentially limit further upside if market sentiment shifts.

Find out about the key risks to this Andlauer Healthcare Group narrative.

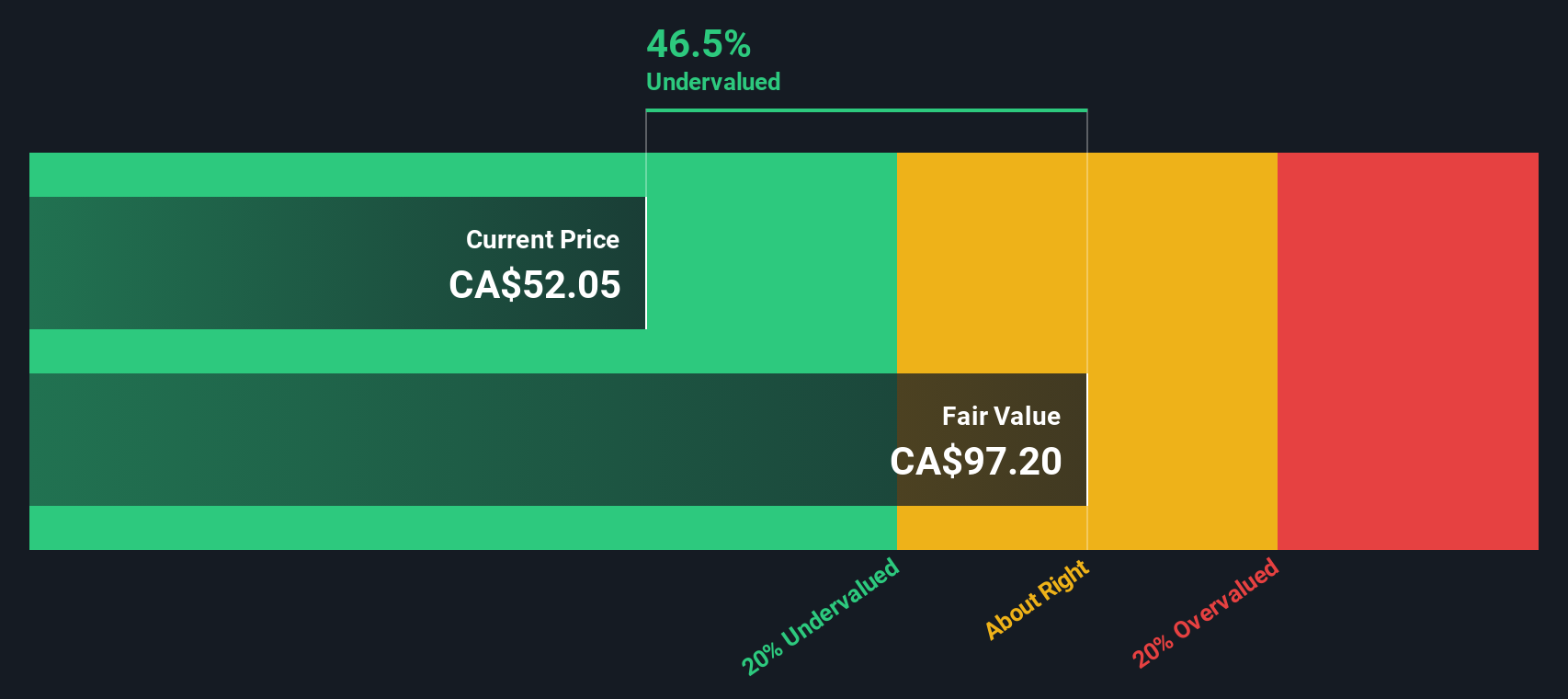

Another View: Discounted Cash Flow Signals Deep Value

While the market’s focus is often on earnings multiples, a second approach using the SWS DCF model offers a very different perspective. This model estimates Andlauer Healthcare Group’s fair value at CA$97.43 per share, which is substantially higher than its recent price. Does this signal a hidden opportunity for patient investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Andlauer Healthcare Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Andlauer Healthcare Group Narrative

If you want to dig deeper or take a different view, you can easily shape your own analysis in under three minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Andlauer Healthcare Group.

Looking for more investment ideas?

Make your next investing move count by checking out today's most promising themes across global markets. If you miss this chance, you could regret sitting on the sidelines as trends accelerate.

- Tap into potent dividend growth with companies offering reliable income streams and see which ones make the cut in these 18 dividend stocks with yields > 3% for yields above 3%.

- Uncover tomorrow’s technology leaders by reviewing these 24 AI penny stocks and explore companies capitalizing on breakthroughs in artificial intelligence-driven industries right now.

- Capture unique value opportunities and lock in great potential by tracking these 878 undervalued stocks based on cash flows based on strong underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AND

Andlauer Healthcare Group

A supply chain management company, provides a platform of customized third-party logistics (3PL) and specialized transportation solutions for the healthcare sector in Canada and the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion