- Canada

- /

- Metals and Mining

- /

- TSX:ARG

TSX Penny Stock Gems: Happy Belly Food Group Among 3 Exciting Picks

Reviewed by Simply Wall St

The Canadian market has been experiencing a subdued growth outlook, influenced by slower consumer spending and population growth, while the U.S. faces uncertainty around interest rate decisions due to recent economic data disruptions. In such a climate, investors often look for opportunities that offer potential upside with manageable risk, making penny stocks an intriguing area to explore. Although the term "penny stocks" may seem outdated, these investments in smaller or newer companies can still provide significant growth potential when backed by strong fundamentals and financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.11 | CA$54.1M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.00 | CA$199.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.43 | CA$3.59M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$50.32M | ✅ 3 ⚠️ 1 View Analysis > |

| Monument Mining (TSXV:MMY) | CA$1.07 | CA$355.45M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.23 | CA$791.7M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.14 | CA$22.2M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.77 | CA$140.59M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$185.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.77 | CA$10.92M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 402 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

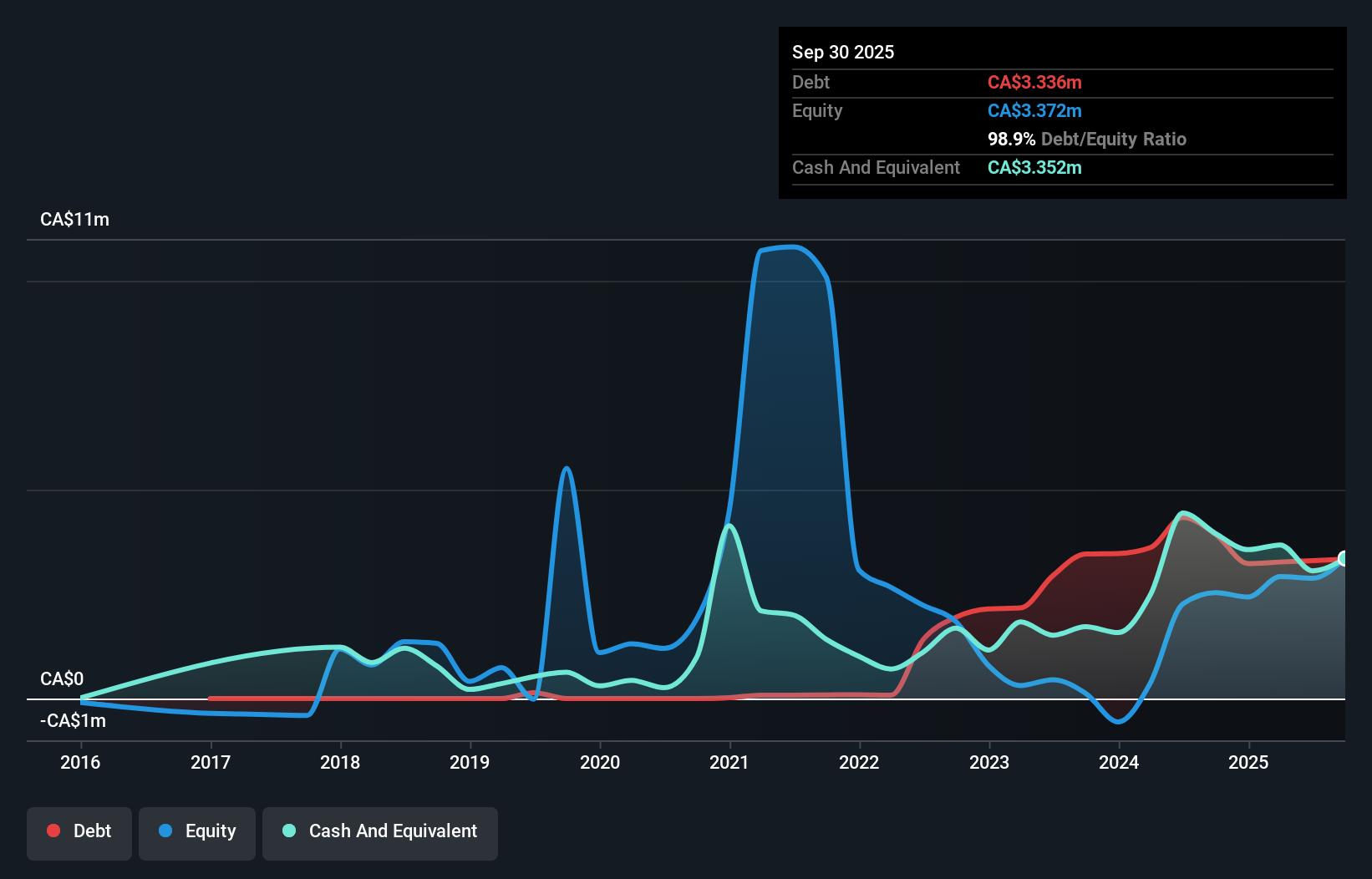

Happy Belly Food Group (CNSX:HBFG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Happy Belly Food Group Inc. is a multi-branded restaurant company focused on acquiring and scaling emerging food brands across Canada, with a market cap of CA$226.22 million.

Operations: Happy Belly Food Group Inc. has not reported any specific revenue segments.

Market Cap: CA$226.22M

Happy Belly Food Group Inc. is a multi-branded restaurant company with a market cap of CA$226.22 million, focusing on strategic expansion through franchise agreements and real estate acquisitions across Canada and the U.S., notably in Texas. Despite being pre-revenue, it has reduced losses over five years by 42.3% annually and maintains sufficient cash runway for over three years due to positive free cash flow growth of 18.3% per year. The company's asset-light franchising strategy supports its expansion goals, though challenges remain with short-term assets not covering long-term liabilities and an inexperienced management team averaging 1.2 years tenure.

- Jump into the full analysis health report here for a deeper understanding of Happy Belly Food Group.

- Understand Happy Belly Food Group's earnings outlook by examining our growth report.

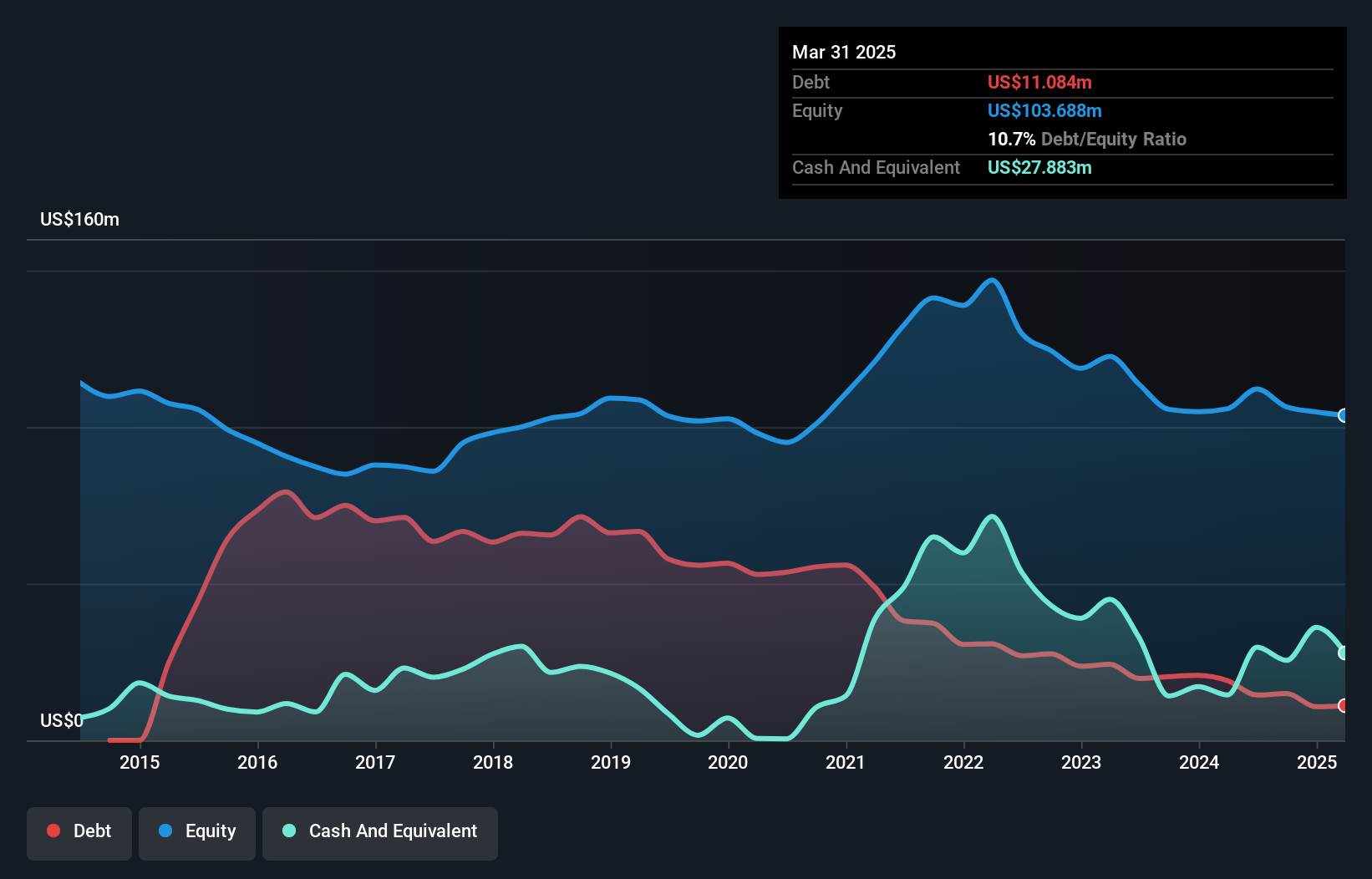

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Amerigo Resources Ltd., operating through its subsidiary Minera Valle Central S.A., is engaged in the production of copper and molybdenum concentrates in Chile, with a market cap of CA$558.76 million.

Operations: The company's revenue is derived from the production of copper concentrates under a tolling agreement with DET, amounting to $198.32 million.

Market Cap: CA$558.76M

Amerigo Resources Ltd., with a market cap of CA$558.76 million, has recently reported increased quarterly sales of US$52.48 million and net income of US$6.66 million, reflecting its operational stability in copper and molybdenum production in Chile. The company maintains a seasoned management team with an average tenure of 7.9 years, while its short-term assets exceed both short-term and long-term liabilities, indicating sound financial health. Despite stable earnings growth challenges over the past year, Amerigo's debt is well-covered by operating cash flow, supporting its dividend payouts though the track record remains unstable amidst significant insider selling recently observed.

- Dive into the specifics of Amerigo Resources here with our thorough balance sheet health report.

- Assess Amerigo Resources' future earnings estimates with our detailed growth reports.

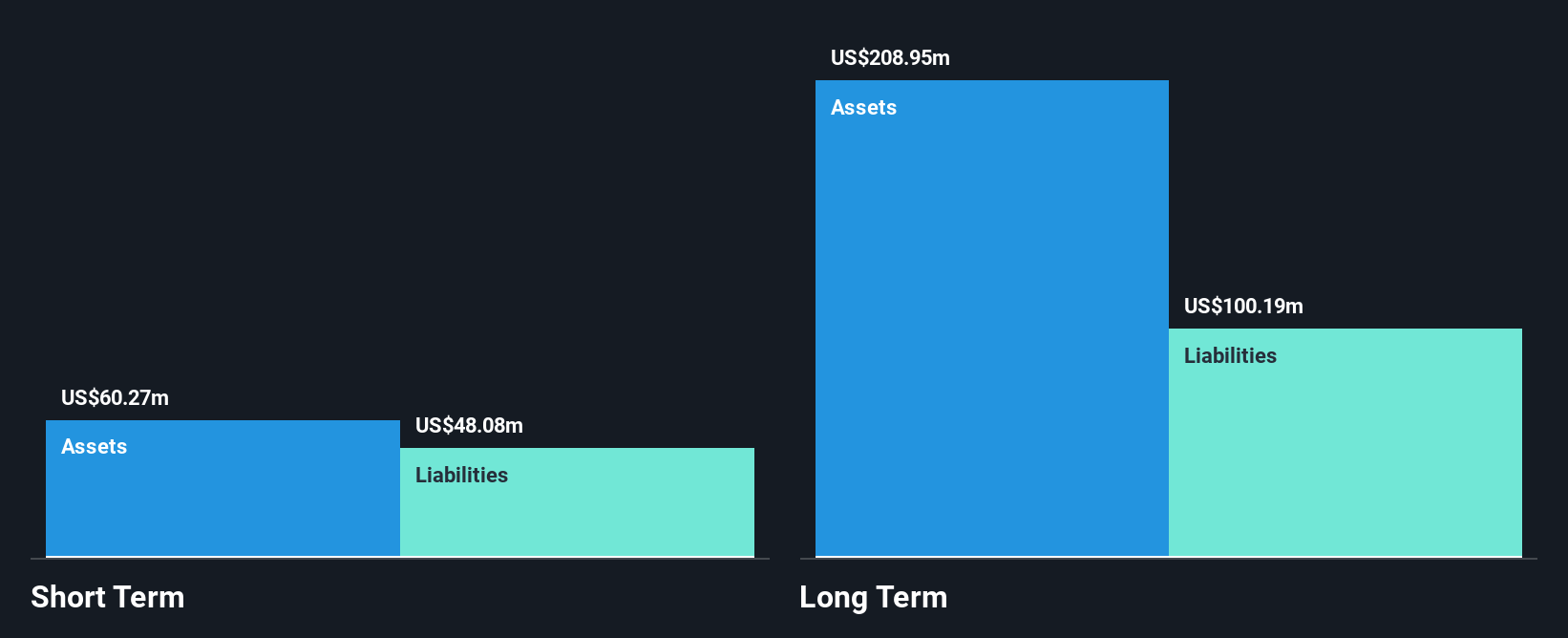

Rio2 (TSX:RIO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rio2 Limited is involved in the exploration, development, and mining of mineral properties across Canada, Peru, Bahamas, and Chile with a market cap of CA$1.02 billion.

Operations: Rio2 Limited does not have any reported revenue segments.

Market Cap: CA$1.02B

Rio2 Limited, with a market cap of CA$1.02 billion, is pre-revenue and focuses on the Fenix Gold Project in Chile. The project is 63% complete and aims for first gold production by January 2026. Despite recent net losses narrowing to US$3.38 million for Q3 2025, Rio2's management team is experienced with no debt burden. However, short-term assets do not cover long-term liabilities of US$100.2 million, posing a financial challenge. Recent index exclusion may affect visibility but ongoing construction progress at Fenix could enhance future prospects if milestones are met as planned.

- Take a closer look at Rio2's potential here in our financial health report.

- Gain insights into Rio2's outlook and expected performance with our report on the company's earnings estimates.

Taking Advantage

- Navigate through the entire inventory of 402 TSX Penny Stocks here.

- Want To Explore Some Alternatives? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success