- Canada

- /

- Healthtech

- /

- CNSX:HBFG

Happy Belly Food Group (CNSX:HBFG): Q3 Revenue Surge Challenges Profitability Concerns

Reviewed by Simply Wall St

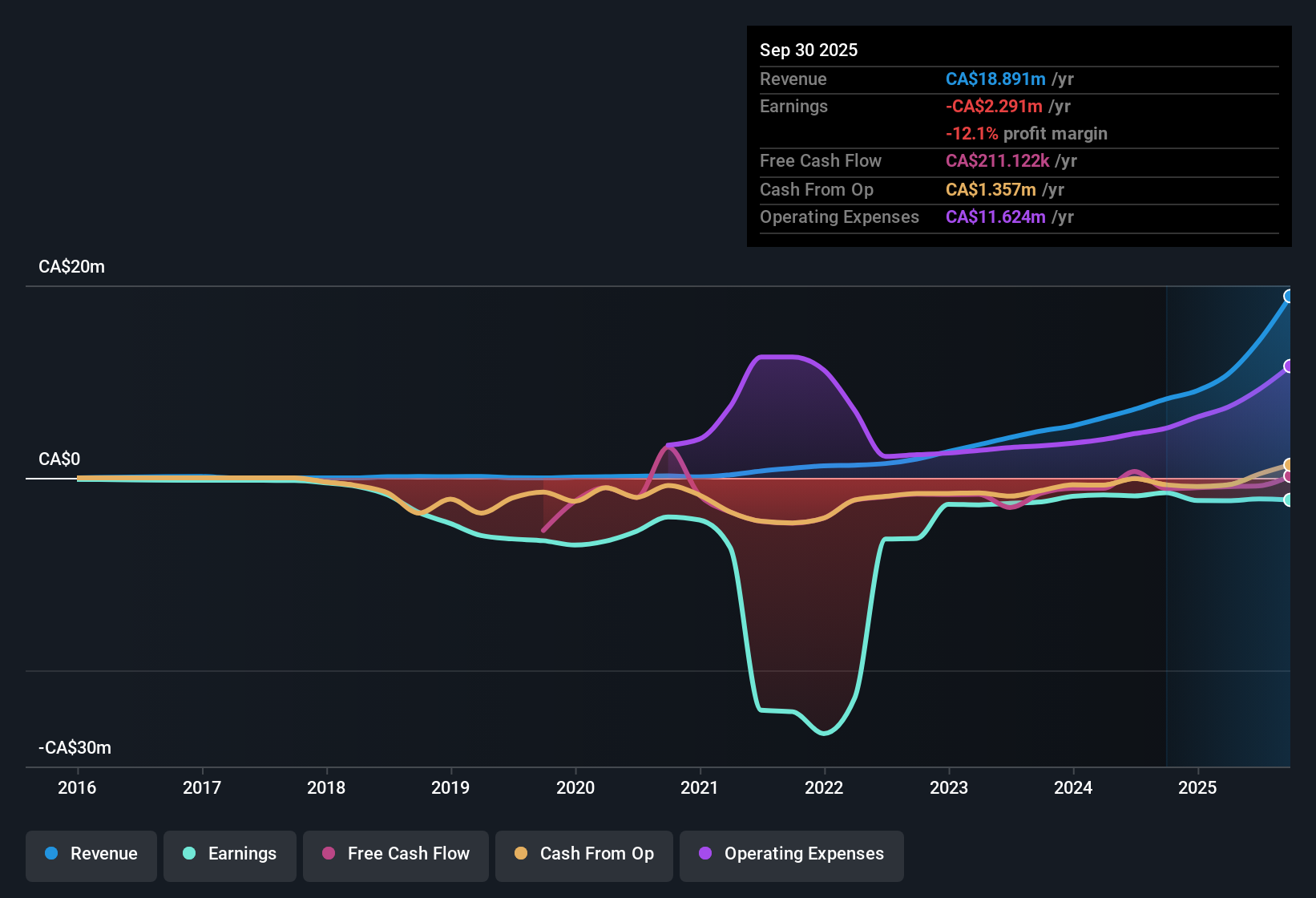

Happy Belly Food Group (CNSX:HBFG) just posted its Q3 2025 results, reporting revenue of $7.2 million and a basic EPS of -0.00199 CAD. The company has reported an increase in revenue from $2.5 million in Q3 2024 to $7.2 million this quarter, with EPS in the same period changing from -0.00126 to -0.00199 CAD. With rapid growth in revenue but net losses still affecting margins, investors are watching closely to see whether increased scale can lead to future profitability.

See our full analysis for Happy Belly Food Group.Now, let’s see how these numbers compare to the narratives shaping market sentiment and investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Narrow as Revenue Hits $18.9 Million LTM

- Trailing twelve month revenue grew to $18.9 million, while net income over the same period remains negative at -$2.29 million. This reflects ongoing unprofitability, but losses have narrowed compared to deeper negatives from past quarters.

- Market observers see the rapid top-line growth as a sign of scaling power, but also point out that profitability remains elusive even with the reduction in annual losses.

- Revenue expanded at a forecast 35.25% annual rate, exceeding the 4.6% Canadian market average. However, each dollar of sales is not yet translating to positive net income.

- This combination of aggressive expansion and the lack of margin improvement increases the importance of future earnings performance.

Shares at 74% Discount to DCF Fair Value

- With shares trading at CA$1.74, the market price is 73.7% below the DCF fair value of $6.61, a sizable gap that few peers in the same sector exhibit.

- Despite this significant discount to DCF fair value, the company trades at a 12x price-to-sales multiple, which is well above the sector’s 3.5x average and the peer group’s 7.4x. This prompts investors to weigh potential upside against an industry premium.

- The discounted share price may attract buyers focused on growth, but high multiples suggest that current sales growth expectations are already reflected compared to the healthcare services sector.

- Optimists may see an opportunity for a re-rating to fair value, while others highlight valuation risks if sales growth slows.

Five-Year Loss Reduction Rate Hits 42.3%

- Over the last five years, the company has cut its annual net losses by an average of 42.3%. This is a notable accomplishment, even as the business continues to report negative net income.

- Market commentary often highlights ongoing unprofitability, but the rate of loss reduction stands out as a positive development for a business at this stage.

- Q3 2025 net loss was -$0.26 million, improving compared to the Q4 2024 loss of -$1.42 million, supporting the narrative of operational turnaround.

- Some see this trend as a sign of improved discipline, while others point to the lack of positive net income as evidence that the path to sustained profitability is not yet complete.

See what the community is saying about future growth drivers and risk factors behind these numbers. Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Happy Belly Food Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Happy Belly Food Group’s persistent losses and unpredictable earnings highlight the difficulties in achieving reliable, sustained profitability.

If you want companies that consistently deliver reliable financial results, use stable growth stocks screener (2073 results) to find those with steadier revenue and earnings than what we have seen here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happy Belly Food Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:HBFG

Happy Belly Food Group

Operates as a multi-branded restaurant company that engages in acquiring and scaling emerging food brands across Canada.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success