Inter-Rock Minerals Inc. (CVE:IRO) Surges 33% Yet Its Low P/E Is No Reason For Excitement

Despite an already strong run, Inter-Rock Minerals Inc. (CVE:IRO) shares have been powering on, with a gain of 33% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 67% in the last year.

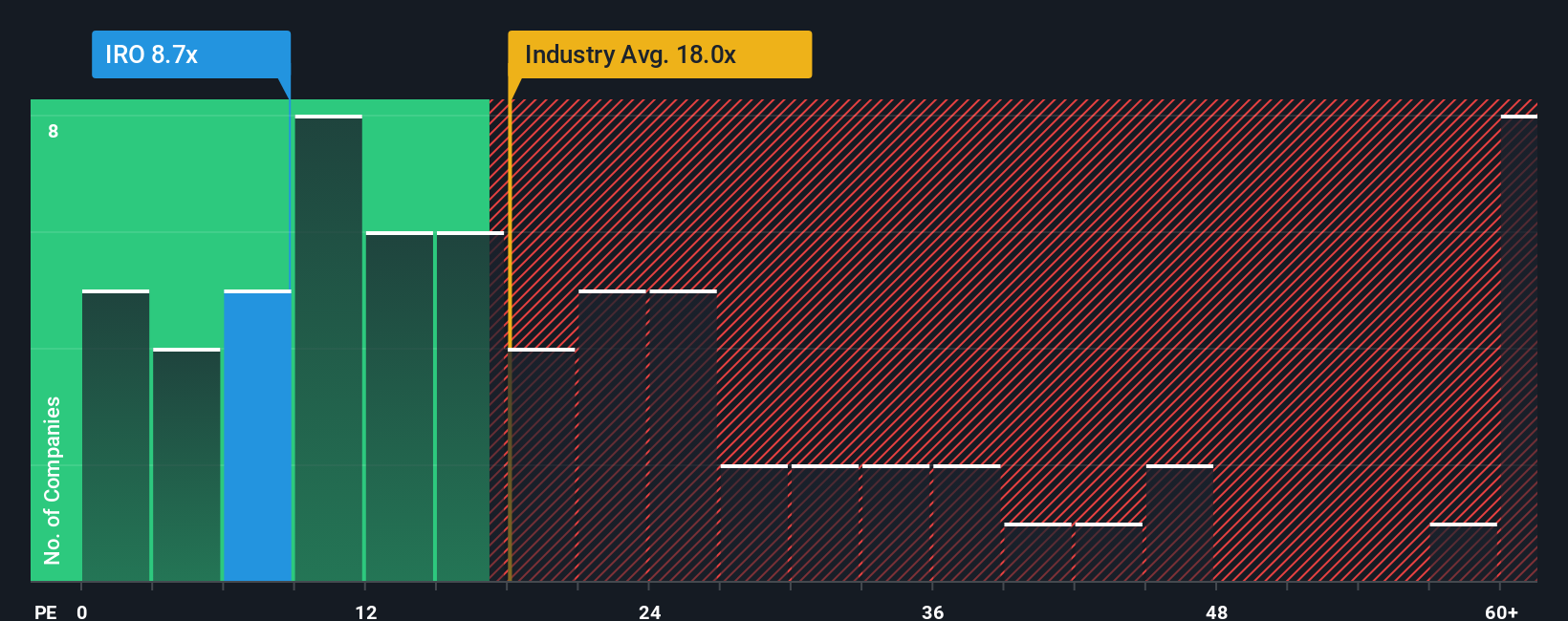

Even after such a large jump in price, given about half the companies in Canada have price-to-earnings ratios (or "P/E's") above 17x, you may still consider Inter-Rock Minerals as an attractive investment with its 8.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

As an illustration, earnings have deteriorated at Inter-Rock Minerals over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

See our latest analysis for Inter-Rock Minerals

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Inter-Rock Minerals' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 8.9%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 29% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Comparing that to the market, which is predicted to deliver 18% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's understandable that Inter-Rock Minerals' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Inter-Rock Minerals' P/E?

The latest share price surge wasn't enough to lift Inter-Rock Minerals' P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Inter-Rock Minerals maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 3 warning signs we've spotted with Inter-Rock Minerals (including 2 which are a bit concerning).

Of course, you might also be able to find a better stock than Inter-Rock Minerals. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:IRO

Inter-Rock Minerals

Through its subsidiaries, produces and distributes specialty feed ingredients in the United States and Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives