Stock Analysis

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that SunOpta Inc. (TSE:SOY) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for SunOpta

What Is SunOpta's Debt?

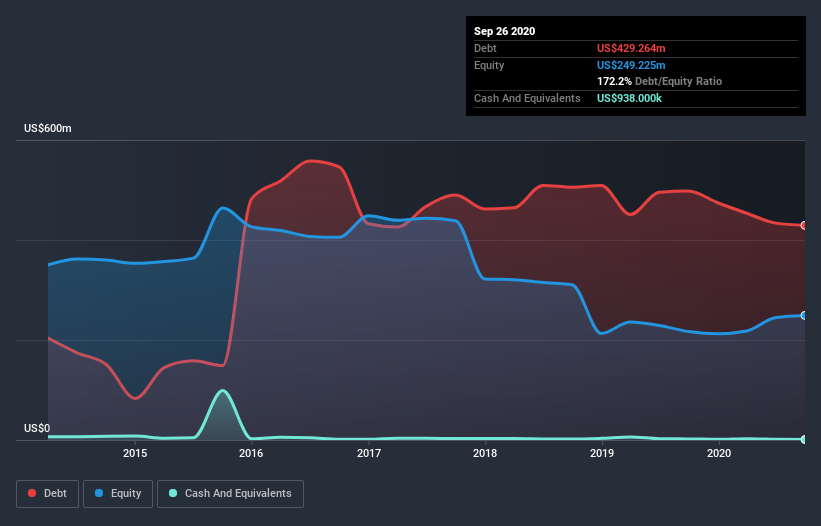

You can click the graphic below for the historical numbers, but it shows that SunOpta had US$429.3m of debt in September 2020, down from US$498.0m, one year before. Net debt is about the same, since the it doesn't have much cash.

How Healthy Is SunOpta's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that SunOpta had liabilities of US$365.5m due within 12 months and liabilities of US$306.7m due beyond that. Offsetting these obligations, it had cash of US$938.0k as well as receivables valued at US$147.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$523.8m.

This deficit isn't so bad because SunOpta is worth US$999.4m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

SunOpta shareholders face the double whammy of a high net debt to EBITDA ratio (5.7), and fairly weak interest coverage, since EBIT is just 1.2 times the interest expense. This means we'd consider it to have a heavy debt load. However, the silver lining was that SunOpta achieved a positive EBIT of US$40m in the last twelve months, an improvement on the prior year's loss. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine SunOpta's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, SunOpta actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Our View

Neither SunOpta's ability to cover its interest expense with its EBIT nor its net debt to EBITDA gave us confidence in its ability to take on more debt. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Looking at all the angles mentioned above, it does seem to us that SunOpta is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should be aware of the 1 warning sign we've spotted with SunOpta .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade SunOpta, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether SunOpta is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:SOY

SunOpta

Engages in manufacture and sale of plant-based and fruit-based food and beverage products in the United States, Canada, and internationally.

Reasonable growth potential and fair value.