Stock Analysis

If You Had Bought SunOpta (TSE:SOY) Stock A Year Ago, You Could Pocket A 270% Gain Today

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. For example, the SunOpta Inc. (TSE:SOY) share price has soared 270% return in just a single year. It's also up 45% in about a month. Having said that, the longer term returns aren't so impressive, with stock gaining just 24% in three years.

View our latest analysis for SunOpta

Because SunOpta made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

SunOpta grew its revenue by 3.5% last year. That's not great considering the company is losing money. So we wouldn't have expected the share price to rise by 270%. The business will need a lot more growth to justify that increase. We're not so sure that revenue growth is driving the market optimism about the stock.

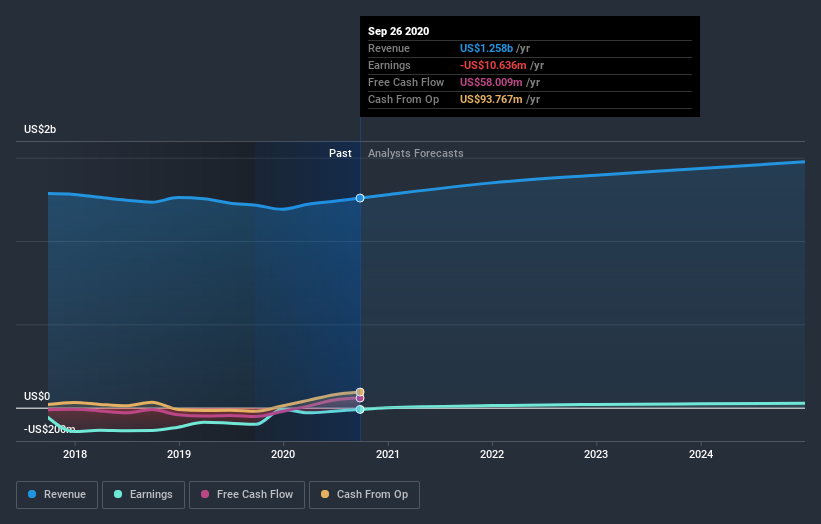

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on SunOpta's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that SunOpta has rewarded shareholders with a total shareholder return of 270% in the last twelve months. That gain is better than the annual TSR over five years, which is 6%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand SunOpta better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with SunOpta .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

When trading SunOpta or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether SunOpta is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:SOY

SunOpta

Engages in manufacture and sale of plant-based and fruit-based food and beverage products in the United States, Canada, and internationally.

Reasonable growth potential and fair value.