Should Maple Leaf Foods’ (TSX:MFI) New Mighty Protein Sticks and Strong Q3 Results Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Earlier this month, Maple Leaf Foods announced the launch of Maple Leaf Mighty Protein™, a new line of chicken protein sticks designed to meet the rising demand among Canadians for convenient, high-protein snacks, alongside reporting sharply improved third-quarter sales and net income results.

- This expansion into protein-focused snacking leverages consumer wellness trends and highlights Maple Leaf Foods' continued emphasis on innovation in its product portfolio.

- We'll explore how introducing Mighty Protein chicken sticks enhances Maple Leaf Foods' investment narrative in light of growing consumer demand for high-protein foods.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Maple Leaf Foods Investment Narrative Recap

Belief in Maple Leaf Foods as an investment often centers around its ability to capitalize on consumer trends for high-protein, wellness-focused foods and deliver value-added growth through innovation. The launch of Maple Leaf Mighty Protein™ highlights this approach, but does not appear to materially impact near-term catalysts tied to margin expansion or offset the biggest risks, which include volatility in earnings if recent gains prove nonrecurring and margin pressure from inflation or consumer behavior shifts.

Among the recent announcements, the third-quarter earnings report stands out in the context of the new product launch. Stronger sales and net income reinforce Maple Leaf Foods' investment in innovation, with topline and bottom-line improvements serving as important validation for expansion into protein-rich snacking as a growth lever ahead of ongoing margin normalization efforts.

However, in contrast to positive sales momentum, investors should be aware that the company's current margin expansion efforts heavily rely on normalization in the pork market and consumer response to higher prices...

Read the full narrative on Maple Leaf Foods (it's free!)

Maple Leaf Foods' narrative projects CA$5.6 billion revenue and CA$467.3 million earnings by 2028. This requires 4.2% yearly revenue growth and a CA$372.7 million earnings increase from CA$94.6 million today.

Uncover how Maple Leaf Foods' forecasts yield a CA$36.81 fair value, a 52% upside to its current price.

Exploring Other Perspectives

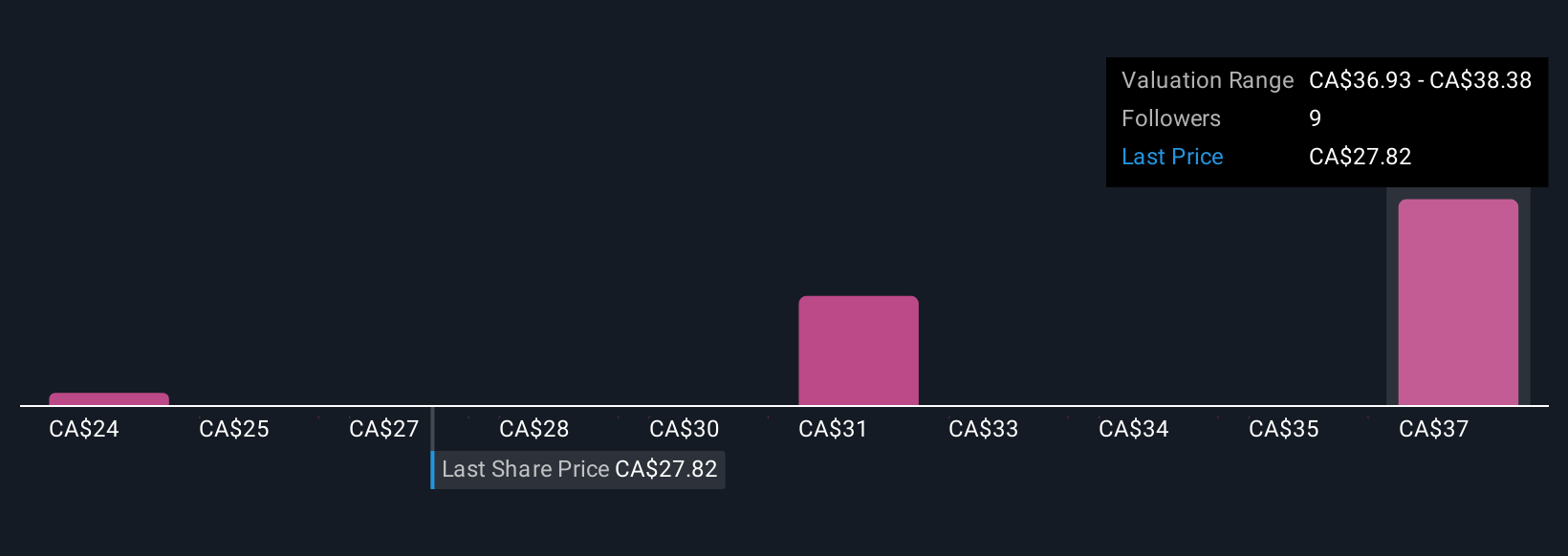

Three community members from Simply Wall St assessed Maple Leaf Foods' fair value between CA$23.92 and CA$51.25. While many see upside linked to protein demand trends, others are cautious about earnings volatility if recent sales performance cannot be sustained, so explore a variety of viewpoints to inform your own outlook.

Explore 3 other fair value estimates on Maple Leaf Foods - why the stock might be worth over 2x more than the current price!

Build Your Own Maple Leaf Foods Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Maple Leaf Foods research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Maple Leaf Foods research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Maple Leaf Foods' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MFI

Maple Leaf Foods

Produces food products in Canada, the United States, Japan, China, and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives