Corby Spirit and Wine (TSE:CSW.A) Has Announced A Dividend Of CA$0.21

Corby Spirit and Wine Limited (TSE:CSW.A) will pay a dividend of CA$0.21 on the 29th of September. The dividend yield will be 4.5% based on this payment which is still above the industry average.

See our latest analysis for Corby Spirit and Wine

Corby Spirit and Wine's Payment Has Solid Earnings Coverage

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before this announcement, Corby Spirit and Wine was paying out 75% of earnings, but a comparatively small 50% of free cash flows. This leaves plenty of cash for reinvestment into the business.

Looking forward, earnings per share could rise by 6.4% over the next year if the trend from the last few years continues. If the dividend continues on this path, the payout ratio could be 73% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

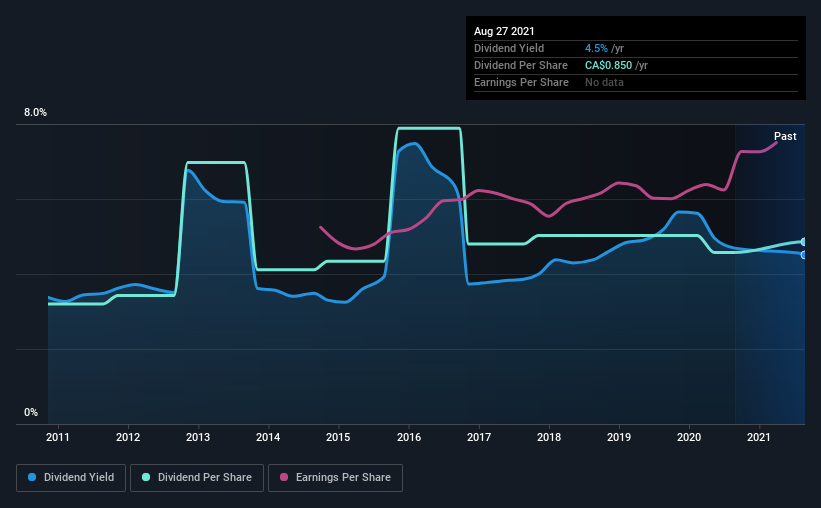

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from CA$0.56 in 2011 to the most recent annual payment of CA$0.85. This means that it has been growing its distributions at 4.3% per annum over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Corby Spirit and Wine Could Grow Its Dividend

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Corby Spirit and Wine has seen EPS rising for the last five years, at 6.4% per annum. Recently, the company has been able to grow earnings at a decent rate, but with the payout ratio on the higher end we don't think the dividend has many prospects for growth.

In Summary

Overall, we think Corby Spirit and Wine is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Corby Spirit and Wine that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:CSW.A

Corby Spirit and Wine

Manufactures, markets, and imports spirits, wines, and ready-to-drink cocktails in Canada, the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives