- Canada

- /

- Metals and Mining

- /

- TSXV:AFM

Corby Spirit and Wine And 2 Other Hidden Gems with Strong Financial Metrics

Reviewed by Simply Wall St

The Canadian market is currently navigating a landscape marked by ambiguity in monetary policy guidance from both the Federal Reserve and the Bank of Canada, leading to potential volatility as investors react to economic data releases. Amidst this backdrop, identifying stocks with strong financial metrics can provide stability and growth potential for investors looking for opportunities in uncertain times. In this article, we explore Corby Spirit and Wine along with two other lesser-known Canadian companies that exhibit robust financial health, making them intriguing prospects in today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| Senvest Capital | 63.10% | -24.28% | -25.94% | ★★★★★★ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Corby Spirit and Wine (TSX:CSW.A)

Simply Wall St Value Rating: ★★★★☆☆

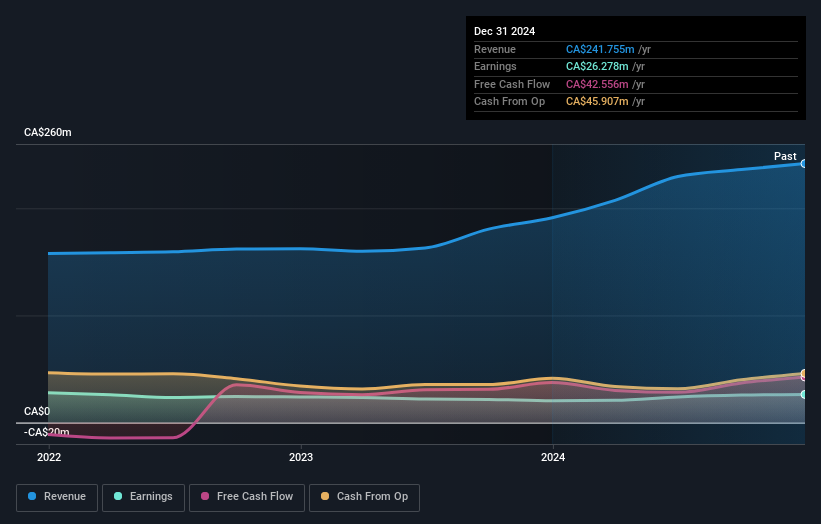

Overview: Corby Spirit and Wine Limited, along with its subsidiaries, engages in the manufacturing, marketing, and importing of spirits, wines, and ready-to-drink cocktails across Canada, the United States, the United Kingdom, and other international markets with a market cap of CA$397.50 million.

Operations: The company's primary revenue streams include case goods, generating CA$212.28 million, and commissions amounting to CA$30.59 million. Gross profit margin trends reveal key insights into the company's financial performance over time.

Corby Spirit and Wine, a notable player in Canada's beverage sector, recently reported annual sales of C$246.79 million, up from C$229.66 million the previous year, reflecting its solid market presence. The company's net income rose to C$27.43 million from last year's C$23.91 million, with basic earnings per share increasing to C$0.96 from C$0.84. Corby's recent agreement with Vinarchy North America Inc., granting exclusive rights to represent certain wine brands in Canada for two years starting September 2025, positions it well for future growth despite a high net debt-to-equity ratio of 49.7%.

- Navigate through the intricacies of Corby Spirit and Wine with our comprehensive health report here.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

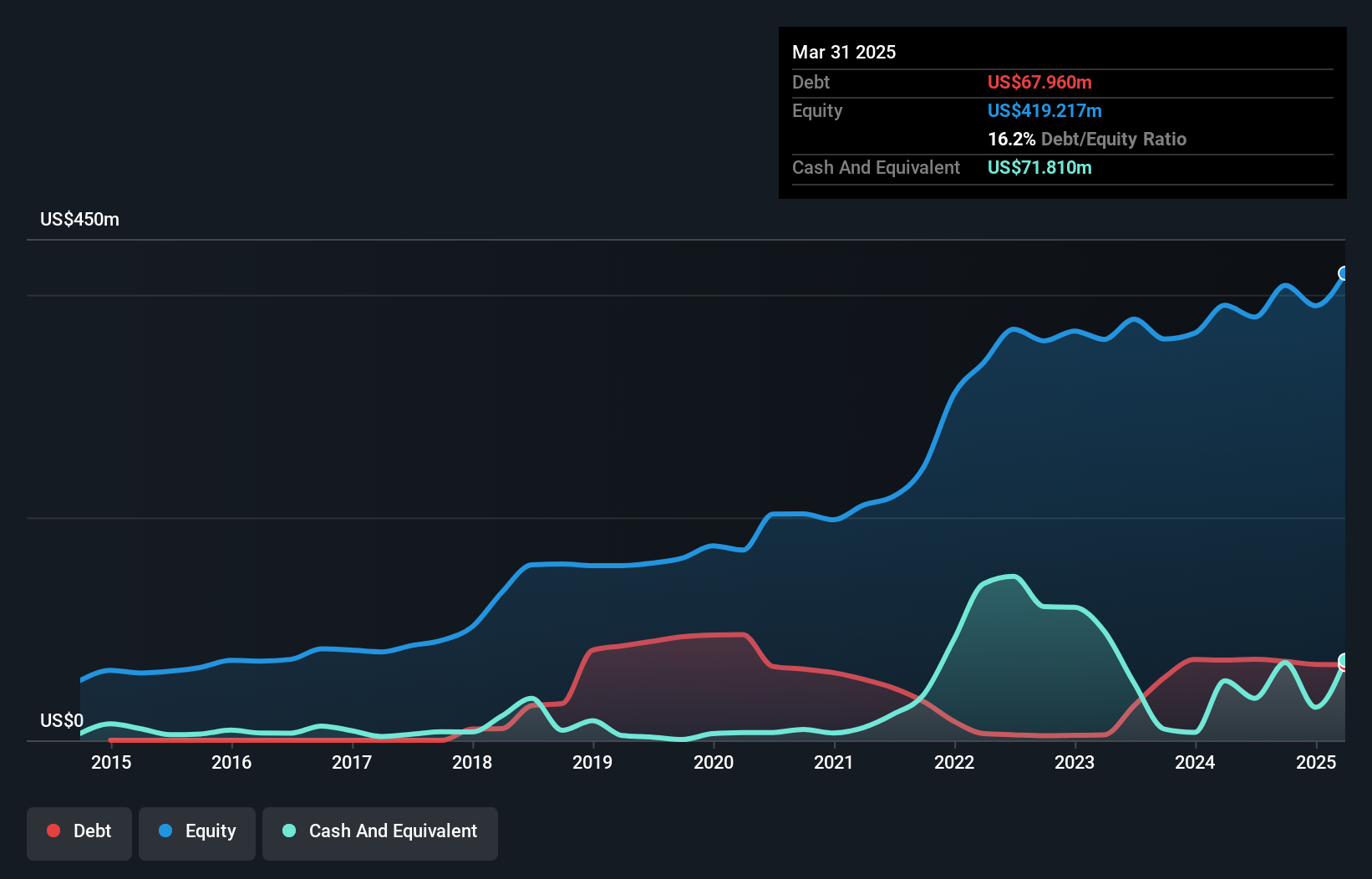

Overview: Alphamin Resources Corp. is involved in the production and sale of tin concentrate, with a market capitalization of approximately CA$1.18 billion.

Operations: The primary revenue stream for Alphamin Resources comes from the production and sale of tin concentrate, generating approximately $579.49 million.

Alphamin Resources, a nimble player in the mining sector, has shown impressive financial performance with earnings growth of 113.6% over the past year, outpacing its industry peers. The company is trading at a notable 63.8% below its estimated fair value and boasts high-quality earnings. Its debt management is commendable as evidenced by a reduced debt to equity ratio from 32.7% to 11.9% over five years and interest coverage of 40.9 times EBIT, indicating strong financial health. Recent board changes following Alpha Mining's acquisition suggest strategic shifts that could further bolster Alphamin’s market position and operational efficiency.

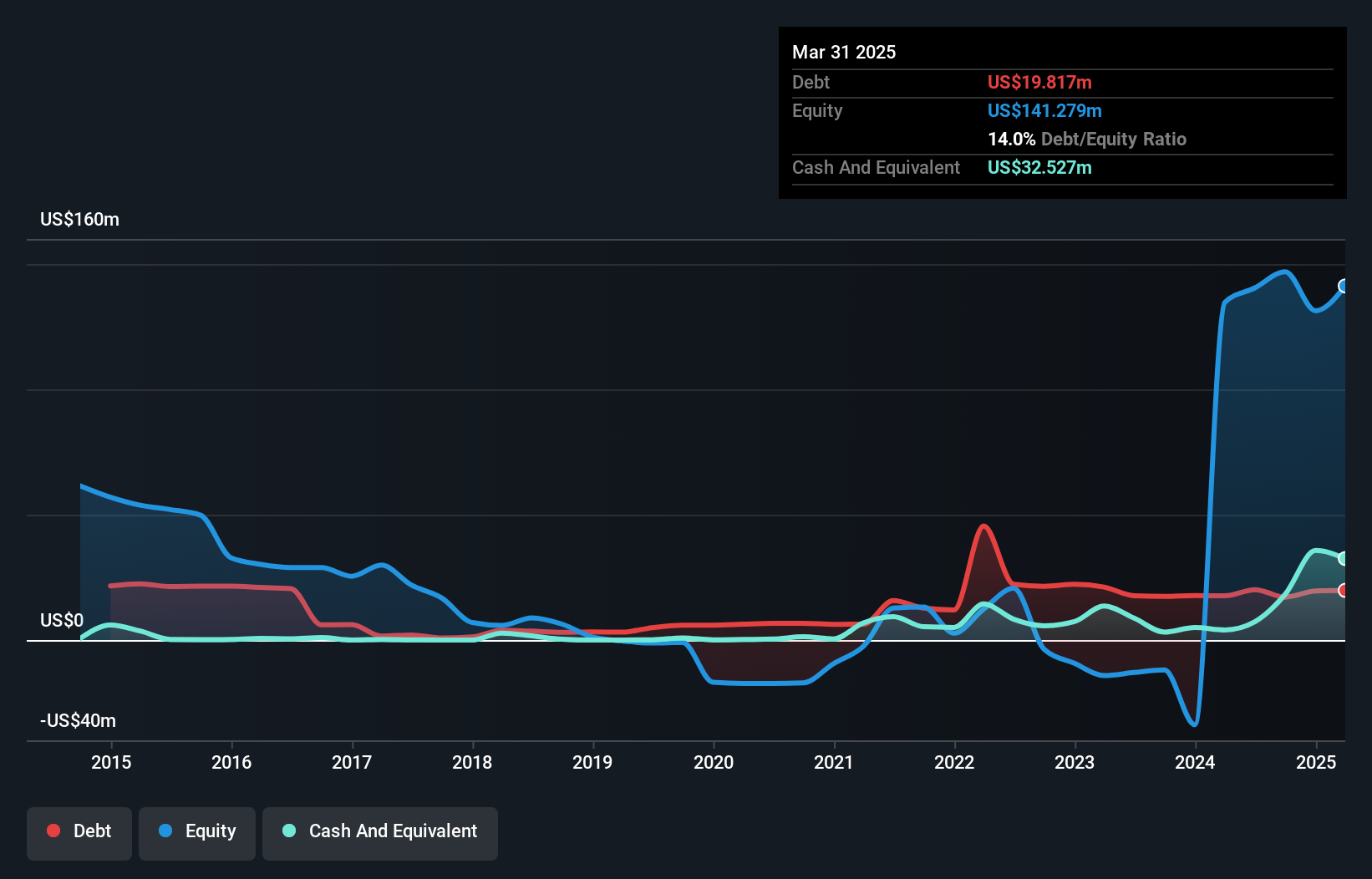

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, production, and operation of mineral properties in Latin America with a market cap of CA$858.41 million.

Operations: Santacruz Silver Mining generates revenue primarily from its mineral properties, with significant contributions from Zimapan ($90.00 million) and SAN Lucas ($88.04 million). The company also earns substantial income from Bolivar ($82.69 million) and Caballo Blanco Group ($73.94 million), while Porco adds $40.12 million to the total revenue stream.

Santacruz Silver Mining, a smaller player in the mining sector, has shown some intriguing financial dynamics. Despite a dip in production figures—silver equivalent production at 3.55 million ounces compared to 4.17 million ounces last year—the company reported significant net income growth for Q2 2025 at US$20.98 million from US$1.45 million previously, indicating strong earnings quality and profitability improvements despite lower margins of 20% from last year's 48.5%. Trading at over half below its fair value estimate suggests potential undervaluation, while its structured payment plan with Glencore is likely to enhance financial discipline and long-term value creation through expected savings of US$40 million by October's end.

Seize The Opportunity

- Reveal the 46 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AFM

Alphamin Resources

Engages in the production and sale of tin concentrate.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives