The Big Rock Brewery (TSE:BR) Share Price Is Down 69% So Some Shareholders Are Wishing They Sold

We think intelligent long term investing is the way to go. But unfortunately, some companies simply don't succeed. For example, after five long years the Big Rock Brewery Inc. (TSE:BR) share price is a whole 69% lower. That's an unpleasant experience for long term holders. The falls have accelerated recently, with the share price down 11% in the last three months.

Check out our latest analysis for Big Rock Brewery

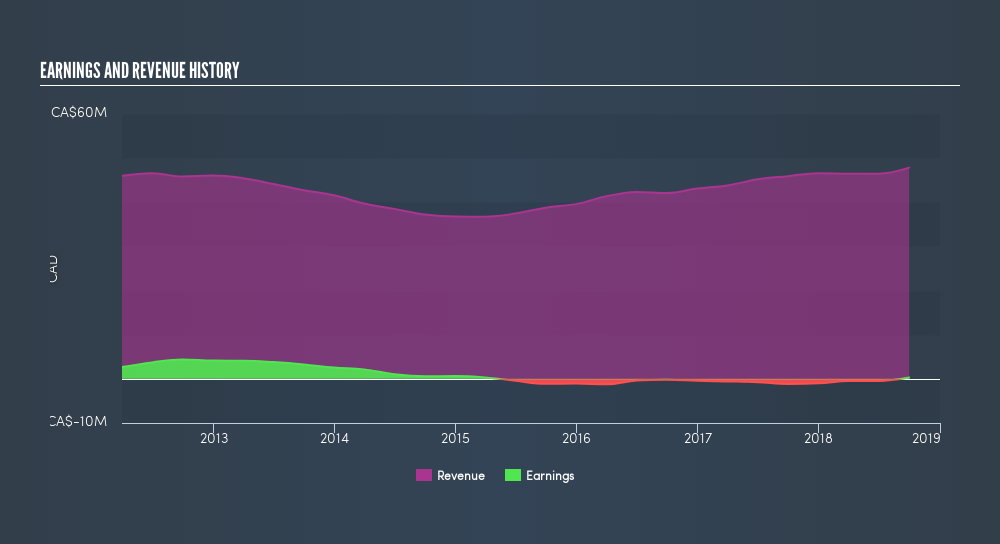

We don't think that Big Rock Brewery's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, companies that are not judged on their (small) profits should be growing revenue quickly. The main reason for this is that fast revenue growth can be readily extrapolated into a profitable future, but stagnant revenue cannot.

In the last half decade, Big Rock Brewery saw its revenue increase by 4.4% per year. That's far from impressive given all the money it is losing. It's likely this weak growth has contributed to an annualised return of 21% for the last five years. We want to see an acceleration of revenue growth (or profits) before showing much interest in this one. However, it's possible too many in the market will ignore it, and there may be an opportunity if it starts to recover down the track.

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Big Rock Brewery has rewarded shareholders with a total shareholder return of 12% in the last twelve months. Notably the five-year annualised TSR loss of 20% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Big Rock Brewery by clicking this link.

Big Rock Brewery is not the only stock insiders are buying. So take a peek at this freelist of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BR

Big Rock Brewery

Produces, markets, and distributes craft beers, ciders, and other alcoholic and non-alcoholic beverages primarily in Canada.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026