Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Prospera Energy Inc. (CVE:PEI) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Prospera Energy

What Is Prospera Energy's Debt?

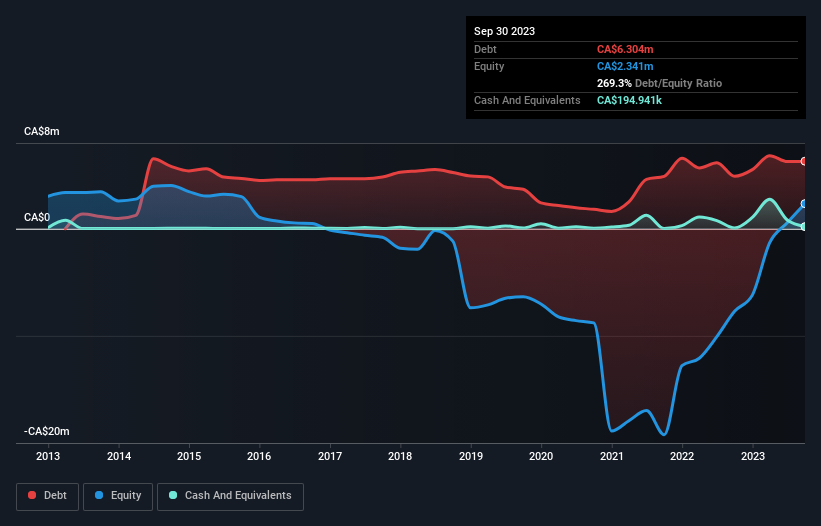

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Prospera Energy had CA$6.30m of debt, an increase on CA$4.89m, over one year. However, because it has a cash reserve of CA$194.9k, its net debt is less, at about CA$6.11m.

How Strong Is Prospera Energy's Balance Sheet?

We can see from the most recent balance sheet that Prospera Energy had liabilities of CA$17.0m falling due within a year, and liabilities of CA$25.0m due beyond that. On the other hand, it had cash of CA$194.9k and CA$3.90m worth of receivables due within a year. So it has liabilities totalling CA$37.8m more than its cash and near-term receivables, combined.

When you consider that this deficiency exceeds the company's CA$36.3m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Prospera Energy will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Prospera Energy had a loss before interest and tax, and actually shrunk its revenue by 17%, to CA$10.0m. We would much prefer see growth.

Caveat Emptor

While Prospera Energy's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost CA$857k at the EBIT level. Considering that alongside the liabilities mentioned above make us nervous about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through CA$10m in negative free cash flow over the last year. That means it's on the risky side of things. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Prospera Energy (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:PEI

Prospera Energy

A natural resources company, engages in the acquisition, exploration, and development of petroleum and natural gas properties in Canada.

Slight risk and slightly overvalued.

Market Insights

Community Narratives