- Canada

- /

- Oil and Gas

- /

- TSXV:ORC.B

We Think Orca Energy Group (CVE:ORC.B) Might Have The DNA Of A Multi-Bagger

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. With that in mind, the ROCE of Orca Energy Group (CVE:ORC.B) looks great, so lets see what the trend can tell us.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Orca Energy Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.25 = US$34m ÷ (US$207m - US$70m) (Based on the trailing twelve months to September 2024).

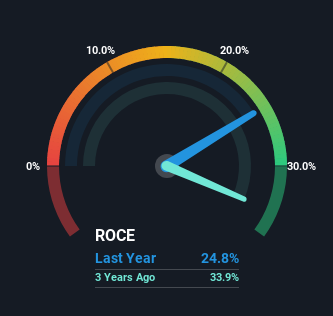

Therefore, Orca Energy Group has an ROCE of 25%. In absolute terms that's a great return and it's even better than the Oil and Gas industry average of 8.9%.

See our latest analysis for Orca Energy Group

Above you can see how the current ROCE for Orca Energy Group compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Orca Energy Group for free.

What The Trend Of ROCE Can Tell Us

Orca Energy Group has not disappointed in regards to ROCE growth. The figures show that over the last five years, returns on capital have grown by 41%. That's not bad because this tells for every dollar invested (capital employed), the company is increasing the amount earned from that dollar. In regards to capital employed, Orca Energy Group appears to been achieving more with less, since the business is using 31% less capital to run its operation. If this trend continues, the business might be getting more efficient but it's shrinking in terms of total assets.

The Bottom Line On Orca Energy Group's ROCE

In a nutshell, we're pleased to see that Orca Energy Group has been able to generate higher returns from less capital. Given the stock has declined 15% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. So researching this company further and determining whether or not these trends will continue seems justified.

If you want to know some of the risks facing Orca Energy Group we've found 4 warning signs (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ORC.B

Orca Energy Group

Engages in the exploration, development, production, and supply of petroleum and natural gas to the power and industrial sectors in Tanzania.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success