- Canada

- /

- Oil and Gas

- /

- TSXV:NSE

Even With A 61% Surge, Cautious Investors Are Not Rewarding New Stratus Energy Inc.'s (CVE:NSE) Performance Completely

New Stratus Energy Inc. (CVE:NSE) shares have had a really impressive month, gaining 61% after a shaky period beforehand. But the last month did very little to improve the 65% share price decline over the last year.

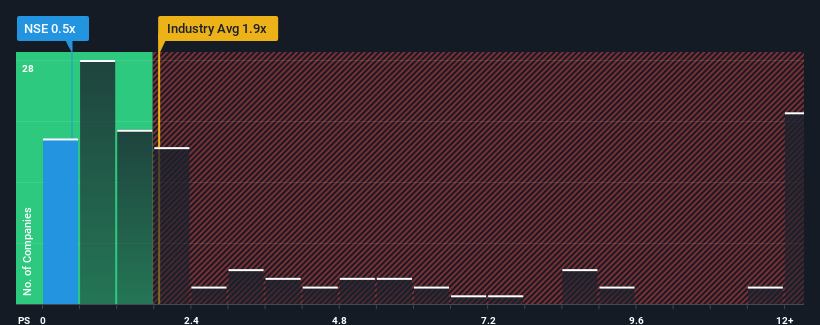

Even after such a large jump in price, New Stratus Energy's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a buy right now compared to the Oil and Gas industry in Canada, where around half of the companies have P/S ratios above 1.9x and even P/S above 7x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for New Stratus Energy

What Does New Stratus Energy's P/S Mean For Shareholders?

Recent times have been quite advantageous for New Stratus Energy as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on New Stratus Energy's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For New Stratus Energy?

New Stratus Energy's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to shrink 4.6% in the next 12 months, the company's positive momentum based on recent medium-term revenue results is a bright spot for the moment.

In light of this, it's quite peculiar that New Stratus Energy's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

New Stratus Energy's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that New Stratus Energy is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. One assumption would be that there are some underlying risks to revenue that are keeping the P/S from rising to match the its strong performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

It is also worth noting that we have found 3 warning signs for New Stratus Energy that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if New Stratus Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NSE

New Stratus Energy

Engages in the acquisition, exploration, and development of oil and gas properties in Mexico, Ecuador, Colombia, and Canada.

Medium-low with weak fundamentals.

Market Insights

Community Narratives