- Canada

- /

- Metals and Mining

- /

- TSXV:GT

TSX Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by trade developments, central bank meetings, and fiscal debates, investors are keenly observing potential catalysts for volatility. While the term "penny stocks" might seem outdated, these smaller or newer companies continue to offer intriguing opportunities for growth at accessible price points. By focusing on those with strong balance sheets and solid fundamentals, investors can uncover hidden gems that may provide both stability and potential upside.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.67 | CA$594.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.33 | CA$722.21M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.58 | CA$190.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.435 | CA$12.46M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.74 | CA$459.06M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.87 | CA$14.86M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.28 | CA$101.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.45 | CA$141.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.81 | CA$143.13M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$173.06M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 874 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

American Creek Resources (TSXV:AMK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: American Creek Resources Ltd. is engaged in the acquisition and exploration of mineral properties in Canada, with a market cap of CA$45.13 million.

Operations: There are no specific revenue segments reported for this company.

Market Cap: CA$45.13M

American Creek Resources Ltd., with a market cap of CA$45.13 million, is currently pre-revenue and unprofitable, facing increased losses over the past five years. The company has no long-term liabilities and more cash than debt but only a short cash runway of three months based on free cash flow estimates. Despite these challenges, American Creek recently raised additional capital through private placements and is involved in a potential acquisition by Tudor Gold Corp., valued at approximately CA$45.8 million, which could provide strategic opportunities pending regulatory approvals expected by September 2025.

- Click to explore a detailed breakdown of our findings in American Creek Resources' financial health report.

- Learn about American Creek Resources' historical performance here.

GT Resources (TSXV:GT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GT Resources Inc. focuses on the exploration and development of mineral resource properties in Canada and Finland, with a market cap of CA$13.61 million.

Operations: GT Resources Inc. currently does not report any revenue segments.

Market Cap: CA$13.61M

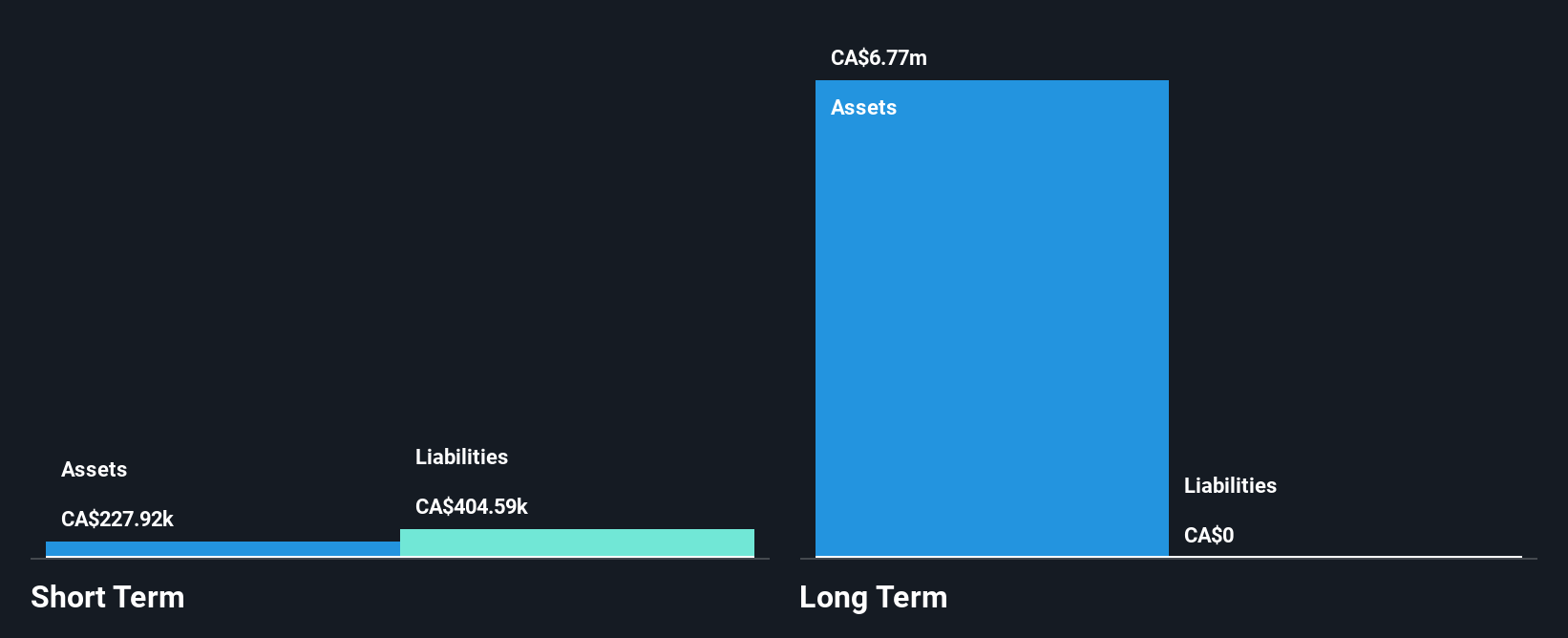

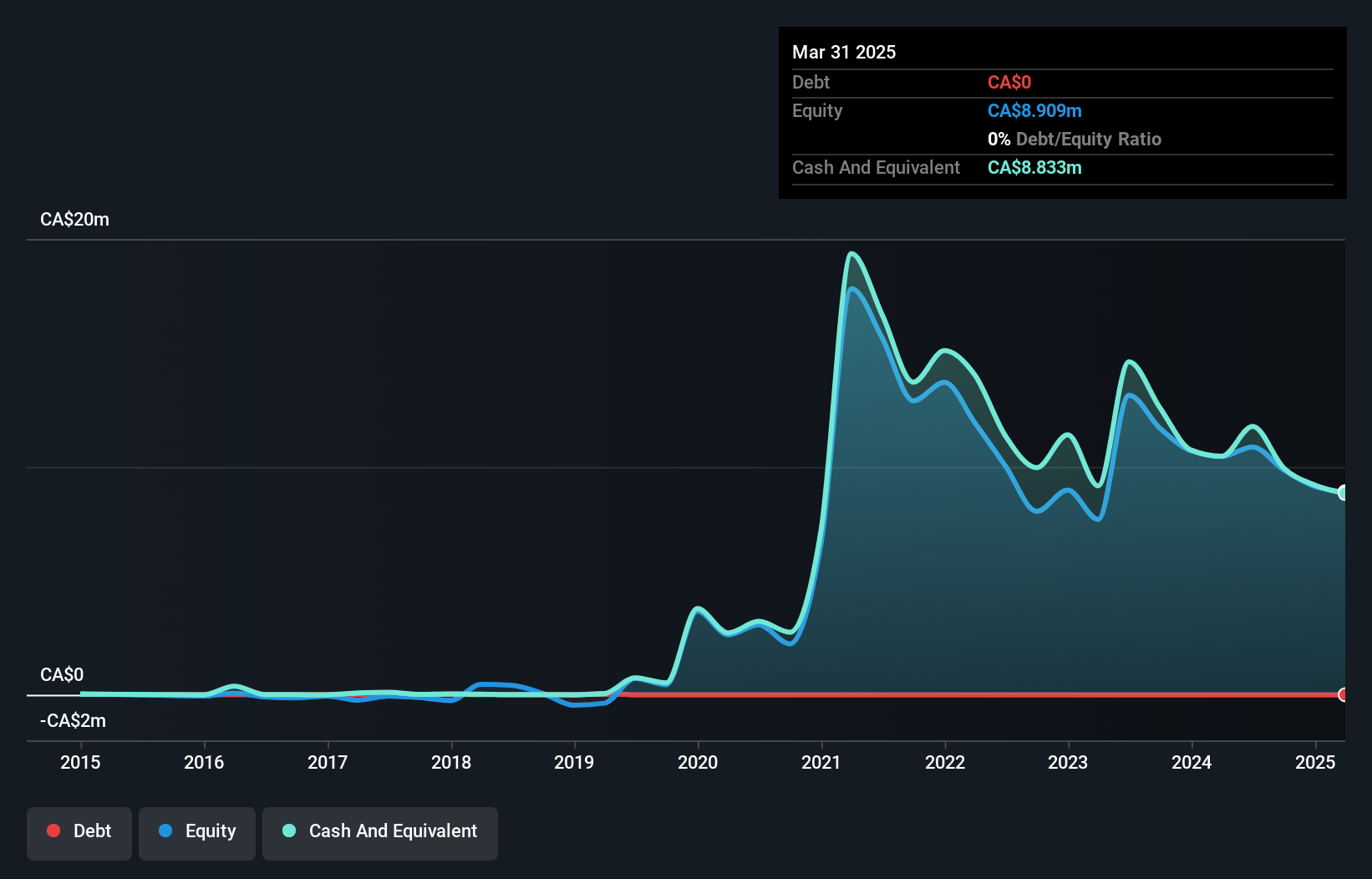

GT Resources Inc., with a market cap of CA$13.61 million, is pre-revenue and currently unprofitable, although it has managed to reduce its losses over the past five years by 3.1% annually. The company benefits from being debt-free and having a seasoned management team with an average tenure of 5.8 years. Its short-term assets significantly exceed its short-term liabilities, providing some financial stability despite high share price volatility and negative return on equity (-31.7%). GT Resources has sufficient cash runway for nearly two years if it continues reducing free cash flow at historical rates of 12.9% annually.

- Jump into the full analysis health report here for a deeper understanding of GT Resources.

- Understand GT Resources' track record by examining our performance history report.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hemisphere Energy Corporation is involved in the acquisition, exploration, development, and production of petroleum and natural gas interests in Canada, with a market cap of CA$173.06 million.

Operations: The company's revenue is primarily derived from its petroleum and natural gas interests, totaling CA$84.99 million.

Market Cap: CA$173.06M

Hemisphere Energy Corporation, with a market cap of CA$173.06 million, shows promising attributes for investors considering penny stocks. The company is debt-free and has stable financial health, with short-term assets exceeding both short and long-term liabilities. Its seasoned management and board contribute to its stability, while its net profit margins have improved to 41.5% from last year's 36.1%. Despite earnings growth deceleration compared to its five-year average, Hemisphere's recent quarterly revenue rose to CA$21.3 million from CA$16.56 million year-over-year, supporting continued dividend payments and share buybacks as part of shareholder returns strategy.

- Get an in-depth perspective on Hemisphere Energy's performance by reading our balance sheet health report here.

- Examine Hemisphere Energy's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Investigate our full lineup of 874 TSX Penny Stocks right here.

- Seeking Other Investments? The latest GPUs need a type of rare earth metal called Terbium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GT

GT Resources

Engages in the exploration and development of mineral resource properties in Canada and Finland.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion