- Canada

- /

- Oil and Gas

- /

- TSXV:EU

September 2025 TSX Penny Stocks With Promising Potential

Reviewed by Simply Wall St

Amidst the current economic landscape, where central banks in both Canada and the U.S. are navigating uncertain waters with interest rate decisions, investors are keeping a close eye on market volatility and data releases. In this climate, penny stocks—often representing smaller or newer companies—continue to capture attention as potential investment opportunities. While the term "penny stocks" might seem outdated, these investments can offer a blend of affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$3.27 | CA$80.9M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$23.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.30 | CA$2.71M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.37 | CA$51.82M | ✅ 2 ⚠️ 1 View Analysis > |

| Zedcor (TSXV:ZDC) | CA$4.66 | CA$497.13M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.24 | CA$785.05M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.55 | CA$413.42M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.67 | CA$180.69M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.15 | CA$203.15M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.72 | CA$8.71M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is involved in the exploration and development of mineral properties in the United States, with a market cap of CA$481.23 million.

Operations: Trilogy Metals Inc. does not report any revenue segments as it is primarily focused on the exploration and development of mineral properties in the United States.

Market Cap: CA$481.23M

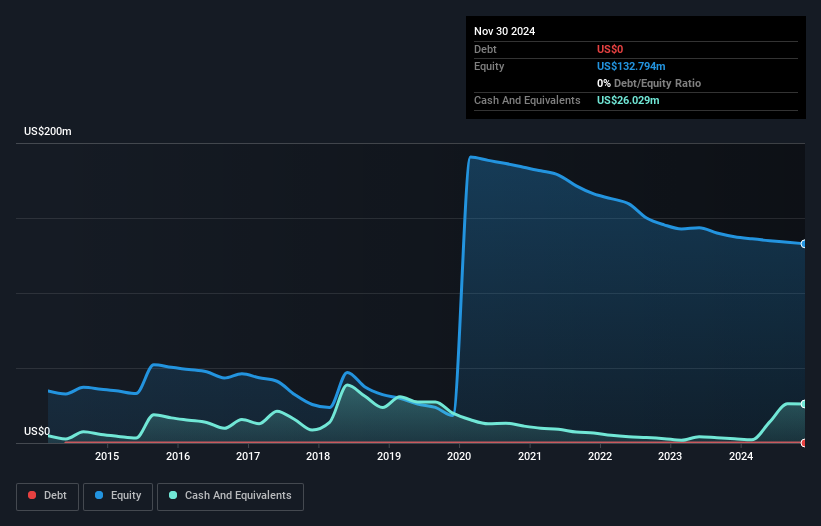

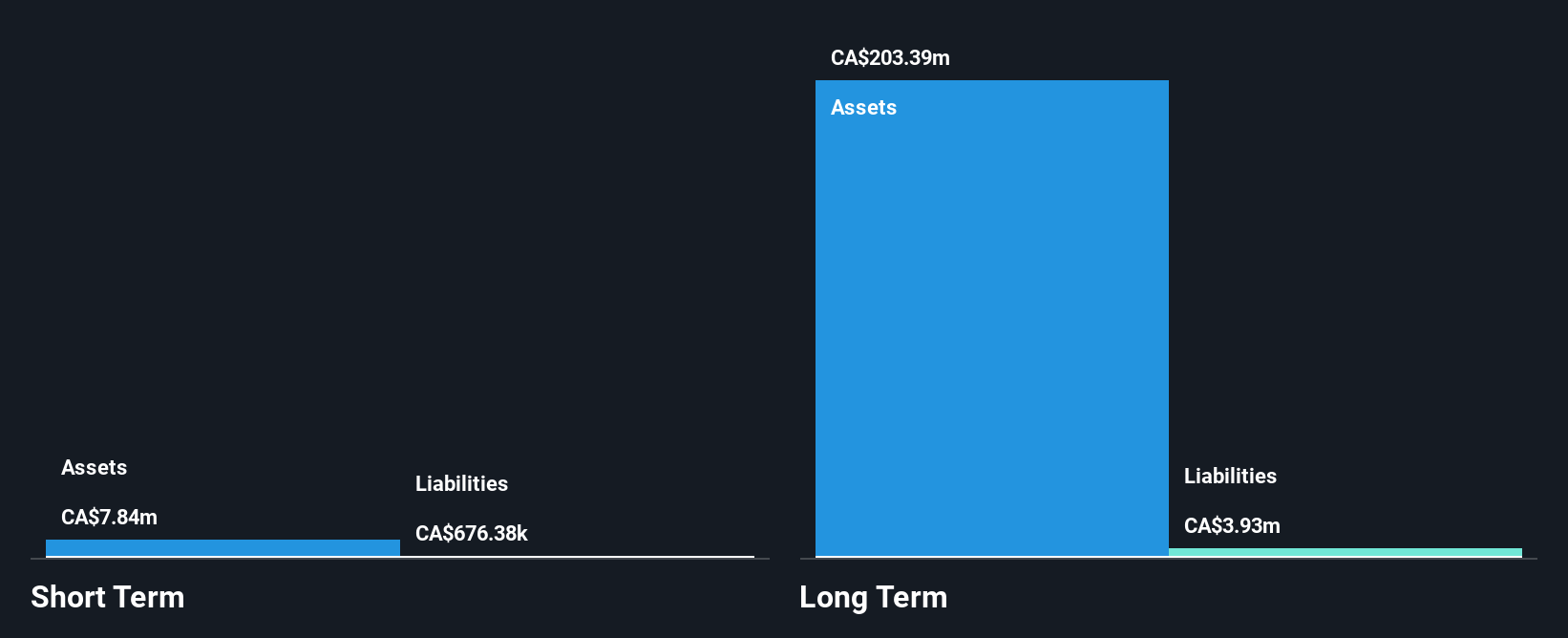

Trilogy Metals Inc., with a market cap of CA$481.23 million, is currently pre-revenue and focuses on mineral exploration in the U.S. Despite being debt-free and having sufficient cash runway for over three years, the company remains unprofitable with increasing losses over the past five years. Recent developments include its addition to the S&P Global BMI Index and participation in industry conferences, which may enhance visibility among investors. The management team and board are experienced, providing stability as they navigate financial challenges. Trilogy's short-term assets significantly exceed both short-term and long-term liabilities, offering some financial resilience.

- Get an in-depth perspective on Trilogy Metals' performance by reading our balance sheet health report here.

- Gain insights into Trilogy Metals' historical outcomes by reviewing our past performance report.

enCore Energy (TSXV:EU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: enCore Energy Corp. focuses on acquiring, exploring, developing, and extracting uranium resource properties in the United States with a market cap of CA$806.38 million.

Operations: The company's revenue primarily comes from the acquisition, exploration, and development of mineral properties, generating $44.52 million.

Market Cap: CA$806.38M

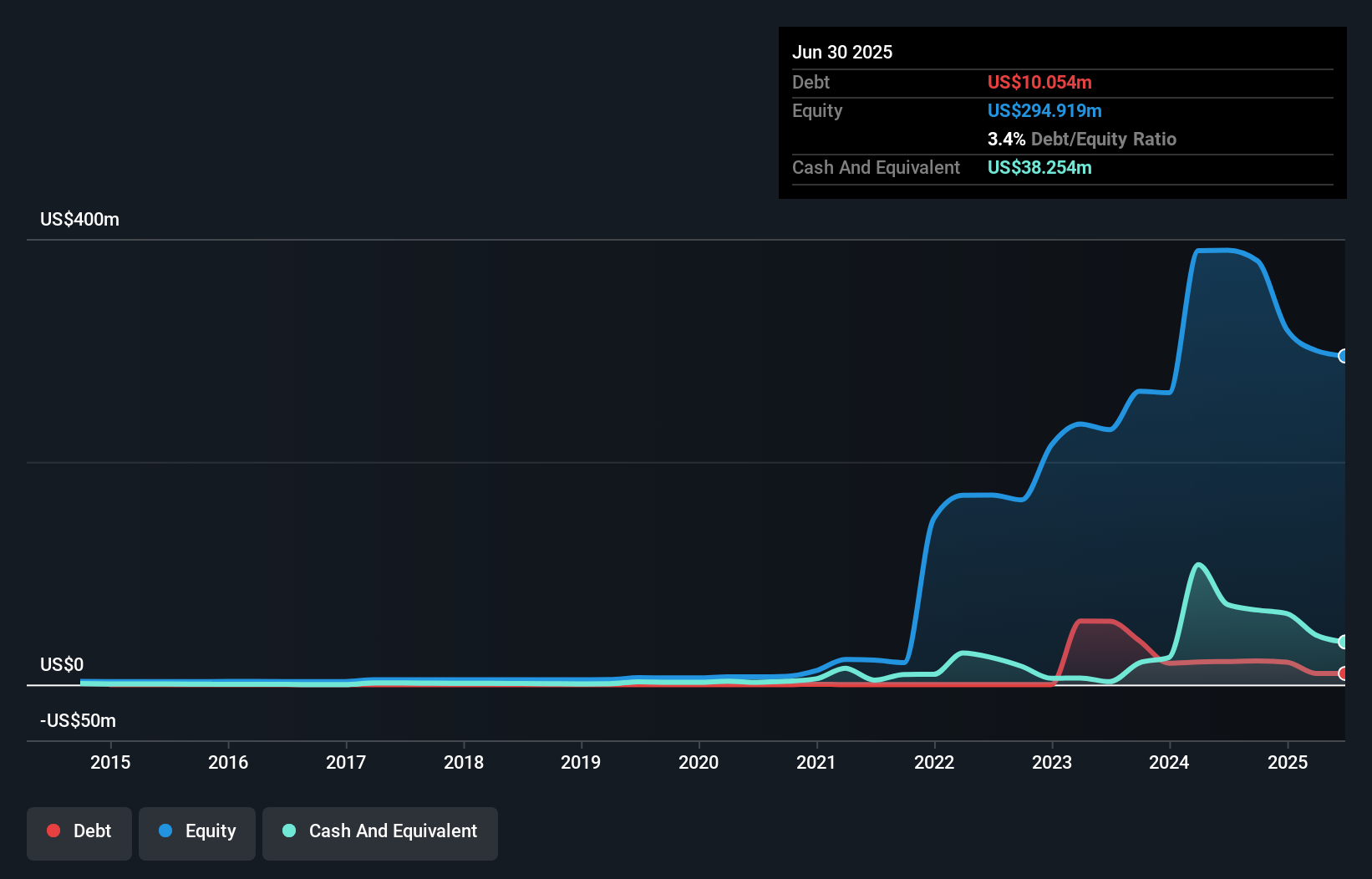

enCore Energy Corp., with a market cap of CA$806.38 million, focuses on uranium extraction in the U.S. The company recently appointed Robert Willette as CEO and Kevin Kremke as CFO, both bringing extensive industry experience. enCore's Dewey Burdock Project received key federal permits, advancing its development schedule. Despite generating US$44.52 million in revenue, the company remains unprofitable with negative return on equity and increased losses over five years. However, it has more cash than debt and short-term assets exceeding liabilities, providing some financial stability amidst ongoing operational expansions at the Alta Mesa Uranium Project using ISR technology.

- Take a closer look at enCore Energy's potential here in our financial health report.

- Gain insights into enCore Energy's future direction by reviewing our growth report.

Atha Energy (TSXV:SASK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Atha Energy Corp. is a mineral company focused on acquiring, exploring, and evaluating mineral resources in Canada, with a market cap of CA$196.77 million.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: CA$196.77M

Atha Energy Corp., with a market cap of CA$196.77 million, remains pre-revenue and is focused on mineral exploration in Canada. The company recently closed an oversubscribed private placement, raising CA$11.5 million, which enhances its financial position despite ongoing net losses. Atha Energy's exploration efforts have yielded promising results, including new uranium mineralization discoveries at the RIB East Discovery site within the Angikuni Basin. While the board and management team are relatively inexperienced with short tenures, the absence of debt provides some financial flexibility as they continue their exploration programs and seek further resource development opportunities.

- Dive into the specifics of Atha Energy here with our thorough balance sheet health report.

- Learn about Atha Energy's future growth trajectory here.

Key Takeaways

- Dive into all 412 of the TSX Penny Stocks we have identified here.

- Interested In Other Possibilities? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EU

enCore Energy

Engages in the acquisition, exploration, development, and extraction of uranium resource properties in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives