- Canada

- /

- Oil and Gas

- /

- TSXV:CBV

Most Shareholders Will Probably Find That The CEO Compensation For Cobra Venture Corporation (CVE:CBV) Is Reasonable

CEO Dan Evans has done a decent job of delivering relatively good performance at Cobra Venture Corporation (CVE:CBV) recently. As shareholders go into the upcoming AGM on 13 May 2021, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for Cobra Venture

Comparing Cobra Venture Corporation's CEO Compensation With the industry

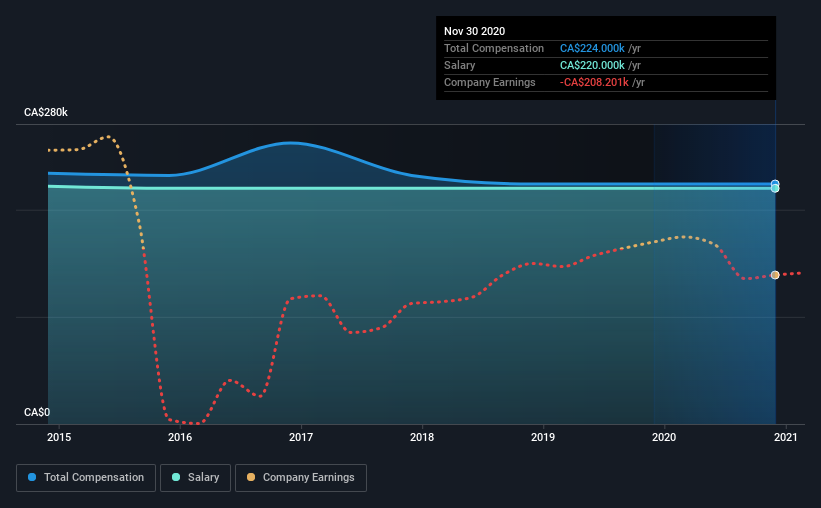

According to our data, Cobra Venture Corporation has a market capitalization of CA$2.1m, and paid its CEO total annual compensation worth CA$224k over the year to November 2020. There was no change in the compensation compared to last year. In particular, the salary of CA$220.0k, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$244m, we found that the median total CEO compensation was CA$250k. This suggests that Cobra Venture remunerates its CEO largely in line with the industry average. Furthermore, Dan Evans directly owns CA$124k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$220k | CA$220k | 98% |

| Other | CA$4.0k | CA$4.0k | 2% |

| Total Compensation | CA$224k | CA$224k | 100% |

On an industry level, around 51% of total compensation represents salary and 49% is other remuneration. Cobra Venture has gone down a largely traditional route, paying Dan Evans a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Cobra Venture Corporation's Growth Numbers

Cobra Venture Corporation has seen its earnings per share (EPS) increase by 42% a year over the past three years. It saw its revenue drop 32% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Cobra Venture Corporation Been A Good Investment?

Cobra Venture Corporation has served shareholders reasonably well, with a total return of 23% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Cobra Venture pays its CEO a majority of compensation through a salary. Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Cobra Venture that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:CBV

Cobra Venture

Engages in the exploration and development of petroleum and natural gas properties in Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives