- Canada

- /

- Oil and Gas

- /

- TSXV:ARH

Altima Energy (TSXV:ARH): A Fresh Look at Valuation After Recent Market Swings

Reviewed by Kshitija Bhandaru

Has Altima Energy (TSXV:ARH) Caught Your Eye? Let’s Talk About the Recent Moves

If you have Altima Energy (TSXV:ARH) on your radar, you are not alone. The stock’s recent ups and downs might be making investors pause to ask what is really going on, especially since there is no single big event driving the shift. Sometimes, attention itself can become a signal. When markets move without a major news story, it leaves room for investors to question the underlying value or wonder if something is brewing beneath the surface. That curiosity is exactly what makes these moments worth a closer look.

Over the past year, Altima Energy has quietly delivered an impressive 2.2% return, bolstered by an 81% jump year-to-date and a standout 13% gain over the past three months, despite a recent dip in the last month. Moves like these suggest momentum is there, even if price action has cooled recently. The company does not have any headline-making announcements to point to at the moment, but sometimes the absence of news is as interesting as its presence.

So after a strong year and dynamic swings, is Altima Energy positioning itself as a value opportunity, or is the market already baking in all its future growth potential?

Price-to-Sales of 11x: Is it justified?

Altima Energy currently trades at a Price-to-Sales (P/S) ratio of 11x, making it appear expensive compared to its peers. For context, the average P/S ratio among comparable companies in the sector stands at 2.1x.

The Price-to-Sales ratio compares a company’s market value to its revenue. This metric is often used for companies lacking consistent profitability, such as in the energy sector, as it offers a clearer measure of value than earnings-based metrics.

Altima Energy's valuation implies that investors are willing to pay a premium for each dollar of sales. However, this premium is significant, with prices more than 5 times higher than the peer average. This suggests the market has high expectations for future growth or strategic developments. Without meaningful revenue growth or profitability so far, justifying such a lofty multiple is challenging.

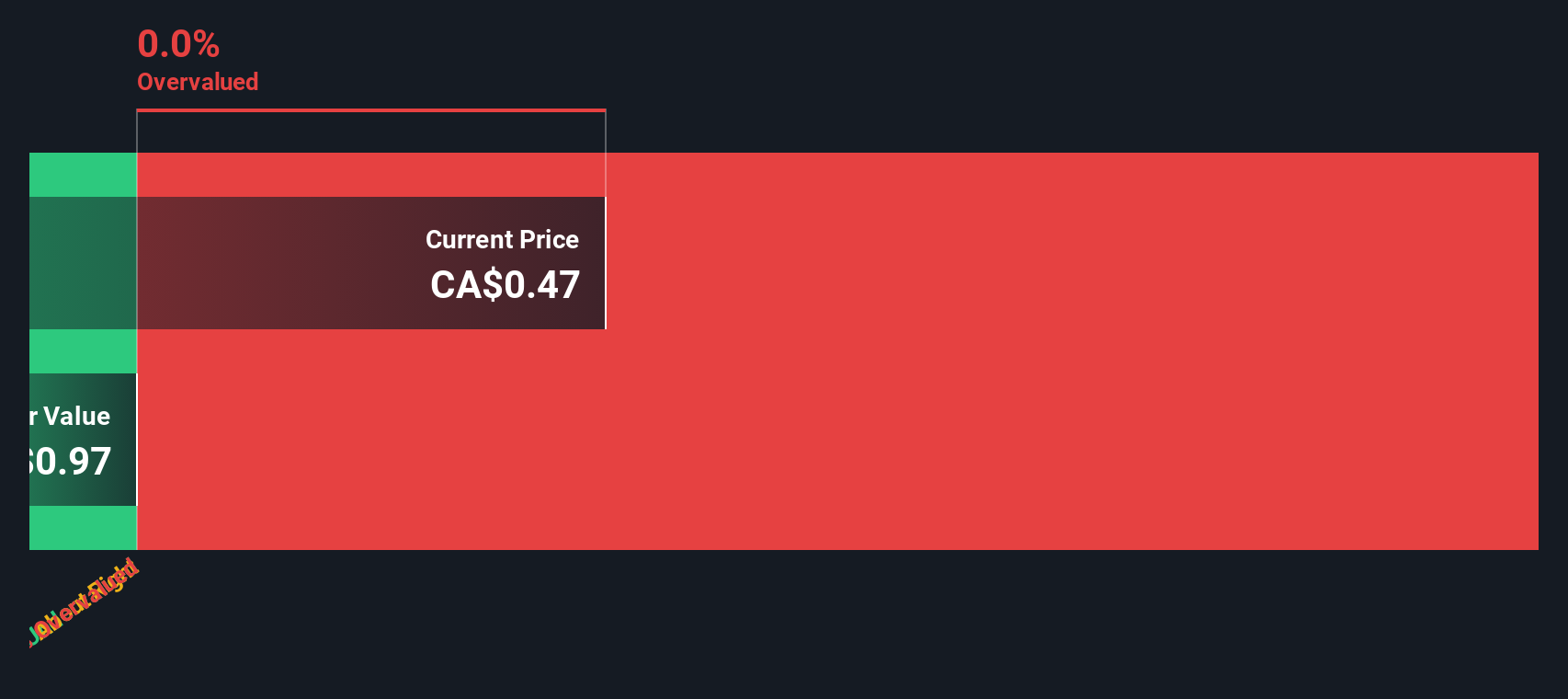

Result: Fair Value of $0.15 (OVERVALUED)

See our latest analysis for Altima Energy.However, low revenue growth and ongoing negative net income could quickly challenge the premium that investors currently see in Altima Energy’s valuation.

Find out about the key risks to this Altima Energy narrative.Another View: Discounted Cash Flow Model

Taking a step back, our SWS DCF model usually offers a data-driven look at a company’s true worth. This time, however, there is not enough reliable data to run the numbers. This gap leaves the earlier valuation without a second opinion. What do investors do when one approach is off the table?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Altima Energy Narrative

If you would rather draw your own conclusions or want to see how the numbers stack up firsthand, creating your own take is quick and easy. Do it your way

A great starting point for your Altima Energy research is our analysis highlighting 6 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not wait for opportunity to knock twice. Expand your horizons with investment themes tailored to where the future is heading. These curated ideas could help you spot your next big winner before the crowd.

- Unlock the potential of tomorrow’s digital revolution by starting your search with AI penny stocks powering breakthroughs in artificial intelligence and automation.

- Accelerate your portfolio with undervalued stocks based on cash flows packed with companies trading below their intrinsic value, where savvy investors spot true bargains before the mainstream catches on.

- Fuel your growth strategy with dividend stocks with yields > 3% offering reliable income streams from businesses with yields above 3 percent. This approach can help you build financial resilience through changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARH

Altima Energy

A junior energy company, engages in the acquisition, exploration and development of petroleum and natural gas in Canada.

Medium-low risk with weak fundamentals.

Market Insights

Community Narratives