- Canada

- /

- Oil and Gas

- /

- TSX:YGR

Can You Imagine How Yangarra Resources's (TSE:YGR) Shareholders Feel About The 76% Share Price Increase?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some Yangarra Resources Ltd. (TSE:YGR) shareholders are probably rather concerned to see the share price fall 47% over the last three months. But over three years, the returns would have left most investors smiling In the last three years the share price is up, 76%: better than the market.

Check out our latest analysis for Yangarra Resources

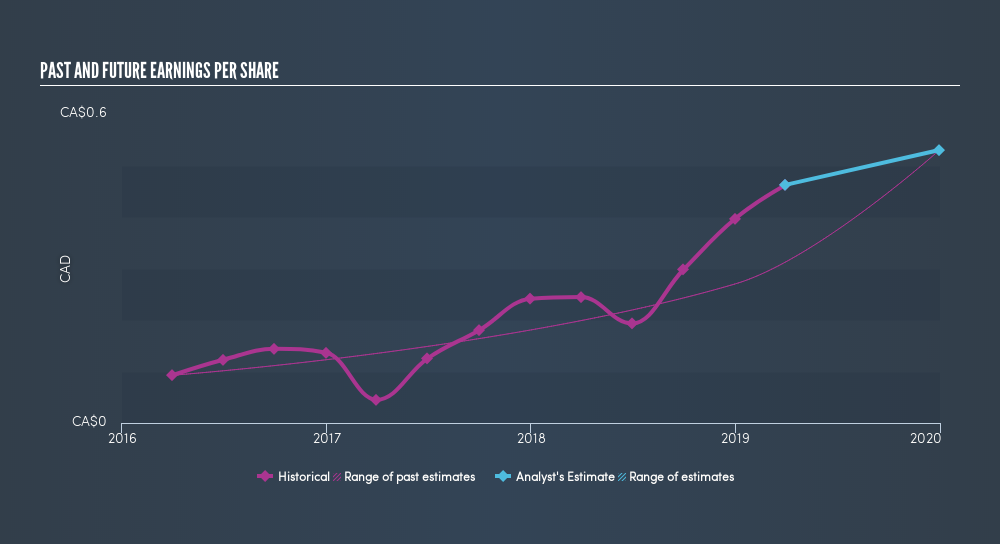

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Yangarra Resources achieved compound earnings per share growth of 71% per year. The average annual share price increase of 21% is actually lower than the EPS growth. So it seems investors have become more cautious about the company, over time. We'd venture the lowish P/E ratio of 3.92 also reflects the negative sentiment around the stock.

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Yangarra Resources's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 0.6% in the last year, Yangarra Resources shareholders lost 67%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:YGR

Yangarra Resources

A junior oil and gas company, engages in the exploration, development, and production of natural gas and conventional oil resource properties in Western Canada.

Excellent balance sheet and fair value.

Market Insights

Community Narratives