- Canada

- /

- Metals and Mining

- /

- TSXV:SME

February 2025's Rising Stars: Penny Stocks On The TSX

Reviewed by Simply Wall St

As we enter 2025, the Canadian market has been relatively stable, with the TSX seeing a modest 3% increase amid contained inflation and potential central bank rate cuts. In this context, identifying stocks with solid financials and growth potential is crucial for investors looking to navigate these conditions effectively. Penny stocks, while an older term, continue to represent smaller or emerging companies that may offer attractive opportunities; we've pinpointed three such stocks on the TSX that combine balance sheet strength with promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.71 | CA$174.02M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$451.7M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.51 | CA$14.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$659.81M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.83 | CA$379.19M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.84 | CA$309.32M | ★★★★★☆ |

| New Gold (TSX:NGD) | CA$3.90 | CA$3.19B | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$1.95 | CA$191.47M | ★★★★★☆ |

Click here to see the full list of 932 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

North Peak Resources (TSXV:NPR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: North Peak Resources Ltd. focuses on the exploration and development of gold and silver properties, with a market cap of CA$19.38 million.

Operations: North Peak Resources Ltd. does not currently report any revenue segments.

Market Cap: CA$19.38M

North Peak Resources Ltd., with a market cap of CA$19.38 million, remains pre-revenue as it focuses on exploration and development in the gold sector. Recent drilling at its Prospect Mountain Property in Nevada revealed promising high-grade gold intersections, suggesting potential for future resource development. The company is debt-free, with short-term assets covering liabilities comfortably. However, it faces challenges with a limited cash runway and unprofitability marked by increasing losses over the past five years. The appointment of Rupert Williams as CEO brings experience in capital raising and could enhance strategic direction amid these operational hurdles.

- Unlock comprehensive insights into our analysis of North Peak Resources stock in this financial health report.

- Assess North Peak Resources' previous results with our detailed historical performance reports.

Sama Resources (TSXV:SME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sama Resources Inc. is a company focused on exploring and developing mineral properties in West Africa, with a market cap of CA$17.61 million.

Operations: Sama Resources Inc. currently does not report any revenue segments.

Market Cap: CA$17.61M

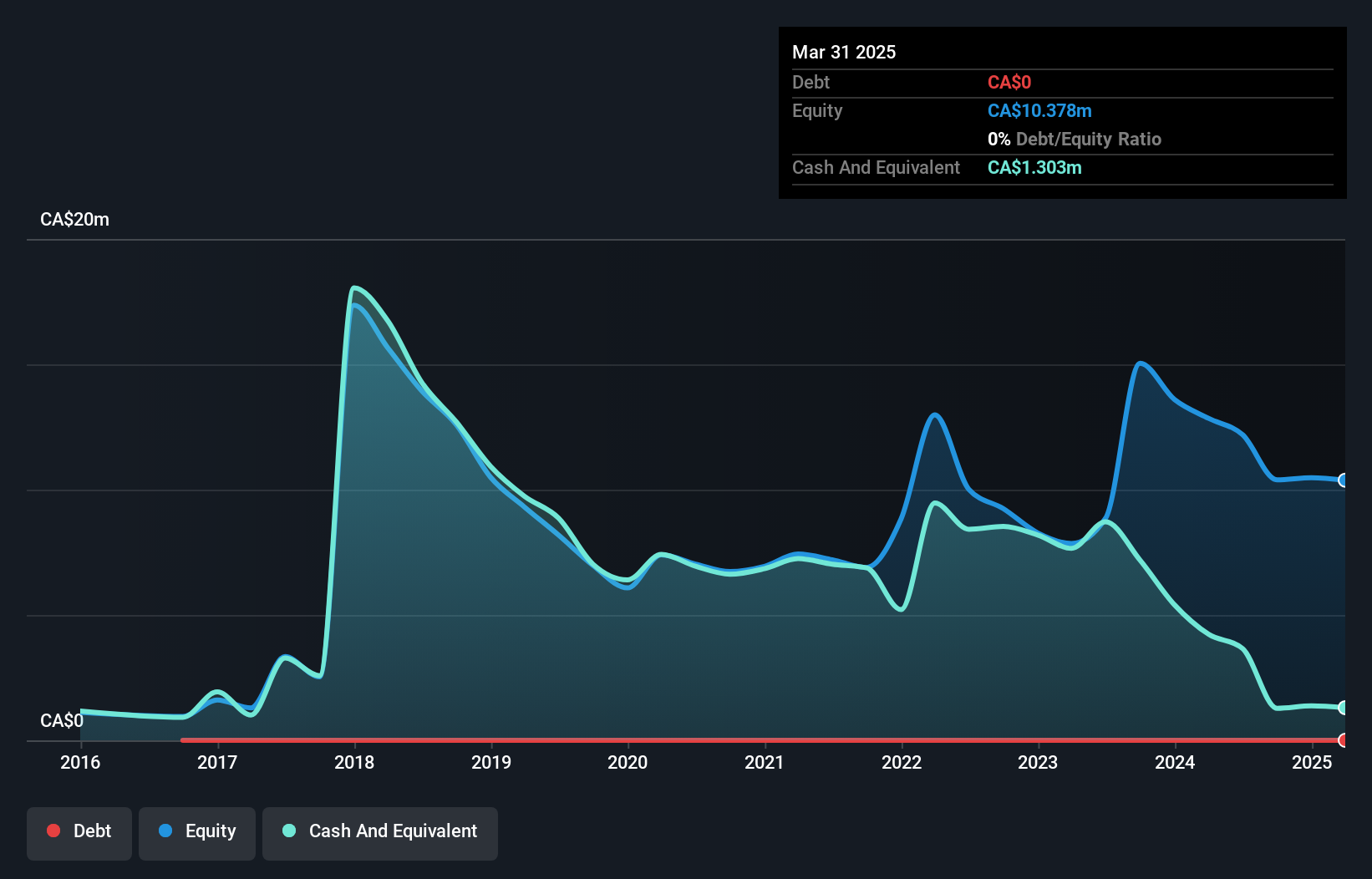

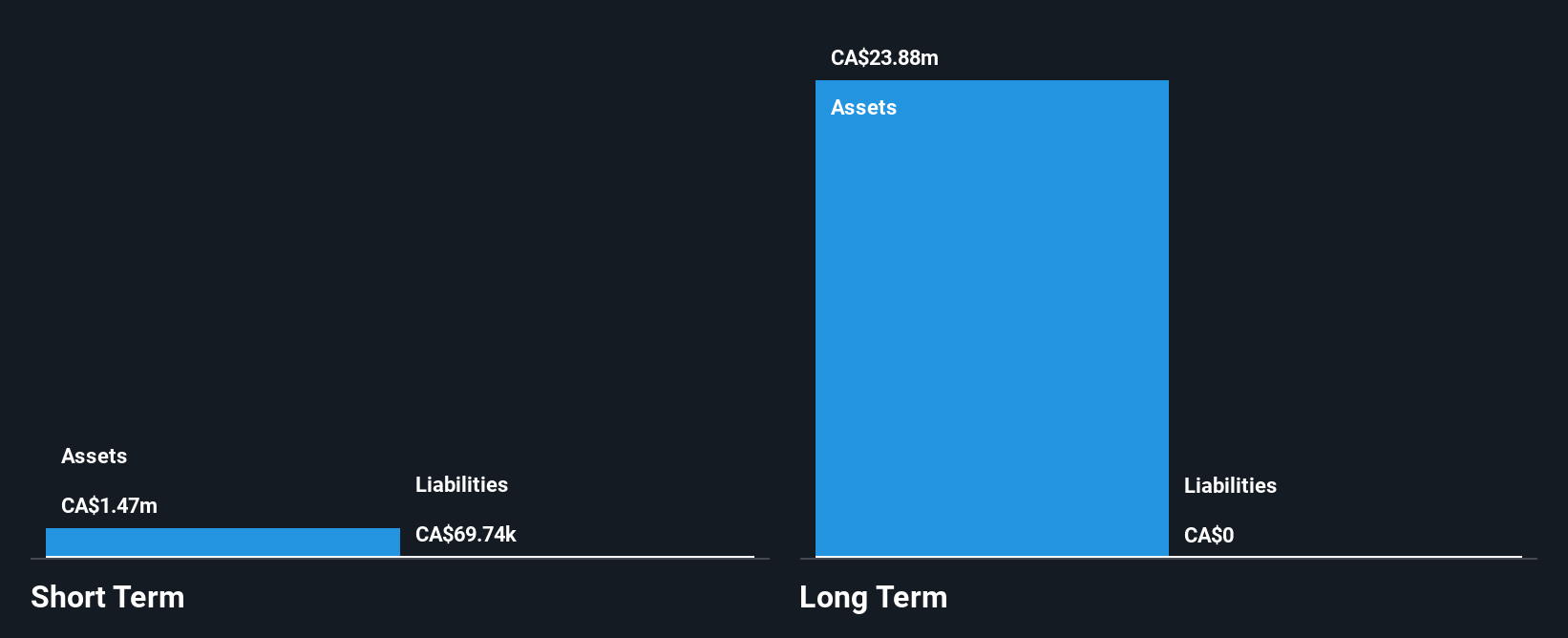

Sama Resources Inc., with a market cap of CA$17.61 million, is pre-revenue as it focuses on mineral exploration in West Africa. The company benefits from a seasoned management team with an average tenure of 10.4 years and a stable weekly volatility at 10%. Sama has no debt or long-term liabilities, ensuring financial flexibility, and its short-term assets (CA$1.9M) significantly exceed liabilities (CA$2.8K). Despite becoming profitable last year, its low Return on Equity (18.2%) indicates room for improvement in generating shareholder value compared to the broader Canadian market's price-to-earnings ratio of 14.9x.

- Click here to discover the nuances of Sama Resources with our detailed analytical financial health report.

- Gain insights into Sama Resources' past trends and performance with our report on the company's historical track record.

Western Energy Services (TSX:WRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Energy Services Corp. is an oilfield service company operating in Canada and the United States with a market cap of CA$81.39 million.

Operations: Western Energy Services Corp. has not reported any specific revenue segments.

Market Cap: CA$81.39M

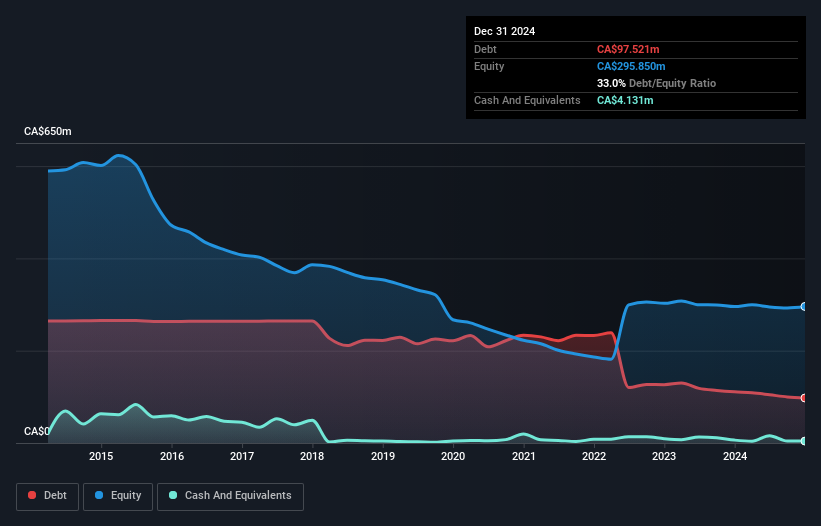

Western Energy Services Corp., with a market cap of CA$81.39 million, recently reported annual sales of CA$223.08 million, slightly down from the previous year. Despite being unprofitable, it has reduced losses by 53% annually over five years and maintains a positive cash runway exceeding three years due to stable free cash flow. The company benefits from experienced leadership and financial flexibility following debt restructuring efforts in 2022. However, its short-term assets cover only part of its long-term liabilities (CA$100.2M), posing potential challenges as it navigates market conditions under interim CEO Gavin Lane's guidance.

- Click to explore a detailed breakdown of our findings in Western Energy Services' financial health report.

- Understand Western Energy Services' earnings outlook by examining our growth report.

Turning Ideas Into Actions

- Take a closer look at our TSX Penny Stocks list of 932 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SME

Sama Resources

Explores and develops mineral properties in West Africa and Canada.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives