- Canada

- /

- Oil and Gas

- /

- TSX:WCP

Whitecap Resources (TSX:WCP): Assessing Valuation After Q3 Revenue Surge and Profit Dip

Reviewed by Simply Wall St

Whitecap Resources (TSX:WCP) has released its third quarter earnings, catching investors’ attention with a surge in revenue compared to last year, even as net income and earnings per share declined for the period.

See our latest analysis for Whitecap Resources.

Whitecap Resources’ latest quarter has made waves, with revenue climbing sharply but profitability taking a step back. The mixed results come after a stretch of steady dividend affirmations and regular earnings updates. While 2025’s start has been a touch softer for the share price, which is down 1.6% year-to-date, long-term investors are still sitting on a robust 5.8% total shareholder return over the past twelve months and an impressive 472.6% five-year total return. This suggests there may be sustained growth potential, despite occasional bumps in the road.

If this kind of momentum piques your interest, you might enjoy exploring what else is out there. Discover fast growing stocks with high insider ownership

With the stock still trading well below its analyst price target and robust revenue growth on display, is Whitecap Resources currently undervalued, or has the market already priced in its future potential?

Most Popular Narrative: 54.8% Undervalued

Whitecap Resources’ most followed narrative pegs its fair value far above the last close, highlighting expectations for substantial upside. This perspective centers on long-term dividend strength and a bullish production outlook as key drivers behind the projected share price growth.

The firm’s orientation toward monthly dividend returns makes it attractive in the face of lower interest rates. Canadian interest rates have been declining, with five rate cuts in 2024, including two 50 bps cuts in October and December. This trend makes domestic dividend payers more attractive. Meanwhile, Whitecap has been paying stable monthly dividends, as its business objective is to focus on profitable production growth with sustainable dividends paid out from funds flow.

Curious what’s powering this sky-high valuation? According to the narrative, a bold mix of steady production expansion and ambitious margin assumptions create a valuation story that bucks recent market trends. Find out which financial levers, projected well into the future, underpin this confident price forecast. The full picture may surprise you.

Result: Fair Value of $22.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable oil price swings and upcoming political events on both sides of the border could quickly challenge even the most optimistic outlook for Whitecap Resources.

Find out about the key risks to this Whitecap Resources narrative.

Another View: What Do Earnings Ratios Say?

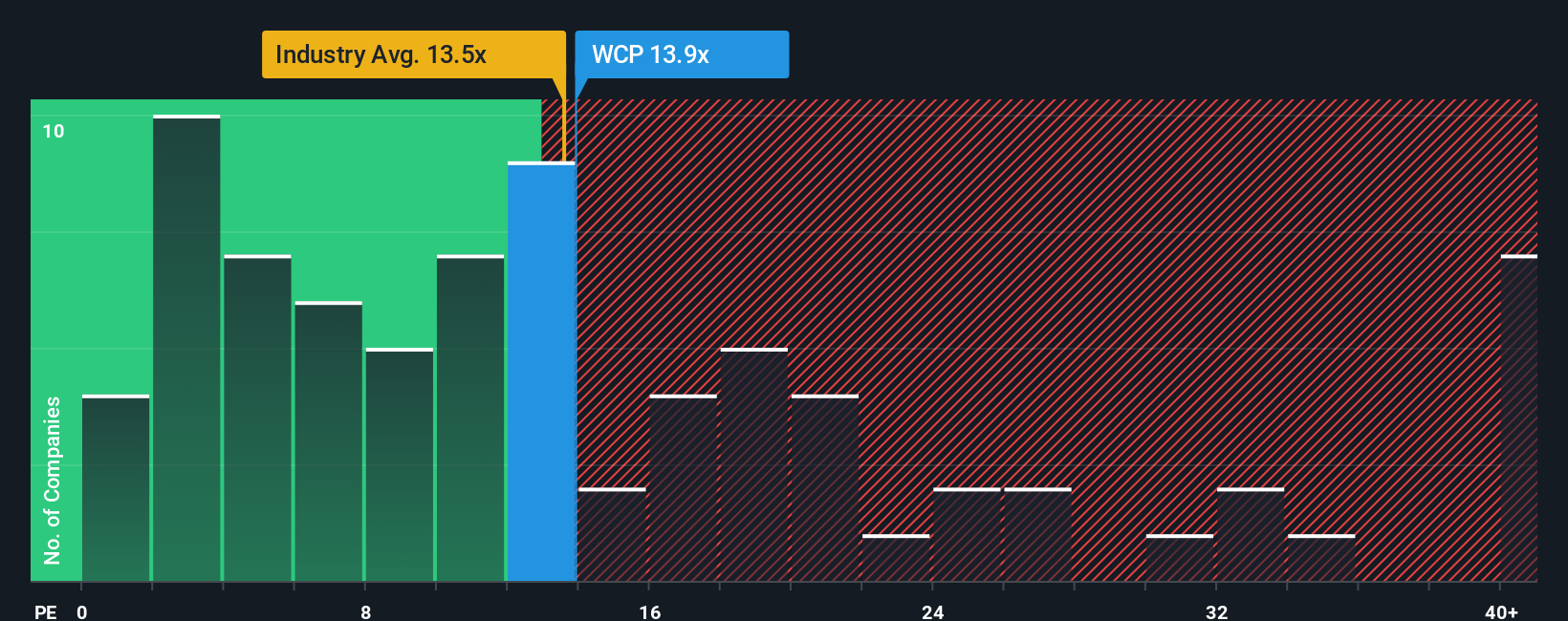

Taking a look at Whitecap Resources through the lens of its earnings-based valuation, the company’s current ratio is 12.6 times earnings. This is just above the industry average of 12 but well below the peer average of 15.5 and a fair ratio of 15.3. While that suggests some upside, such a gap could also reflect risk the market sees ahead. So, does this present a clear bargain or is the value more complicated?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Whitecap Resources Narrative

If the current story doesn't quite fit your viewpoint or you want to investigate further, it takes just a few minutes to shape your own analysis your way with Do it your way.

A great starting point for your Whitecap Resources research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Want an edge in today’s market? Stay ahead by acting on sharp ideas. Don’t let great opportunities slip through your fingers while others seize them.

- Sprint toward unique gains with these 874 undervalued stocks based on cash flows, where companies trading below their potential may offer lucrative upside for value-seeking investors.

- Capitalize on fast-growing trends by targeting these 26 AI penny stocks, connecting you with firms pushing boundaries in artificial intelligence and driving sector innovation.

- Boost steady income by prioritizing these 17 dividend stocks with yields > 3%, featuring stocks that reward consistently with yields over 3% and help secure your financial future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Whitecap Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion