Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Whitecap Resources Inc. (TSE:WCP) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Whitecap Resources

How Much Debt Does Whitecap Resources Carry?

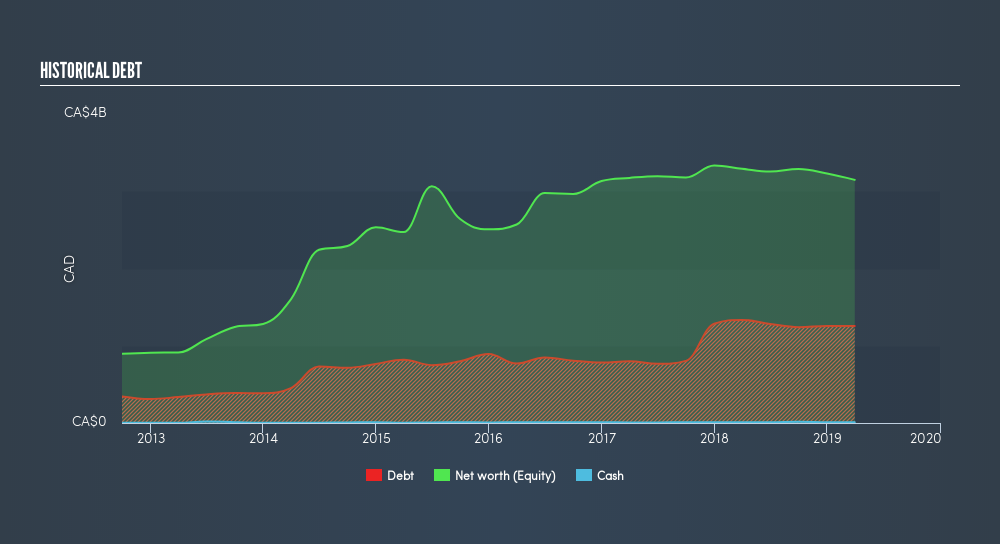

The image below, which you can click on for greater detail, shows that Whitecap Resources had debt of CA$1.26b at the end of March 2019, a reduction from CA$1.33b over a year. Net debt is about the same, since the it doesn't have much cash.

How Strong Is Whitecap Resources's Balance Sheet?

The latest balance sheet data shows that Whitecap Resources had liabilities of CA$249.3m due within a year, and liabilities of CA$2.72b falling due after that. Offsetting these obligations, it had cash of CA$10.2m as well as receivables valued at CA$160.6m due within 12 months. So it has liabilities totalling CA$2.80b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CA$1.68b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt After all, Whitecap Resources would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though Whitecap Resources's debt is only 1.5, its interest cover is really very low at 1.7. In large part that's it has so much depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) Either way there's no doubt the stock is using meaningful leverage. We also note that Whitecap Resources improved its EBIT from a last year's loss to a positive CA$93m. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Whitecap Resources's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Happily for any shareholders, Whitecap Resources actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

To be frank both Whitecap Resources's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Looking at the balance sheet and taking into account all these factors, we do believe that debt is making Whitecap Resources stock a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. Given our hesitation about the stock, it would be good to know if Whitecap Resources insiders have sold any shares recently. You click here to find out if insiders have sold recently.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:WCP

Whitecap Resources

Engages in the acquisition, development, and production of petroleum and natural gas properties and assets in Western Canada.

Very undervalued with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives