- Canada

- /

- Oil and Gas

- /

- TSX:URE

Ur-Energy (TSX:URE) Valuation Under the Microscope After Widening Q3 Losses

Reviewed by Simply Wall St

Ur-Energy (TSX:URE) released its third quarter earnings, revealing sales of $6.32 million, slightly below last year’s figure. The company reported a net loss that widened to $27.46 million for the period.

See our latest analysis for Ur-Energy.

Despite the heavier quarterly loss, Ur-Energy’s share price has shown notable resilience with a 90-day return of 31.21% and a one-year total shareholder return of 33.53%. Longer-term investors have seen even stronger gains. This suggests bullish sentiment is holding up even as near-term momentum wavers.

If you’re weighing what’s next in the sector, consider expanding your view and see what stands out among fast growing stocks with high insider ownership

With shares still trading well below analyst targets, the question becomes: Is Ur-Energy undervalued at its current levels, or is the market already accounting for all expected growth in the uranium sector?

Price-to-Sales of 14.9x: Is it justified?

Ur-Energy is currently trading at a price-to-sales (P/S) ratio of 14.9 times, which signals a rich valuation compared to both its industry peers and our internal fair value models. The last close was CA$2.27, significantly higher than where the broader sector currently sits on this metric.

The price-to-sales ratio helps investors assess how much they are paying per dollar of sales, making it particularly useful for companies like Ur-Energy that are still working toward profitability. For a mining and energy company, a high P/S can reflect market expectations of substantial future revenue growth, but it can also indicate overheating if not supported by fundamentals.

Ur-Energy’s P/S multiple stands far above both the Canadian Oil and Gas industry average of 2.5x and the peer group average of 7.3x. In addition, our estimate of a fair P/S ratio here is 0x, based on recent lack of profitability and sector dynamics. Ur-Energy’s current ratio suggests the market is assuming aggressive growth expectations that may be difficult to achieve unless operational results improve significantly.

Explore the SWS fair ratio for Ur-Energy

Result: Price-to-Sales of 14.9x (OVERVALUED)

However, persistent net losses and growth targets that may prove challenging if uranium demand softens remain clear risks to the current bullish outlook.

Find out about the key risks to this Ur-Energy narrative.

Another View: A Deep Discount to Fair Value?

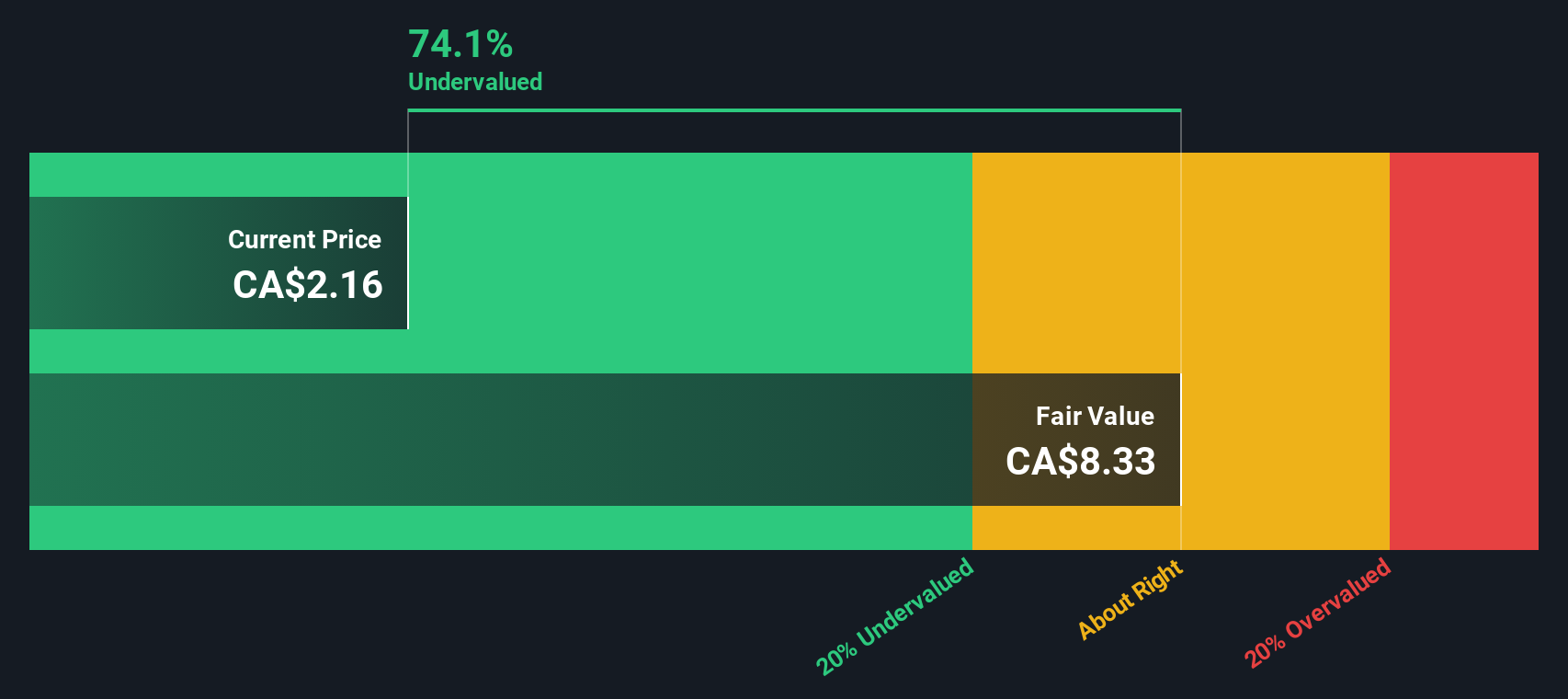

While a high sales multiple suggests potential overvaluation, our DCF model offers a much more optimistic angle. According to this cash flow-based approach, Ur-Energy trades nearly 73% below its estimated fair value. That is a substantial disconnect. Which side of this valuation gap will reality favor?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ur-Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ur-Energy Narrative

If you think these perspectives don’t capture the full picture or you prefer to run your own numbers, you can craft your personal view in just a few minutes: Do it your way

A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead of the curve, expand your watchlist with hand-picked opportunities from our tailored stock screeners below. You'll thank yourself later.

- Boost your potential returns by targeting value plays with these 843 undervalued stocks based on cash flows, built around strong fundamentals and discounted cash flow analysis.

- Power up your portfolio by spotting tomorrow's healthcare breakthroughs with these 33 healthcare AI stocks, searching out leaders in medical AI innovation.

- Capture the momentum of the digital future by selecting high-growth prospects among these 82 cryptocurrency and blockchain stocks, paving the way in blockchain technology and crypto adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives