- Canada

- /

- Oil and Gas

- /

- TSX:URE

Ur-Energy (TSX:URE): Assessing Valuation After Nuclear Industry Roundtable Spotlight

Reviewed by Kshitija Bhandaru

Ur-Energy (TSX:URE) recently took part in TD Cowen’s 10th Annual Nuclear Fuel Cycle and Next Generation Nuclear Roundtable. CEO John W. Cash shared insights on company strategy at the event. This kind of conference exposure often draws investor attention.

See our latest analysis for Ur-Energy.

Ur-Energy’s latest conference appearance comes as momentum in its share price continues to build. After a 31.4% share price return over the past month and an impressive 73.3% gain in the past 90 days, the stock’s one-year total return now sits at 70%. While headlines like recent industry events can fuel short-term moves, the strong multi-year performance suggests that investor sentiment around growth potential remains robust.

If you’re watching how uranium and nuclear energy trends are pushing stocks, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Given its rapid gains and strong revenue growth, investors now face a crucial question: is Ur-Energy still undervalued at today's prices, or has the market already factored in the company’s growth story?

Price-to-Sales Ratio of 17.9x: Is it justified?

Ur-Energy currently trades at a price-to-sales ratio of 17.9x at its last close of CA$2.72, sitting below its peer average but notably above the broader sector.

The price-to-sales (P/S) ratio compares the company’s market price to its revenues, a key metric for unprofitable or high-growth companies where earnings may still be negative. For Ur-Energy, this ratio provides insight into how investors are valuing its current and projected revenues in the context of its market position and growth prospects within the uranium sector.

Compared to its direct peers, Ur-Energy appears to offer relatively better value, as the peer average P/S is higher at 25.4x. However, when measured against the Canadian Oil and Gas industry average of just 2.5x and the estimated fair price-to-sales ratio of 0.1x, the stock appears very expensive. This suggests that despite a favorable comparison with peers, the broader market and fair value benchmarks indicate the stock price might be high if forward growth does not materialize as the market expects.

Explore the SWS fair ratio for Ur-Energy

Result: Price-to-Sales of 17.9x (OVERVALUED)

However, investors should still watch for declining uranium prices or operational setbacks, since either could quickly challenge Ur-Energy's current valuation narrative.

Find out about the key risks to this Ur-Energy narrative.

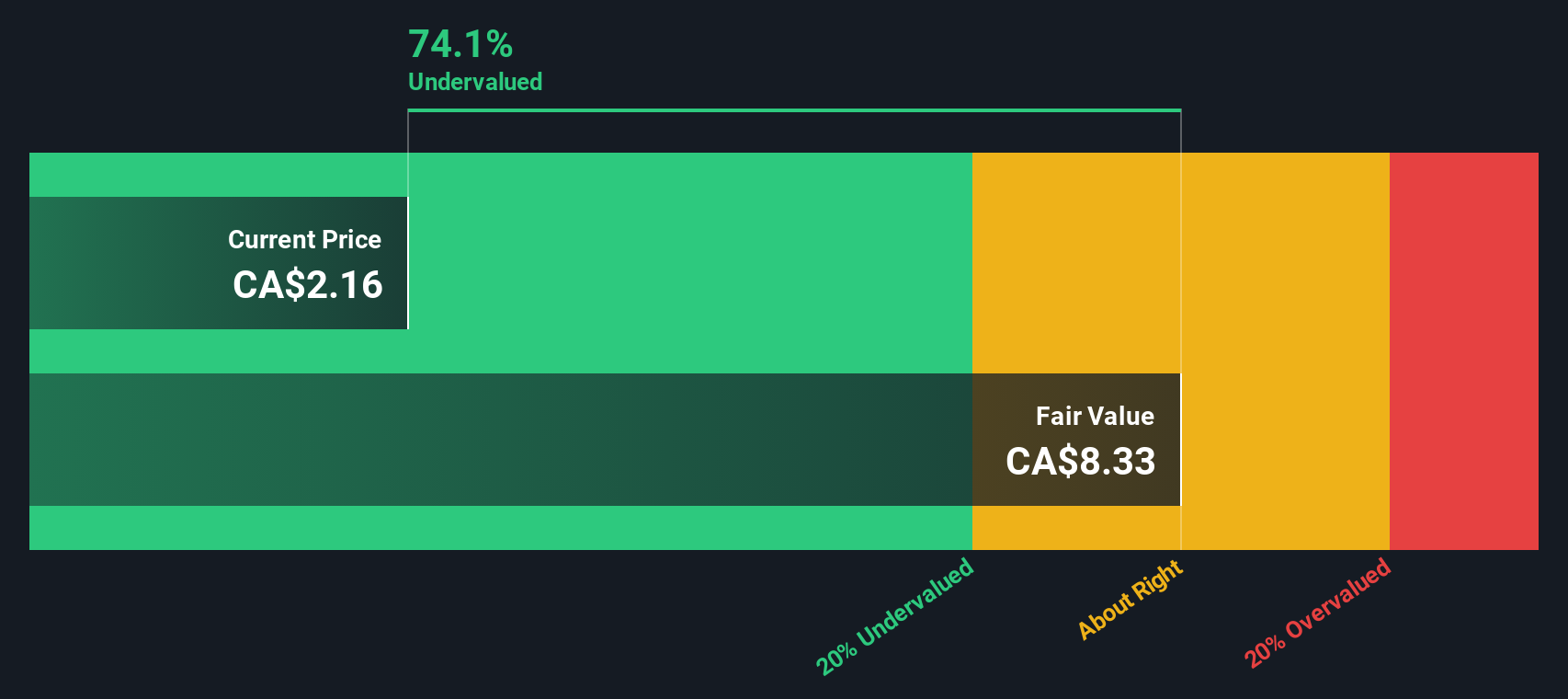

Another View: DCF Model Says It's Undervalued

Looking from a different angle, our DCF model estimates Ur-Energy’s fair value at CA$8.35, which is well above its current price of CA$2.72. This method suggests the stock could be trading at a steep discount and challenges conclusions from the price-to-sales ratio. Could the market have overlooked the company’s true potential, or are optimistic forecasts driving the gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ur-Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ur-Energy Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily create your own perspective in just a few minutes. Do it your way

A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always staying a step ahead. Make sure you catch unique opportunities that could help power your portfolio’s growth. Don’t let them pass you by.

- Unlock steady income by checking out these 19 dividend stocks with yields > 3%, offering attractive yields and strong track records in a volatile market.

- Gain exposure to the future of healthcare by browsing these 33 healthcare AI stocks, with exciting advancements in medical technology.

- Boost your watchlist with these 898 undervalued stocks based on cash flows, which could be trading below their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives