- Canada

- /

- Oil and Gas

- /

- TSX:URE

Is Ur-Energy's (TSX:URE) Growing Revenue Worth the Rising Losses?

Reviewed by Sasha Jovanovic

- Ur-Energy Inc. recently announced third quarter 2025 results, reporting sales of US$6.32 million with a net loss of US$27.46 million, both compared to the previous year.

- While sales grew over the nine-month period, the company's net losses increased considerably, highlighting a key challenge between revenue momentum and higher expenses.

- We'll explore how the combination of sales growth and widened losses shapes Ur-Energy's investment narrative and risk outlook.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Ur-Energy's Investment Narrative?

To be comfortable owning shares in Ur-Energy at this point, I think you'd need to believe in the company's ability to convert recent growth in uranium production and long-term contracts into future profitability, despite persistent losses. The latest results show revenue momentum hasn't translated into improved bottom-line performance, with net losses widening considerably in the third quarter. This may weigh on near-term sentiment and calls into question how quickly the business can manage higher costs as it ramps up operations at Lost Creek and Shirley Basin. The CEO transition this December adds another layer to watch, but with an experienced team, some may see it as part of the company's evolution toward scaling for higher demand. As the share price has pulled back, the tug-of-war between robust production plans and mounting losses remains front and center, making short-term catalysts like operational milestones more sensitive to cost management risks than before. If these losses deepen further or capital raises become necessary, that could impact the company's financial flexibility. But, with production ramping up, there are still unknowns around whether expenses could keep climbing.

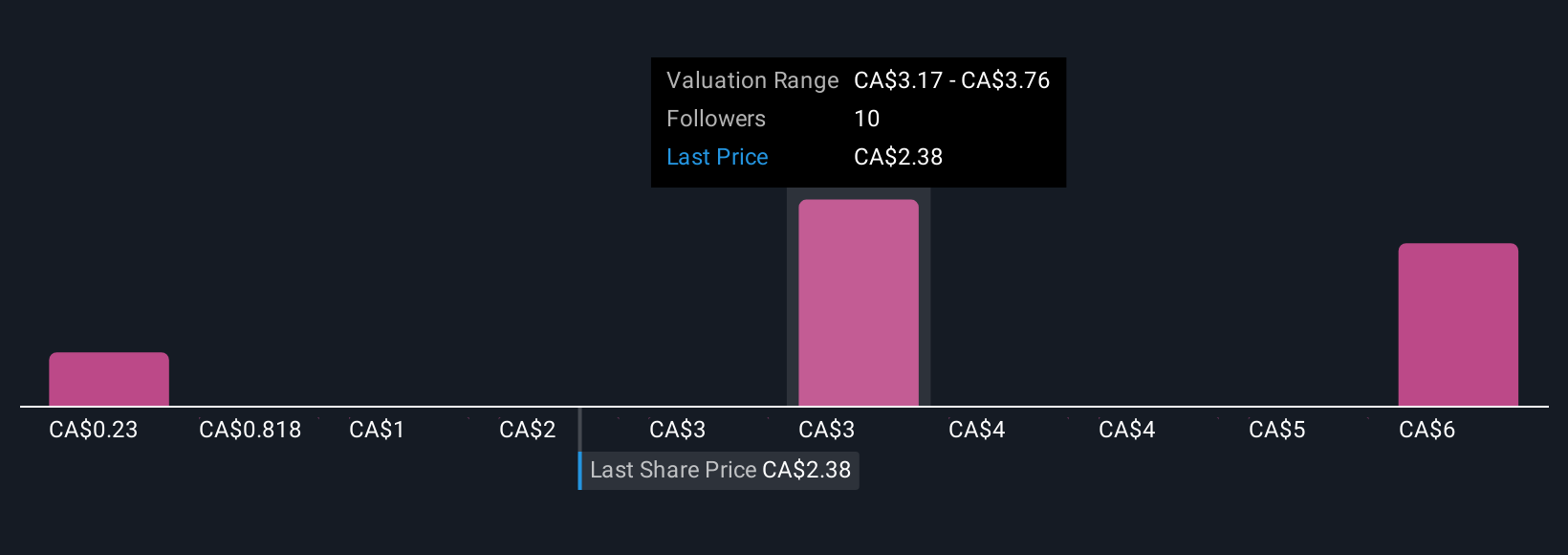

Despite retreating, Ur-Energy's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 7 other fair value estimates on Ur-Energy - why the stock might be worth over 4x more than the current price!

Build Your Own Ur-Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ur-Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ur-Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ur-Energy's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:URE

Ur-Energy

Engages in the acquisition, exploration, development, and operation of uranium mineral properties in the United States.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives