- Canada

- /

- Communications

- /

- TSX:ET

Undiscovered Gems in Canada to Explore February 2025

Reviewed by Simply Wall St

As 2025 unfolds, the Canadian market has been navigating a landscape marked by stabilized yields and moderated inflation, with the TSX showing modest gains of around 3%. In this environment of cautious optimism and potential rate cuts by central banks, uncovering promising small-cap stocks can offer investors unique opportunities to capitalize on growth prospects that align well with these economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Sol Strategies | NA | 13.70% | 4.95% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Enghouse Systems (TSX:ENGH)

Simply Wall St Value Rating: ★★★★★★

Overview: Enghouse Systems Limited, with a market cap of CA$1.45 billion, develops enterprise software solutions globally through its subsidiaries.

Operations: Enghouse Systems generates revenue primarily from its Asset Management Group and Interactive Management Group, with the latter contributing CA$308.92 million. The company's market cap stands at CA$1.45 billion.

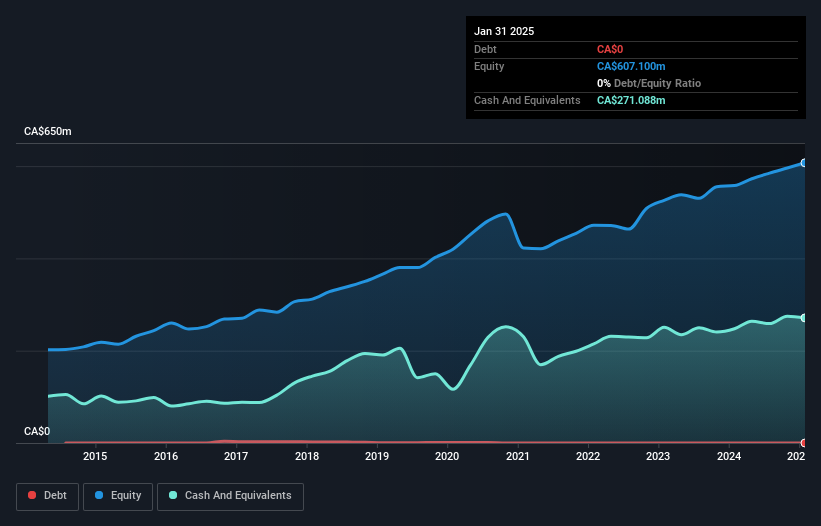

Enghouse Systems, a nimble player in the tech space, stands out with its debt-free status and high-quality earnings. Recent earnings showed a full-year revenue of CA$502.51 million, up from CA$454.02 million the previous year, while net income rose to CA$81.33 million from CA$72.25 million. The company has repurchased 157,781 shares for CA$4.9 million since May 2024, reflecting confidence in its value proposition as it transitions to a SaaS model for better revenue stability and operational efficiency amidst competition from giants like Microsoft and Zoom.

Evertz Technologies (TSX:ET)

Simply Wall St Value Rating: ★★★★★★

Overview: Evertz Technologies Limited designs, manufactures, and distributes video and audio infrastructure solutions for production, post-production, broadcast, and telecommunications markets globally with a market cap of CA$897.62 million.

Operations: Evertz Technologies generates revenue primarily from the television broadcast equipment market, which accounted for CA$494.95 million. The company's financial performance is influenced by its cost structure, with a focus on optimizing production and distribution expenses to enhance profitability.

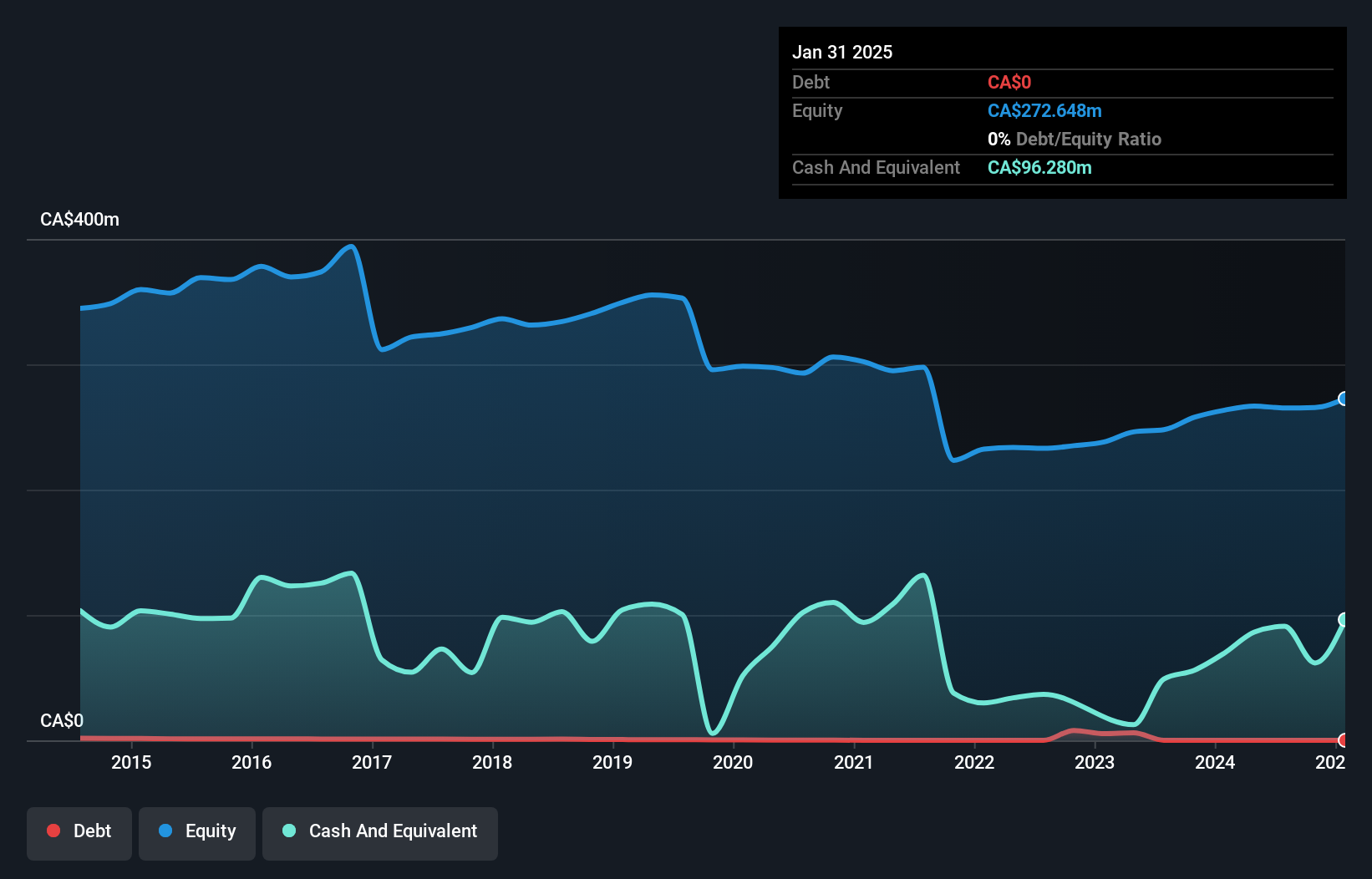

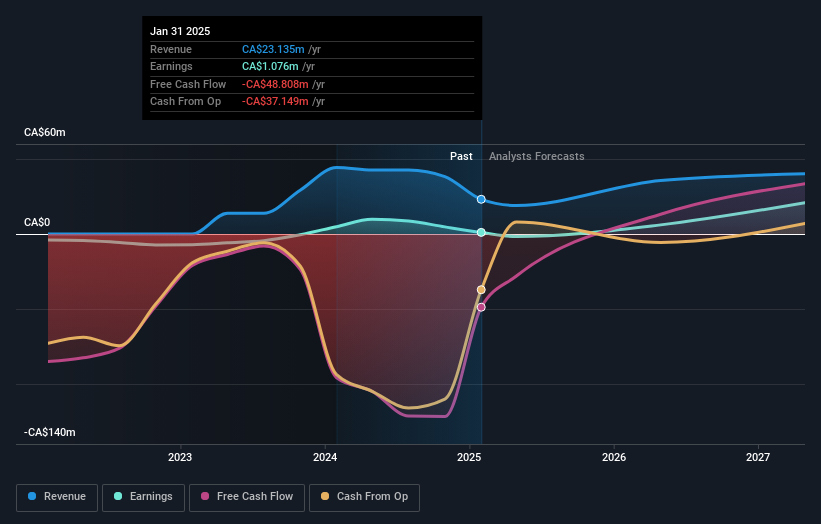

Evertz Technologies, a nimble player in the tech space, showcases a mixed bag of strengths and challenges. Its high-margin technology focus has driven a notable 23.7% rise in recurring software services revenue, while maintaining no debt enhances its financial flexibility. The company's substantial order backlog of $298 million indicates strong demand, yet international revenue has slipped by 46%, posing hurdles for growth. With R&D investments at $36.3 million fueling innovation, Evertz aims to capture emerging opportunities despite rising costs and potential liquidity risks. Analysts foresee annual revenue growth of 4.3%, with profit margins inching from 11.7% to 13.1%.

Uranium Royalty (TSX:URC)

Simply Wall St Value Rating: ★★★★★★

Overview: Uranium Royalty Corp. is a company focused exclusively on acquiring and managing a portfolio of uranium royalties, with a market capitalization of CA$402.11 million.

Operations: The company generates revenue primarily through acquiring and assembling a portfolio of uranium royalties, amounting to CA$38.29 million.

Uranium Royalty Corp. stands out with a remarkable earnings growth of 259.5% over the past year, significantly outpacing the Oil and Gas industry, which saw a negative trend of -25.6%. Despite this impressive performance, recent financial results show some challenges; sales for the second quarter were CAD 10.86 million compared to CAD 15.32 million in the previous year, resulting in a net loss of CAD 0.428 million versus a net income of CAD 3.49 million last year. Notably, URC is debt-free now—a stark contrast to five years ago when its debt-to-equity ratio was at 46%.

- Delve into the full analysis health report here for a deeper understanding of Uranium Royalty.

Evaluate Uranium Royalty's historical performance by accessing our past performance report.

Key Takeaways

- Embark on your investment journey to our 45 TSX Undiscovered Gems With Strong Fundamentals selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evertz Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ET

Evertz Technologies

Engages in the design, manufacture, and distribution of video and audio infrastructure solutions for the production, post-production, broadcast, and telecommunications markets in Canada, the United States, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives