TSX Value Picks Including Exchange Income And 2 Stocks Priced Below Estimated Worth

Reviewed by Simply Wall St

The Canadian stock market has recently reached new all-time highs, showcasing resilience amid global economic uncertainties and policy shifts. In this environment, identifying undervalued stocks can be a prudent strategy for investors seeking to capitalize on potential growth opportunities; focusing on companies with strong fundamentals and attractive valuations is essential in navigating the current market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Whitecap Resources (TSX:WCP) | CA$8.58 | CA$14.08 | 39% |

| Docebo (TSX:DCBO) | CA$37.32 | CA$59.09 | 36.8% |

| Groupe Dynamite (TSX:GRGD) | CA$15.20 | CA$28.17 | 46% |

| Aris Mining (TSX:ARIS) | CA$7.89 | CA$13.07 | 39.6% |

| VersaBank (TSX:VBNK) | CA$15.66 | CA$30.59 | 48.8% |

| Currency Exchange International (TSX:CXI) | CA$20.35 | CA$35.07 | 42% |

| Journey Energy (TSX:JOY) | CA$1.58 | CA$3.03 | 47.8% |

| TerraVest Industries (TSX:TVK) | CA$170.17 | CA$274.22 | 37.9% |

| Laurentian Bank of Canada (TSX:LB) | CA$27.77 | CA$43.32 | 35.9% |

| Aya Gold & Silver (TSX:AYA) | CA$10.35 | CA$20.50 | 49.5% |

We'll examine a selection from our screener results.

Exchange Income (TSX:EIF)

Overview: Exchange Income Corporation operates in aerospace and aviation services and equipment, as well as manufacturing businesses globally, with a market cap of CA$2.99 billion.

Operations: The company's revenue segments include CA$1.07 billion from manufacturing and CA$1.66 billion from aerospace and aviation services and equipment.

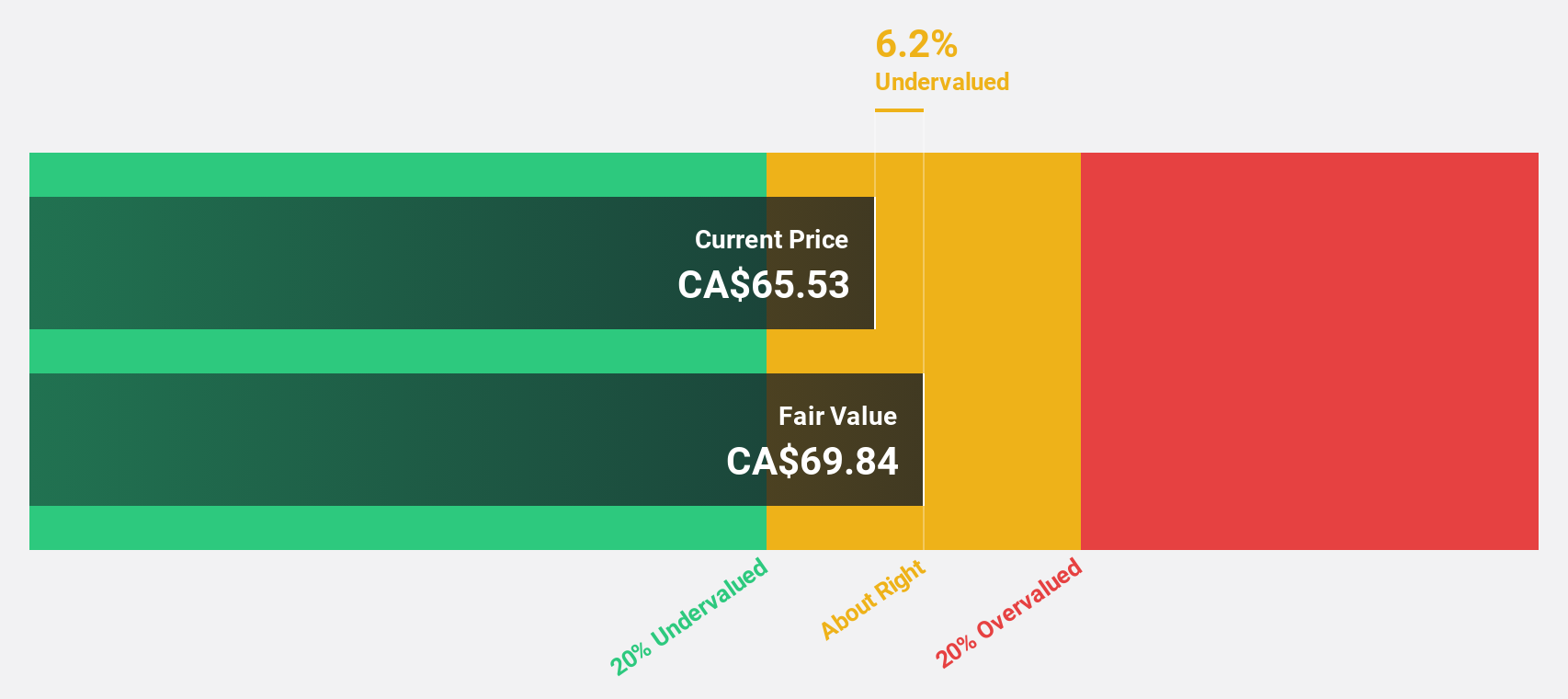

Estimated Discount To Fair Value: 18.8%

Exchange Income Corporation's recent financial results show a robust increase in revenue and net income, with sales rising to C$668.28 million for Q1 2025. The company has expanded its credit facility to C$3 billion, enhancing its liquidity position. Although the dividend yield of 4.54% is not well covered by earnings, the stock trades at C$58.18, below its estimated fair value of C$71.64, suggesting it could be undervalued based on cash flows despite some financial constraints.

- Our comprehensive growth report raises the possibility that Exchange Income is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in Exchange Income's balance sheet health report.

Laurentian Bank of Canada (TSX:LB)

Overview: Laurentian Bank of Canada, along with its subsidiaries, offers a range of financial services to personal, business, and institutional clients across Canada and the United States, with a market cap of CA$1.23 billion.

Operations: The bank generates revenue from its Capital Markets segment, amounting to CA$949.68 million.

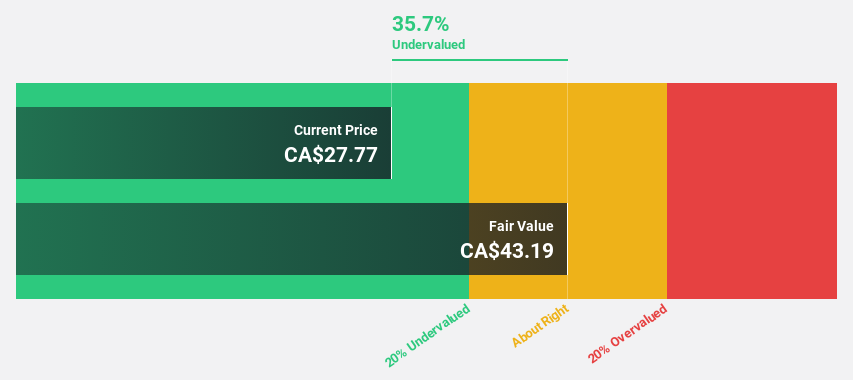

Estimated Discount To Fair Value: 35.9%

Laurentian Bank of Canada is trading at CA$27.77, significantly below its estimated fair value of CA$43.32, highlighting potential undervaluation based on cash flows. Despite a forecasted revenue growth rate of 3.6% annually, which surpasses the Canadian market average, its dividend yield of 6.77% raises sustainability concerns as it isn't well covered by earnings. Recent financials show modest net income growth to CA$38.6 million for Q1 2025, indicating stable performance amidst shareholder activism challenges.

- The analysis detailed in our Laurentian Bank of Canada growth report hints at robust future financial performance.

- Dive into the specifics of Laurentian Bank of Canada here with our thorough financial health report.

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. manufactures and sells goods and services across various sectors including agriculture, mining, energy, and more in Canada, the United States, and internationally with a market cap of CA$3.32 billion.

Operations: The company's revenue segments include Service (CA$216.52 million), Processing Equipment (CA$104.18 million), Compressed Gas Equipment (CA$336.15 million), and HVAC and Containment Equipment (CA$363.00 million).

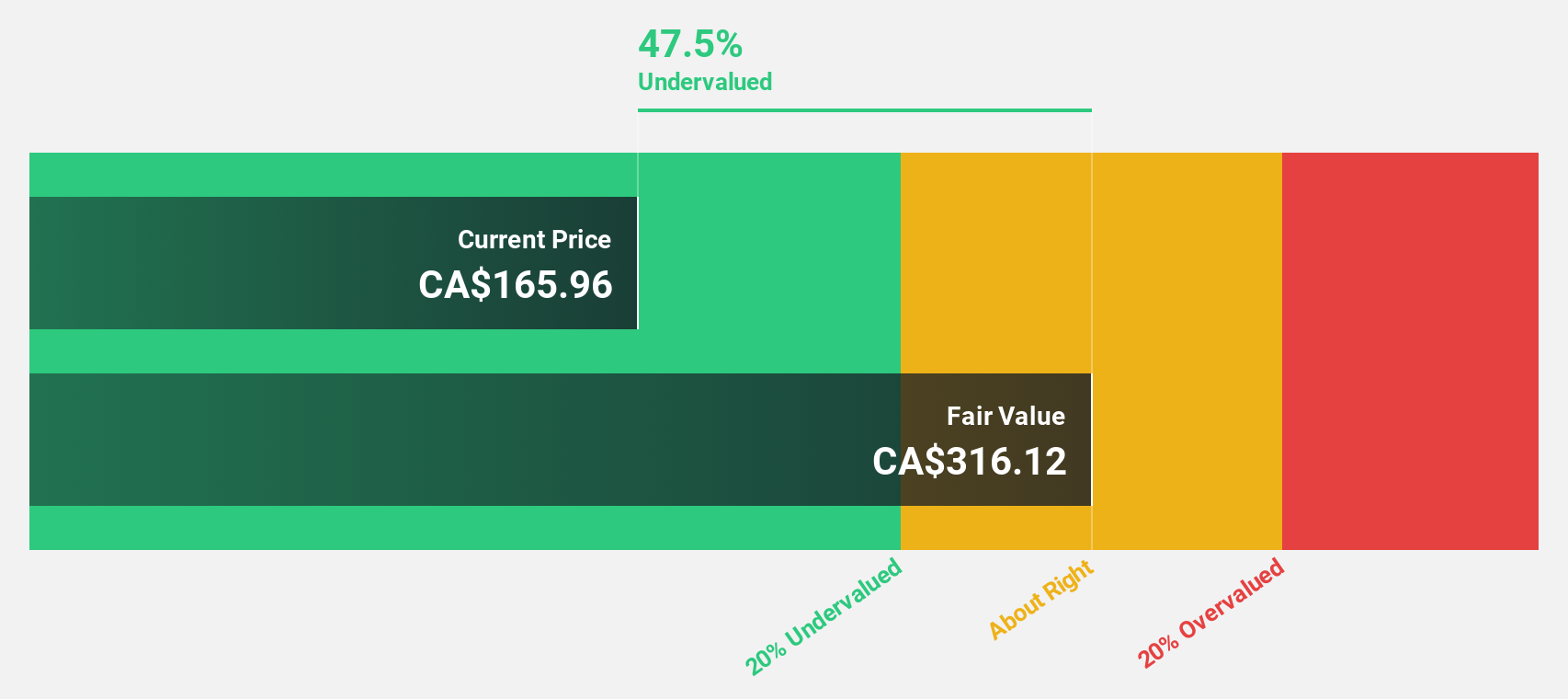

Estimated Discount To Fair Value: 37.9%

TerraVest Industries is trading at CA$170.17, significantly below its estimated fair value of CA$274.22, suggesting undervaluation based on cash flows. Its earnings are forecast to grow 22.81% annually, outpacing the Canadian market's growth rate of 12%. Recent financials reported a substantial revenue increase to CA$311.45 million for Q2 2025, with net income rising to CA$28.19 million from the previous year despite debt concerns related to operating cash flow coverage.

- Our growth report here indicates TerraVest Industries may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of TerraVest Industries.

Seize The Opportunity

- Click through to start exploring the rest of the 22 Undervalued TSX Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, business, and institutional customers in Canada and the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives