- Canada

- /

- Health Care REITs

- /

- TSX:NWH.UN

Top Undervalued Small Caps With Insider Buying In Canada October 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, yet it boasts an impressive 27% increase over the past year with earnings expected to grow by 16% per annum in the coming years. In this dynamic environment, identifying promising small-cap stocks can be particularly rewarding when they exhibit strong fundamentals and insider buying activity.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.0x | 0.9x | 21.76% | ★★★★★★ |

| First National Financial | 10.5x | 3.4x | 49.58% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 38.22% | ★★★★★☆ |

| Nexus Industrial REIT | 3.6x | 3.6x | 19.04% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.09% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 13.0x | 3.5x | 44.68% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -44.98% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 19.31% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.1x | -205.79% | ★★★★☆☆ |

| Freehold Royalties | 14.0x | 6.5x | 49.70% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

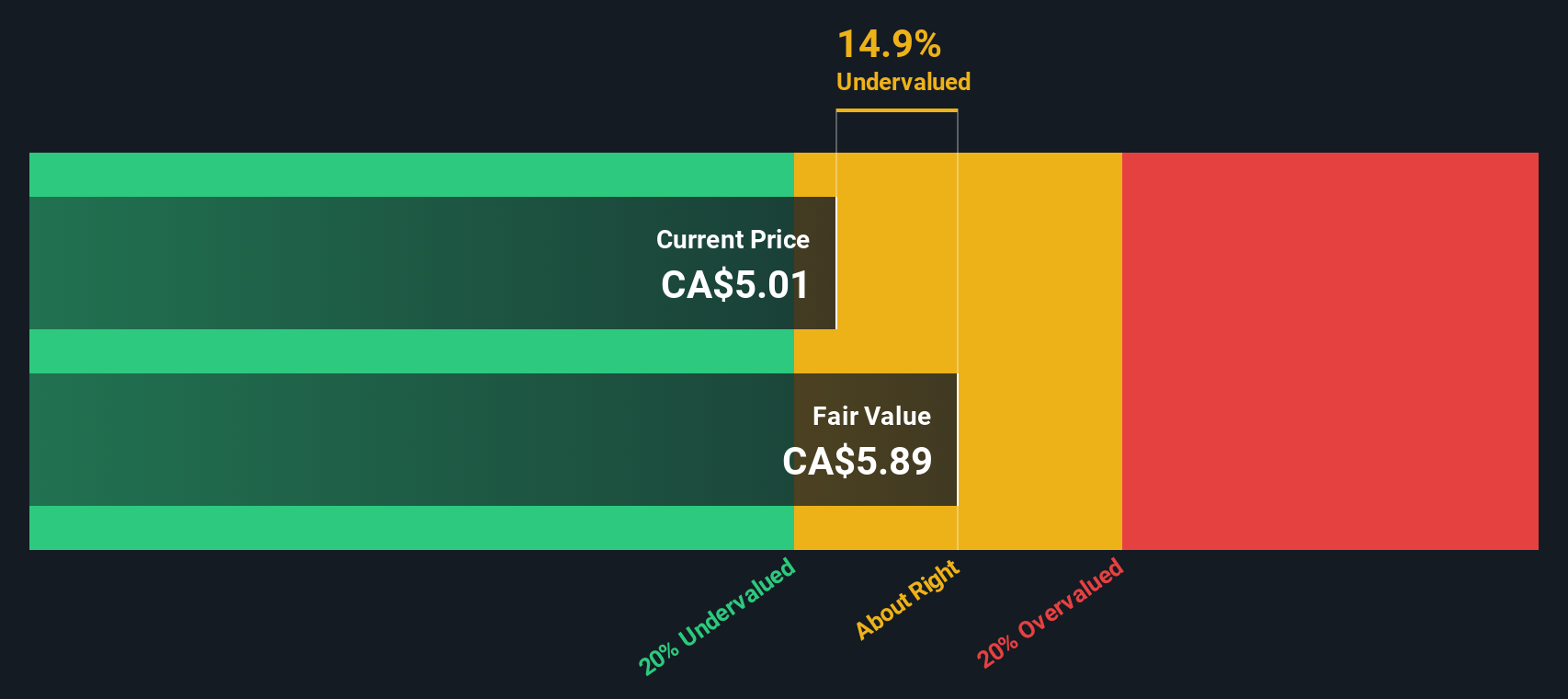

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties is a Canadian company focused on oil and gas exploration and production, with operations generating CA$323.04 million in revenue.

Operations: Freehold Royalties generates revenue primarily from oil and gas exploration and production, with a recent quarterly revenue of CA$323.04 million. The company has seen fluctuations in its net income margin, which was 46.41% as of the latest period. Operating expenses are significant, including depreciation and amortization costs that impact overall profitability. Gross profit margin trends have shown consistency around the high 96% range in recent periods, indicating efficient cost management relative to revenue generation.

PE: 14.0x

Freehold Royalties, a small Canadian company, demonstrates potential value with consistent earnings growth. In Q2 2024, they reported net income of C$39.3 million, up from C$24.26 million the previous year. Basic earnings per share rose to C$0.26 from C$0.16 last year, highlighting profitability improvements despite relying solely on external borrowing for funding—considered higher risk than customer deposits. Insider confidence is evident through recent share purchases in August 2024, suggesting belief in future prospects amidst stable dividend payouts of C$0.09 per share monthly.

- Navigate through the intricacies of Freehold Royalties with our comprehensive valuation report here.

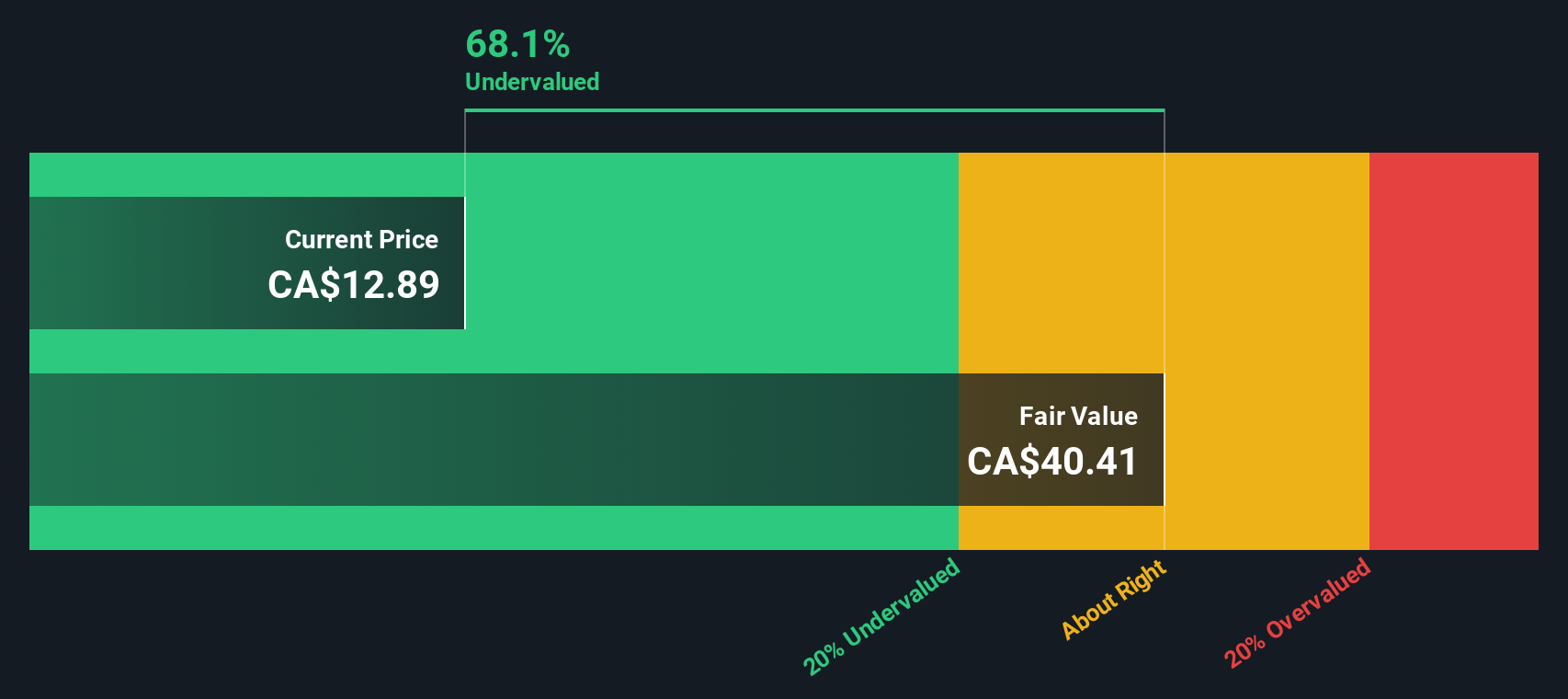

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust is a Canadian company focused on owning and managing healthcare real estate properties, with a market cap of CA$1.86 billion.

Operations: The company generates revenue primarily from the healthcare real estate industry, with recent figures showing CA$523.85 million. The gross profit margin has shown fluctuations over time, reaching 77.81% in the latest period. Operating expenses and non-operating expenses have significantly impacted net income, resulting in a negative net income margin of -75.29% as of the most recent data point.

PE: -3.4x

NorthWest Healthcare Properties Real Estate Investment Trust, a smaller player in the Canadian market, recently renewed its lease at Sabará Hospital, extending its Brazilian portfolio's WALE to 18.2 years. Despite reporting a net loss of C$122 million for Q2 2024, insider confidence is evident with recent share purchases. The REIT declared monthly distributions of C$0.03 per unit through October 2024 and is actively managing leadership transitions as CEO Craig Mitchell plans retirement in mid-2025.

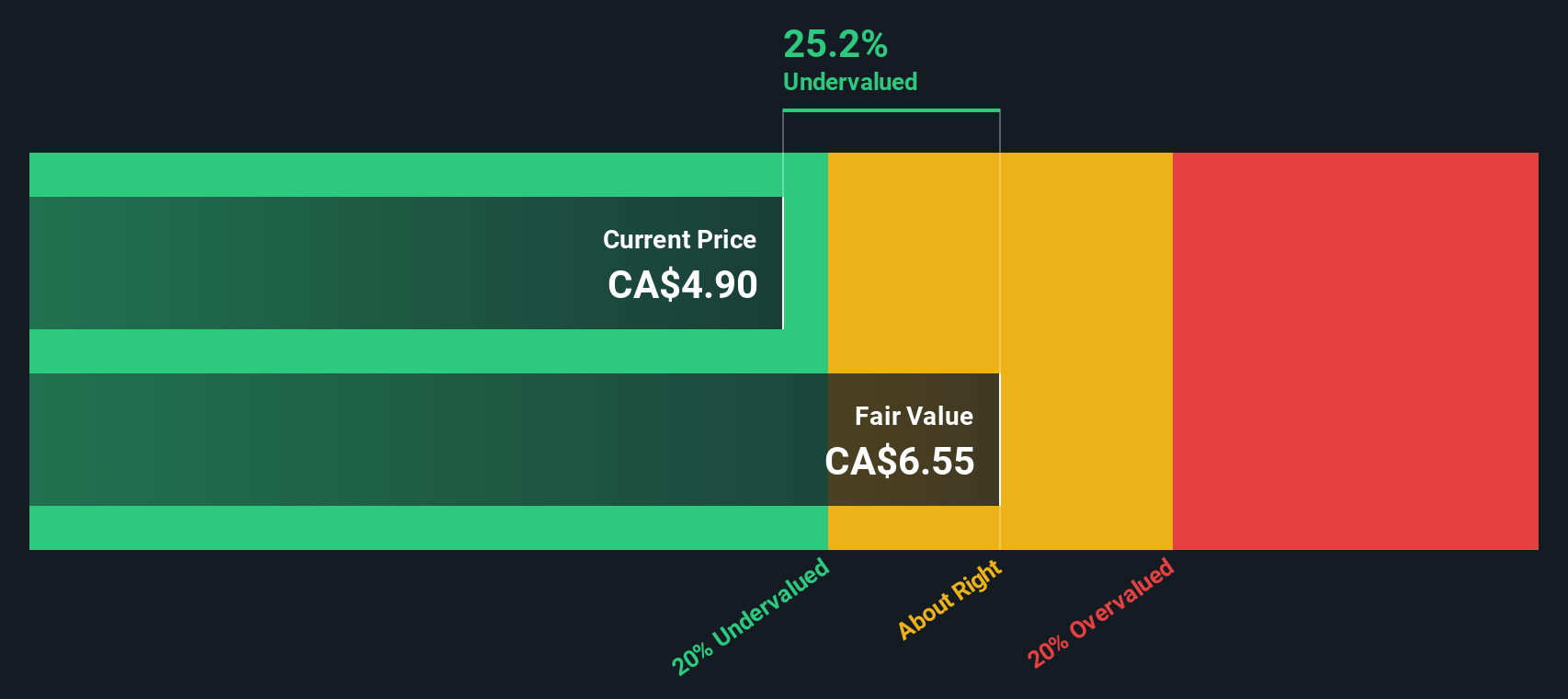

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Tamarack Valley Energy is engaged in the exploration and production of oil and gas, with a market capitalization of CA$2.12 billion.

Operations: Revenue is primarily derived from the exploration and production of oil and gas, with a recent figure of CA$1.48 billion. The gross profit margin has shown variability, reaching 77.03% in the latest period. Operating expenses are significant, including costs such as depreciation and amortization, which were CA$608.90 million recently.

PE: 16.3x

Tamarack Valley Energy, a Canadian energy company, displays characteristics of an undervalued stock with recent financials showing a significant rise in net income to C$94.89 million for Q2 2024 from C$25.74 million the previous year. Despite high debt levels and lower profit margins (8.7% versus last year's 16.3%), insider confidence is evident through share repurchases totaling 9.7 million shares between April and June 2024 for C$32.7 million, indicating potential value recognition by the management team amidst ongoing dividend affirmations at C$0.0125 per share monthly.

- Dive into the specifics of Tamarack Valley Energy here with our thorough valuation report.

Learn about Tamarack Valley Energy's historical performance.

Seize The Opportunity

- Take a closer look at our Undervalued TSX Small Caps With Insider Buying list of 24 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NorthWest Healthcare Properties Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWH.UN

NorthWest Healthcare Properties Real Estate Investment Trust

Northwest provides investors with access to a portfolio of high-quality international healthcare real estate infrastructure comprised as at May 14, 2025, of interests in a diversified portfolio of 169 income-producing properties and 15.8 million square feet of gross leasable area located throughout major markets in North America, Brazil, Europe, and Australasia.

Good value average dividend payer.

Market Insights

Community Narratives