David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Tamarack Valley Energy Ltd. (TSE:TVE) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for Tamarack Valley Energy

What Is Tamarack Valley Energy's Debt?

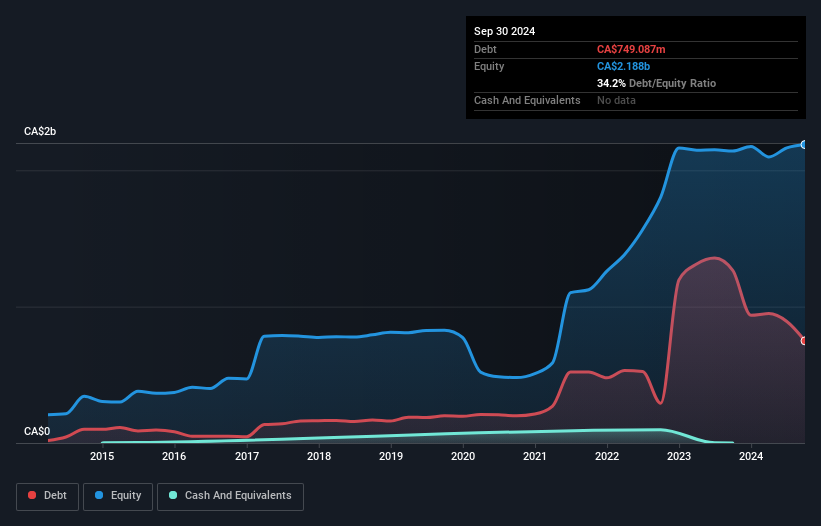

As you can see below, Tamarack Valley Energy had CA$749.1m of debt at September 2024, down from CA$1.27b a year prior. Net debt is about the same, since the it doesn't have much cash.

A Look At Tamarack Valley Energy's Liabilities

The latest balance sheet data shows that Tamarack Valley Energy had liabilities of CA$227.2m due within a year, and liabilities of CA$1.58b falling due after that. Offsetting this, it had CA$246.0k in cash and CA$132.2m in receivables that were due within 12 months. So it has liabilities totalling CA$1.68b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of CA$2.51b, so it does suggest shareholders should keep an eye on Tamarack Valley Energy's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 0.70 and interest cover of 4.9 times, it seems to us that Tamarack Valley Energy is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. It is well worth noting that Tamarack Valley Energy's EBIT shot up like bamboo after rain, gaining 54% in the last twelve months. That'll make it easier to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Tamarack Valley Energy's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Tamarack Valley Energy recorded free cash flow worth 57% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Happily, Tamarack Valley Energy's impressive EBIT growth rate implies it has the upper hand on its debt. But truth be told we feel its level of total liabilities does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that Tamarack Valley Energy can handle its debt fairly comfortably. On the plus side, this leverage can boost shareholder returns, but the potential downside is more risk of loss, so it's worth monitoring the balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Tamarack Valley Energy (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Tamarack Valley Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TVE

Tamarack Valley Energy

Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success