- Canada

- /

- Oil and Gas

- /

- TSX:TPZ

Assessing Topaz Energy’s Value After a 5.5% Drop This Month

Reviewed by Bailey Pemberton

- Wondering if Topaz Energy is a hidden gem or just another energy stock? Let’s dig into what the numbers and market moves might be telling us about its value right now.

- While the stock has dropped 5.5% over the past month and is down 12.1% year-to-date, its performance over the past three and five years has been strong, up 25.8% and 125.4% respectively.

- There hasn’t been any major news rocking the share price lately. However, several recent industry reports and analyst updates have drawn renewed attention to energy stocks like Topaz. This context makes it worth keeping an eye on shifting investor sentiment and sector trends that could impact valuations ahead.

- Based on our analysis, Topaz Energy scores a 3 out of 6 on our valuation checks. This signals some attractive areas but also room for scrutiny. We’ll break down what goes into this score using both classic valuation approaches and, at the end, reveal a smarter way to judge if this stock really offers value.

Find out why Topaz Energy's -3.1% return over the last year is lagging behind its peers.

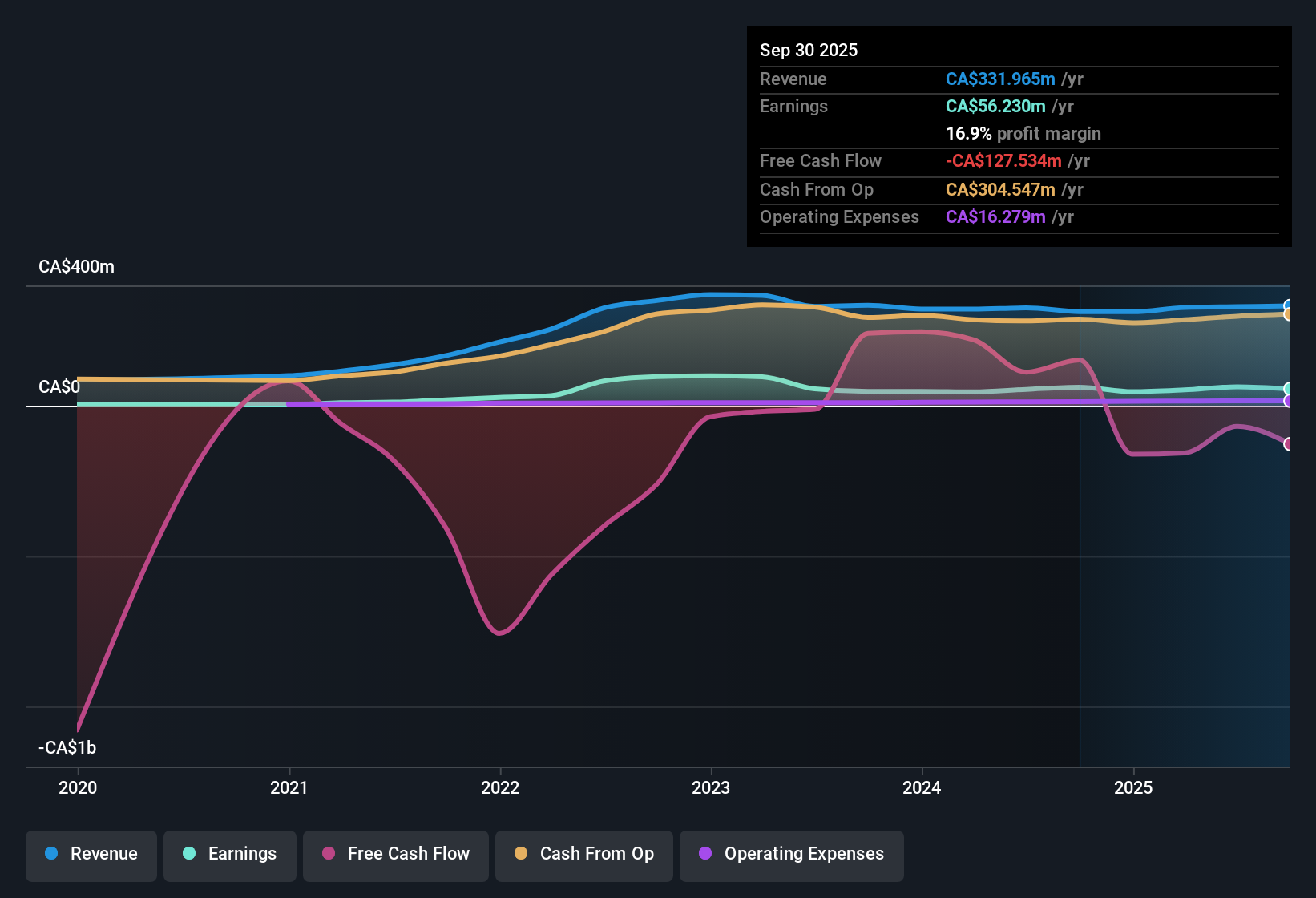

Approach 1: Topaz Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation approach that estimates a company’s intrinsic worth by projecting its future cash flows and then discounting those estimates back to today’s value using a risk-adjusted rate. This method aims to answer one key question: what is Topaz Energy really worth if we focus on the cash it’s likely to generate in the future?

For Topaz Energy, the latest twelve months’ Free Cash Flow stands at CA$4.66 Million. Analysts have forecast steady growth, with cash flow projections rising sharply over the next decade. By 2027, Free Cash Flow is expected to reach CA$353 Million, and extrapolated estimates suggest this could rise to over CA$628 Million by 2035. These numbers are based on analyst predictions for the next five years, with longer-term projections modeled based on observed trends.

Based on this DCF analysis, Topaz Energy’s intrinsic value comes in at CA$90.53 per share. Given its current price, this implies the stock may be trading at a 72.6% discount to its fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Topaz Energy is undervalued by 72.6%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

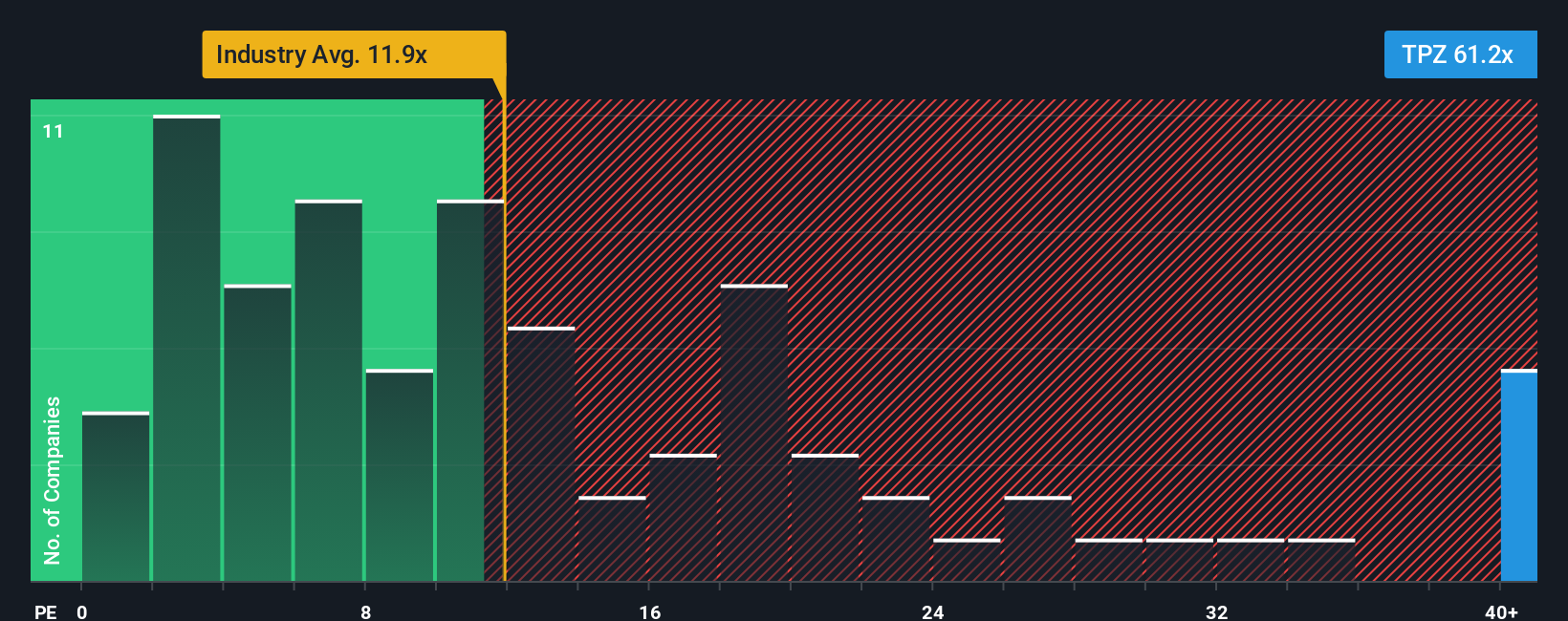

Approach 2: Topaz Energy Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies, as it relates a company's current share price to its per-share earnings. This makes it useful for comparing how much investors are paying for each dollar of profit a company generates.

Growth expectations and risk are key factors in determining what a normal or fair PE ratio should be. Companies with higher growth prospects or lower perceived risks typically command higher PE multiples, while slower-growing or riskier firms tend to have lower ratios.

As of now, Topaz Energy trades at a PE ratio of 60.7x. By comparison, the average PE ratio among its industry peers is just 7.9x, and the broader Oil and Gas sector average is 12.5x. On face value, this suggests Topaz trades at a significant premium to its peers.

However, Simply Wall St's proprietary "Fair Ratio" takes the analysis further. The Fair Ratio adjusts for factors such as Topaz’s earnings growth outlook, profit margins, market cap, risks, and specific industry context. This offers a more tailored benchmark than industry or peer averages. For Topaz, the Fair Ratio stands at 16.8x, indicating what would be reasonable for the company given its profile.

Comparing this Fair Ratio to Topaz Energy’s current PE ratio of 60.7x, the stock appears clearly OVERVALUED by this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Topaz Energy Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are simple, dynamic stories about a company that connect its business outlook to financial forecasts and ultimately to a fair value, allowing you to map your personal perspective onto the numbers. On Simply Wall St’s Community page, you’ll find thousands of these Narratives, easily accessible and created by investors who combine their qualitative view, such as optimism around Topaz’s asset-light model, cash flow growth, or exposure to global energy trends, with their own forecasted revenue, earnings, and margin assumptions. Narratives make it straightforward to judge whether Topaz Energy is a buy, hold, or sell by comparing each Narrative’s fair value to the latest share price. They are instantly updated as new earnings or news emerge. For example, some investors who believe Topaz’s diversified royalties ensure protection from commodity swings may forecast a CA$35.00 fair value. More cautious investors who highlight risks like operator concentration, energy transition headwinds, or regulatory changes might see fair value closer to CA$29.00. This can result in very different investment decisions, and Narratives help you see and choose the story that best matches your outlook.

Do you think there's more to the story for Topaz Energy? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topaz Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TPZ

Topaz Energy

Operates as a royalty and infrastructure energy company in Canada.

Reasonable growth potential and fair value.

Market Insights

Community Narratives