- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Tourmaline Oil (TSX:TOU): Insiders Step In—Exploring Valuation After Leadership Share Purchases

Reviewed by Simply Wall St

Tourmaline Oil (TSX:TOU) saw a fresh round of insider buying, with CEO Mike Rose and several others picking up shares. Many investors interpret these purchases as a show of confidence from the company’s leadership team.

See our latest analysis for Tourmaline Oil.

Tourmaline Oil’s recent insider purchases come amid a subtle rebound, with the share price returning nearly 7% over the past three months. While this momentum has not yet translated into a positive year-to-date share price return, its five-year total shareholder return of over 390% stands out and hints at the company’s longer-term growth potential, even as sentiment is still turning.

If leadership’s show of confidence has you thinking bigger, now is a perfect time to expand your search and discover fast growing stocks with high insider ownership

But with shares trading below analyst price targets and insiders increasing their stakes, investors are left wondering if Tourmaline Oil is undervalued by the market or if the company’s growth prospects are already fully reflected in today’s price.

Most Popular Narrative: 14.9% Undervalued

Tourmaline Oil’s most widely tracked narrative sets a fair value well above the last close price. This highlights a measurable gap between analyst expectations and current market sentiment.

“The ramp-up of LNG Canada and expanding North American export infrastructure are set to relieve local bottlenecks, improve price realizations, and support higher sales volumes for Tourmaline over the next several years. This could positively impact net margins and earnings.”

Behind this fair value is a game-changing set of financial forecasts. Bold revenue growth, future profit shifts, and ambitious production targets combine for a powerful catalyst. Want to see the actual numbers and what’s driving analysts to look far beyond today’s trading levels? Dive in to find out what could move this stock next.

Result: Fair Value of $72.90 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in natural gas prices or delays in LNG export expansion could quickly undermine the optimistic growth projections that are fueling today’s bullish outlook.

Find out about the key risks to this Tourmaline Oil narrative.

Another View: Pricing Signals Put to the Test

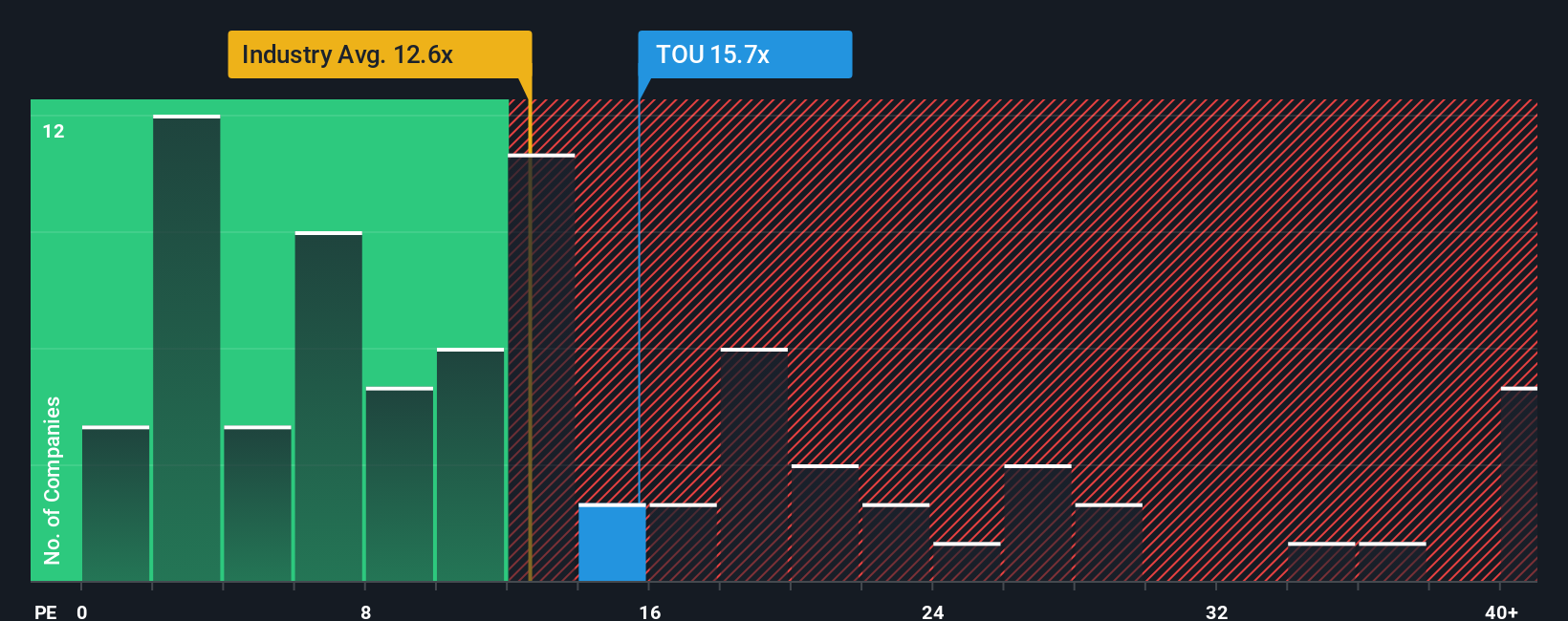

Looking at Tourmaline Oil’s price-to-earnings ratio, shares appear more expensive than both the Canadian oil and gas industry average and their closest peers. The current P/E ratio is also below the market's fair ratio for the stock, which suggests future direction could change. Is this a warning sign, or the start of a bigger move?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you want a different perspective or enjoy diving into your own research, you can quickly build your own narrative from the ground up in just a few minutes. Do it your way

A great starting point for your Tourmaline Oil research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit yourself to just one opportunity when there’s a whole world of smart investment options waiting. Find your next edge with these tailored picks:

- Jump on the wave of innovative firms reshaping artificial intelligence by starting your search with these 26 AI penny stocks.

- Target steady income streams by checking out these 15 dividend stocks with yields > 3%, where you can unlock companies delivering attractive yields over 3%.

- Capitalize on deep value plays by reviewing these 918 undervalued stocks based on cash flows and uncover those that may be overlooked by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives