- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Should Tourmaline Oil’s (TSX:TOU) Ambitious Production Growth and Dividend Plan Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Tourmaline Oil has announced plans to expand production by 36.40% from 2024 to 2029 and expects to pay CA$750 million in base dividends over the next several years, aiming for an accumulated five-year dividend yield of 16.24%.

- The company’s outlook is further boosted by EIA projections for higher natural gas prices, potentially enhancing Tourmaline’s revenues during this period.

- We will examine how Tourmaline’s ambitious multi-year production growth plan could reshape its long-term investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Tourmaline Oil Investment Narrative Recap

To own Tourmaline Oil, an investor needs to believe in both resilient long-term natural gas demand and the company’s ability to execute on ambitious production growth, even through commodity price cycles. The recent production expansion plan and expectations for higher base dividends provide momentum but do not remove the core short-term catalyst: improving natural gas prices. The biggest risk remains price volatility and the potential for local market weaknesses to undercut projected revenues, which this update does not fully resolve.

Among recent developments, Tourmaline’s July 30th LNG feed gas supply agreement with Uniper stands out as closely tied to the multi-year expansion outlined in the news. Securing long-term LNG offtake supports the thesis that new export pathways could boost price realizations, offering a potential buffer against domestic price pressures. This agreement directly addresses the catalyst of increasing international demand and improved market access.

Yet, while ambitious growth plans attract attention, it is the challenge of persistent local gas price volatility that investors should keep in mind…

Read the full narrative on Tourmaline Oil (it's free!)

Tourmaline Oil is expected to reach CA$10.6 billion in revenue and CA$2.7 billion in earnings by 2028. This outlook is based on a forecast annual revenue growth rate of 34.3% and a CA$1.2 billion increase in earnings from the current CA$1.5 billion.

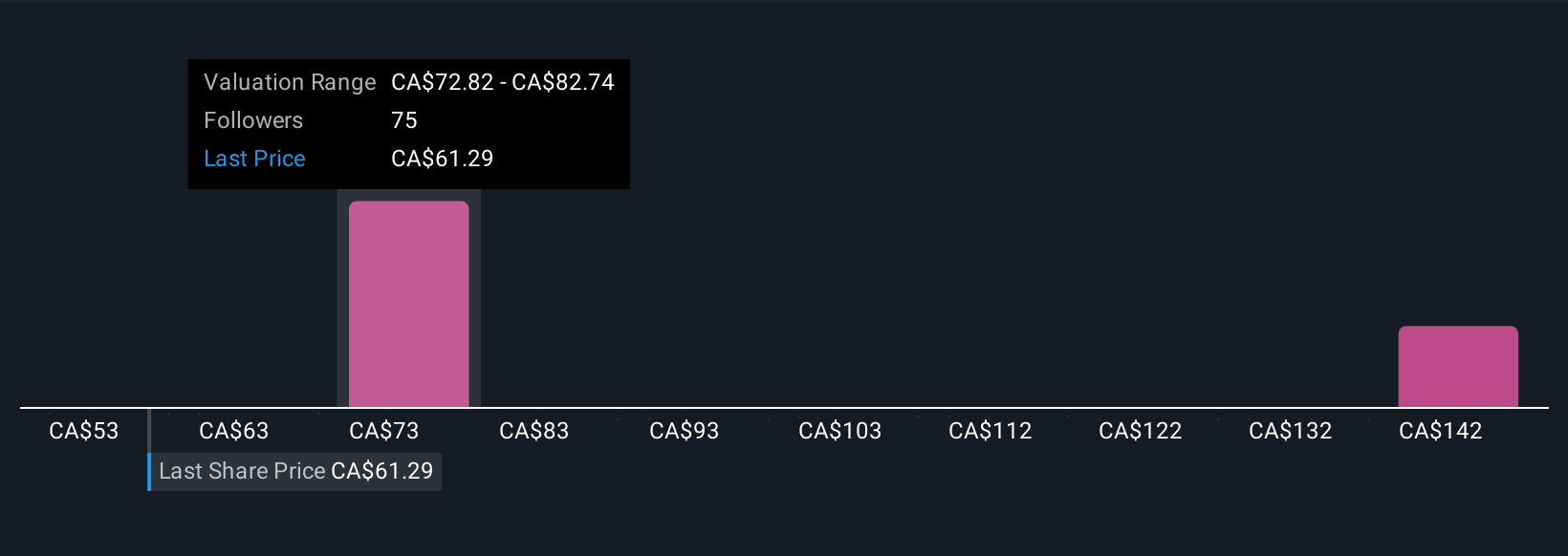

Uncover how Tourmaline Oil's forecasts yield a CA$73.57 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community range from CA$72 to CA$89.13, showing wide expectations for Tourmaline’s share price. Local price volatility remains a pressing risk that could influence whether the company meets elevated growth and payout targets, so consider multiple viewpoints when forming your own outlook.

Explore 3 other fair value estimates on Tourmaline Oil - why the stock might be worth just CA$72.00!

Build Your Own Tourmaline Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tourmaline Oil research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tourmaline Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tourmaline Oil's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives