- Canada

- /

- Aerospace & Defense

- /

- TSX:MAL

Uncovering Undiscovered Gems in Canada This June 2025

Reviewed by Simply Wall St

As the Canadian market navigates ongoing tariff uncertainties, investors have shown resilience, with key indices like the TSX experiencing a notable rise in May. In this dynamic environment, identifying promising small-cap stocks involves looking for companies that can adapt to economic shifts and maintain steady growth despite external challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Yellow Pages | NA | -11.43% | -17.61% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Westshore Terminals Investment | NA | 0.29% | -6.35% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Birchcliff Energy (TSX:BIR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Birchcliff Energy Ltd. is an intermediate oil and natural gas company focused on the exploration, development, and production of natural gas, light oil, condensate, and other natural gas liquids in Western Canada with a market cap of approximately CA$1.81 billion.

Operations: Birchcliff Energy generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$640 million. The company's financial performance can be evaluated by considering key metrics such as its net profit margin.

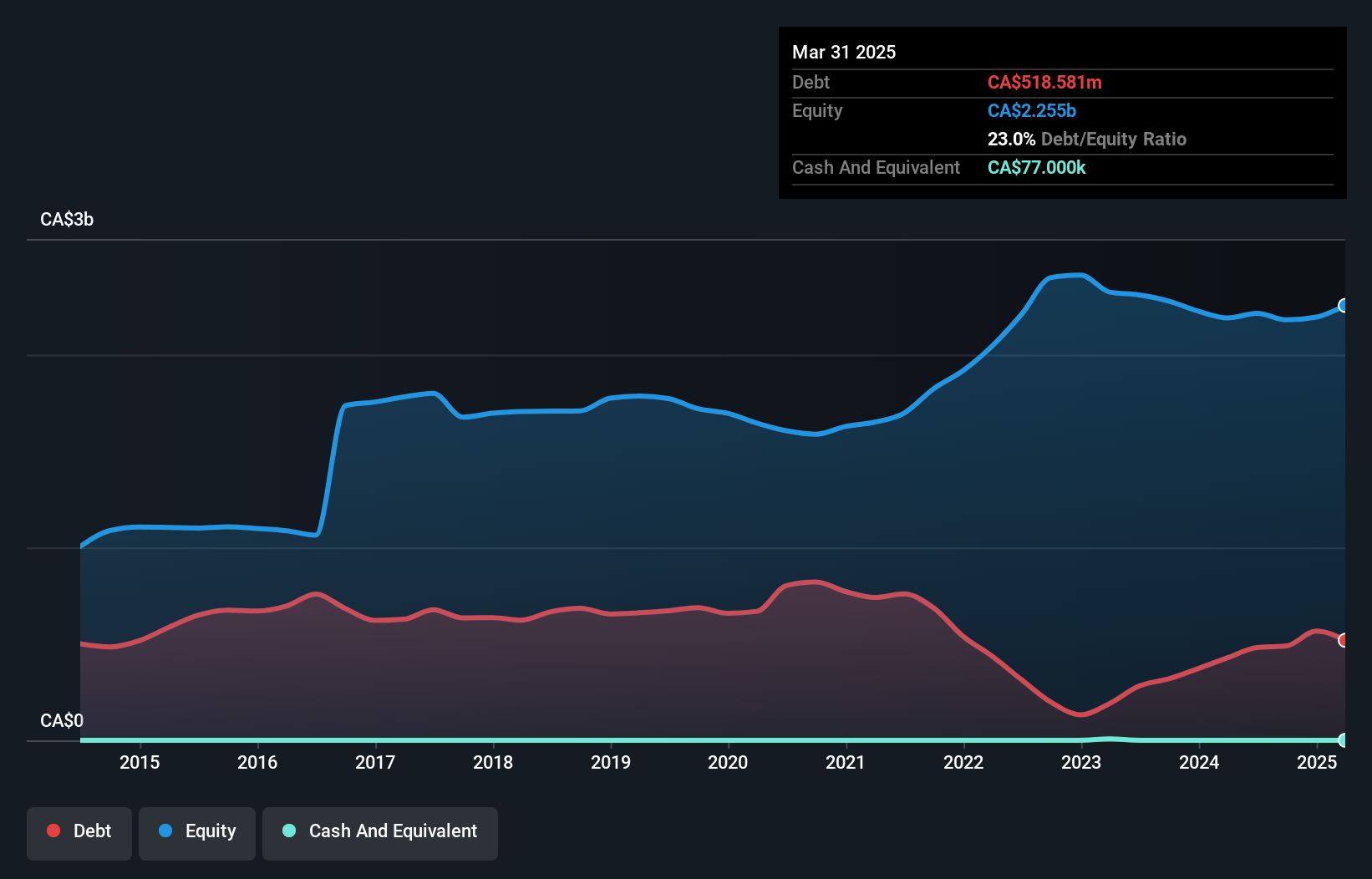

Birchcliff Energy, a notable player in Canada's energy sector, has shown impressive financial performance with earnings growth of 267% over the past year, outpacing the industry average of 3.9%. Its net debt to equity ratio stands at a satisfactory 23%, reflecting prudent financial management. The company reported Q1 2025 revenue of C$243.66 million, up from C$130.21 million a year ago, and net income reached C$65.73 million compared to a loss previously recorded. Despite its strong earnings and well-covered interest payments (4.8x EBIT), Birchcliff's free cash flow remains negative, highlighting areas for improvement amidst robust production forecasts for 2025.

- Dive into the specifics of Birchcliff Energy here with our thorough health report.

Evaluate Birchcliff Energy's historical performance by accessing our past performance report.

Magellan Aerospace (TSX:MAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Magellan Aerospace Corporation, with a market cap of CA$963.93 million, operates through its subsidiaries to engineer and manufacture aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe.

Operations: Magellan Aerospace generates revenue of CA$968.02 million from its aerospace segment.

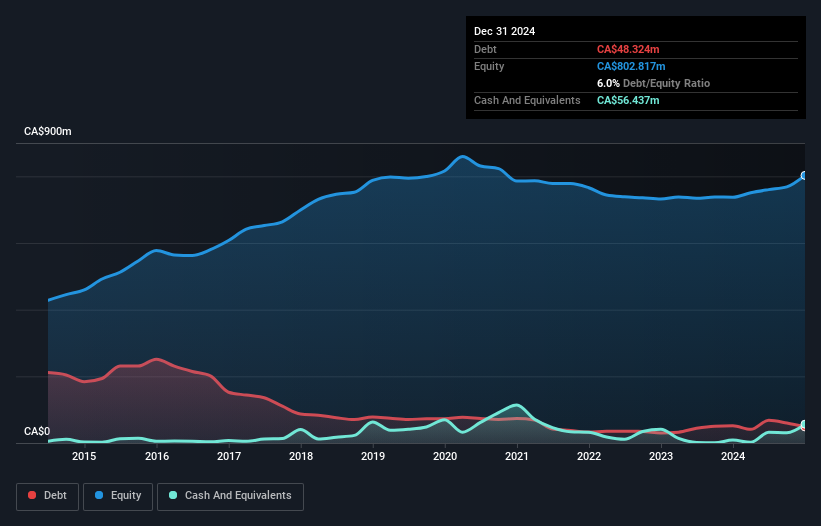

Magellan Aerospace, a nimble player in the aerospace sector, has made notable strides recently. The company's earnings surged 242% over the past year, outpacing the industry average of 26.1%. Its debt-to-equity ratio improved from 9% to 6.1% over five years, reflecting stronger financial health. Magellan's interest payments are comfortably covered by EBIT at a robust 17.4 times coverage. Recent agreements with Pratt & Whitney Canada and GE Aerospace bolster its position as a trusted partner in high-quality component manufacturing. With shares trading at an estimated 53% below fair value, it presents an intriguing opportunity for investors seeking growth potential in this space.

- Get an in-depth perspective on Magellan Aerospace's performance by reading our health report here.

Gain insights into Magellan Aerospace's past trends and performance with our Past report.

Total Energy Services (TSX:TOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Total Energy Services Inc. is an energy services company with operations in Canada, the United States, Australia, and internationally, and it has a market capitalization of approximately CA$391.20 million.

Operations: Total Energy Services generates revenue from four primary segments: Compression and Process Services (CA$442.63 million), Contract Drilling Services (CA$329.49 million), Well Servicing (CA$102.65 million), and Rentals and Transportation Services (CA$79.23 million).

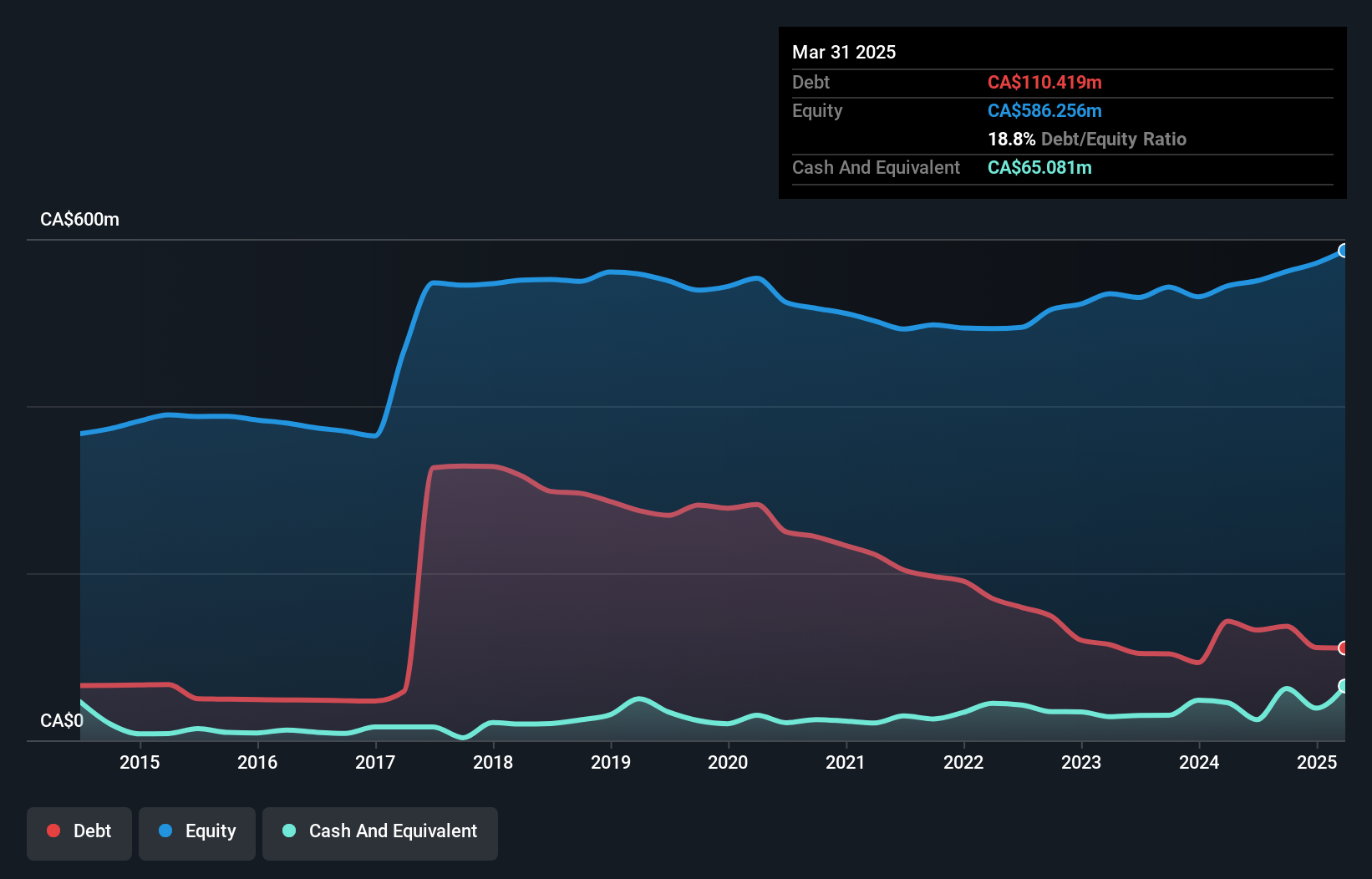

Total Energy Services, a nimble player in the energy services sector, has demonstrated robust growth with earnings surging 94% over the past year, outpacing industry trends. The company boasts a satisfactory net debt to equity ratio of 7.7%, indicating prudent financial management. Its recent acquisition of Saxon and operational expansion in Australia signal potential revenue boosts, supported by a notable increase in its fabrication sales backlog. With an EBIT covering interest payments 10 times over and free cash flow positivity, Total Energy is poised for future growth despite challenges like trade tensions and fluctuating U.S. activity levels.

Turning Ideas Into Actions

- Explore the 40 names from our TSX Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAL

Magellan Aerospace

Through its subsidiaries, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives